Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Key Takeaways:

- XDC Network and Archax have launched tokenized versions of four major money market funds (MMFs) managed by abrdn, Fidelity International, BlackRock, and State Street.

- The initiative offers institutional investors secure and compliant access to quality yield-generating assets.

- The tokenized real-world asset (RWA) sector is expected to reach $16 trillion by 2030.

Blockchain firm XDC Network announced on Monday that it had launched its first tokenized funds through a partnership with Archax, a UK-based FCA-regulated digital asset exchange.

In a press release shared with Cryptonews, the firm said Archax has tokenized four money market funds (MMFs) from the following financial institutions: abrdn, Fidelity International, BlackRock, and State Street. These funds are now available on the XDC Network platform.

XDC Network and Archax stated that they seek to offer institutional investors expanded access to traditional financial instruments through blockchain technology.

“Providing digital representations of major MMFs opens up a potential new audience for these types of yield-bearing products that historically have been challenging for some to access,” said Keith O’Callaghan, Head of Asset Management and Structuring at Archax.

The partnership involves using XDC Network’s proof-of-stake (DPoS) consensus mechanism, allowing transaction settlement and maintaining near-zero gas fees.

“With our platform’s robust performance and functionality, we have the ideal protocol for real-world asset tokenization for institutions who want to work with regulated entities like Archax,” said Angus O’Callaghan, Head of Trading and Markets at XDC Network.

Growth and Potential of Tokenized RWAs

Tokenized money market funds have already experienced growing investor demand, signaling rising market interest.

The tokenization of RWAs (real-world assets) is increasingly prioritized across major markets globally. This shift is largely driven by the traditional financial (TradFi) sector.

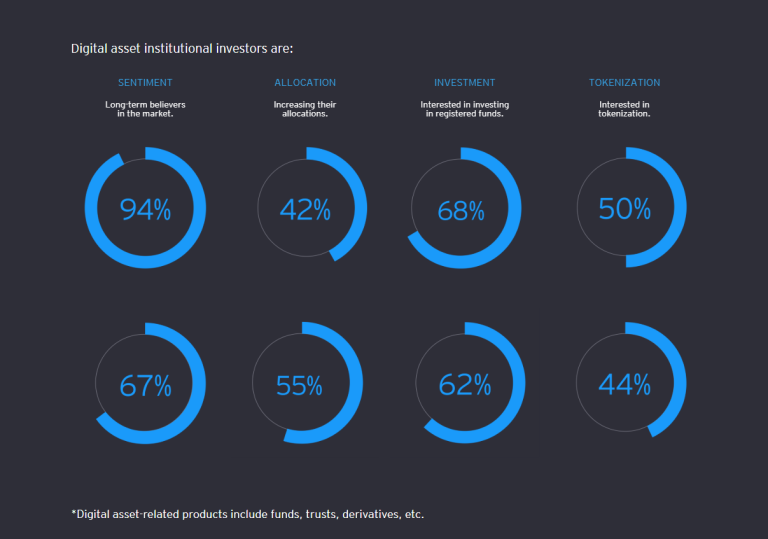

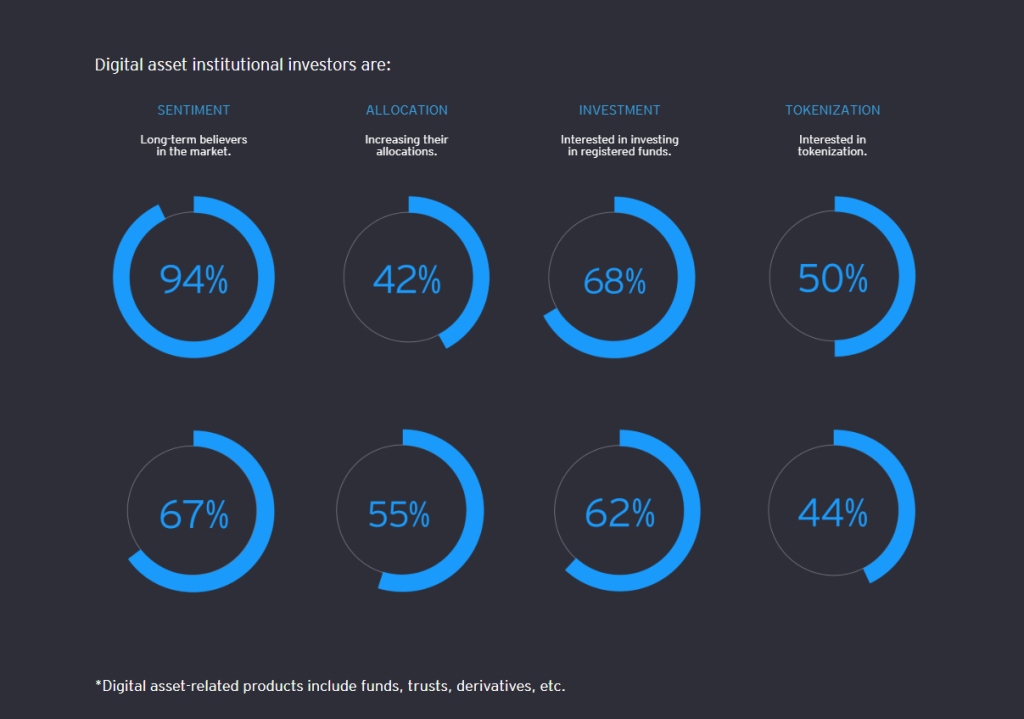

Research from Ernst & Young found that 50% of institutional investors have expressed specific interest in investing in tokenized assets.

According to Standard Chartered, the tokenized RWA market could grow to $30.1 trillion by 2034.

Most recently, the sector reached a new all-time high of $17.4 billion, reports Rachel Wolfson for Cryptonews.

RWA tokenization refers to financial products and tangible assets minted on a blockchain network, allowing increased investor accessibility and better trading opportunities.

The RWA market has expanded by 80% over the past two years and is expected to see strong growth moving forward.

Charting the Future of Investment

Transforming traditional money market funds into digital tokens encourages investors to reconsider the boundaries between conventional finance and digital technology.

This initiative introduces alternative ways to manage risk and liquidity, prompting stakeholders to reevaluate longstanding investment strategies.

As tokenized real-world assets continue to expand, new discussions around portfolio diversification and efficiency emerge.

Each tokenized asset contributes to shaping the ongoing evolution of asset management practices.

Ultimately, this development bridges historical financial practices with current technological capabilities, offering a balanced approach to future investments.