Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Shares of GameStop surged nearly 12% on March 26 after the retailer announced it would allocate proceeds from a $1.3 billion convertible notes offering toward Bitcoin investments.

The company’s revised investment policy now permits a portion of its corporate treasury and future borrowings to be invested directly into Bitcoin and stablecoins.

Despite declining net sales, GameStop holds significant liquidity, reporting cash reserves of $4.77 billion as of February.

This strategic pivot aligns closely with previous Bitcoin adoption moves by firms such as MicroStrategy and Metaplanet, both of which have seen notable stock appreciation after similar announcements.

GameStop’s Bitcoin investment further validates the cryptocurrency’s growing appeal among corporate treasuries, potentially attracting broader institutional participation and strengthening Bitcoin’s market position.

MicroStrategy’s Growing Bitcoin Ambitions

MicroStrategy, now operating as Strategy, could accumulate more than one million Bitcoin by 2033—equating to nearly 5% of Bitcoin’s total supply—according to analysts at Bernstein. Currently, the firm owns approximately 506,137 Bitcoin, purchased at an average cost of $66,608.

Bernstein recently initiated coverage on Strategy’s stock (MSTR) with an “outperform” rating, projecting a 75% potential upside to a target price of $600. Bernstein forecasts Bitcoin reaching $200,000 by 2025 and possibly $1 million by 2033, driven by supportive monetary policies and strong capital markets.

Under bullish market conditions, Strategy’s holdings could reach 5.8% of Bitcoin’s circulating supply.

Strategy’s continued Bitcoin accumulation underscores institutional confidence in Bitcoin as a treasury reserve asset. Nonetheless, short-term volatility persists, with Bitcoin recently trading around $86,982, down 1.33% in the past 24 hours.

U.S. Government Accelerates Digital Payment Transition

President Donald Trump mandated a complete transition to digital federal payments by September 30, 2025, aiming to eliminate paper-based transactions. The administration expects annual taxpayer savings of approximately $657 million through reduced fraud and administrative costs.

The executive order emphasizes electronic fund transfer (EFT) methods, including digital wallets, direct deposits, and debit cards, explicitly ruling out the adoption of a central bank digital currency (CBDC). Trump’s administration maintains a clear stance against government-controlled digital currencies.

This move toward digital payments may indirectly support increased Bitcoin adoption, as users shift toward decentralized digital assets rather than centralized digital currencies.

Bitcoin Price Technical Outlook

Bitcoin (BTC/USD) is consolidating near $87,220 within a symmetrical triangle formation on the 2-hour chart. Price action maintains key support at $86,800, reinforced by the 50-period EMA.

Immediate resistance at $88,800 limits upside momentum, and a confirmed breakout above this level could target $90,750 and $92,800.

On the downside, critical support levels remain at $86,400 and $84,870, with a sustained move below these zones potentially opening the door to $83,200.

The Relative Strength Index (RSI) remains neutral at 51, signaling balanced market sentiment. Traders should monitor volume closely to confirm the next major directional move.

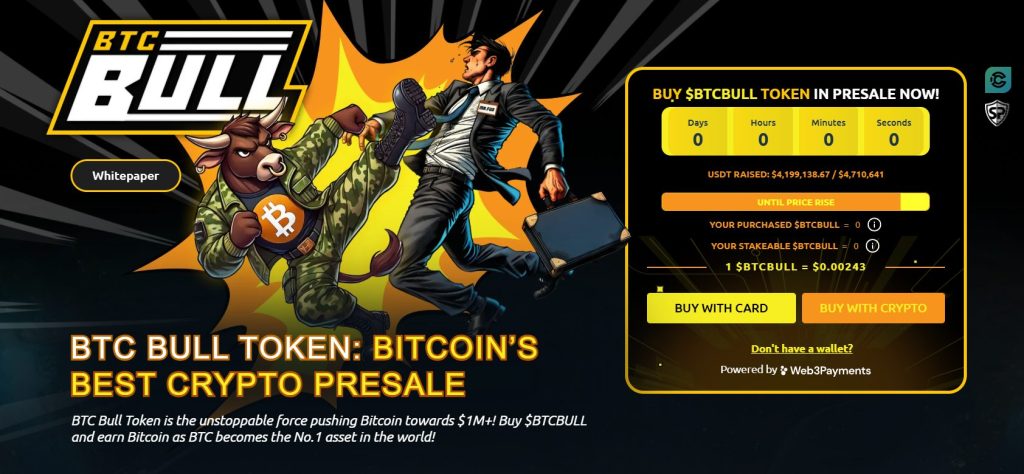

BTC Bull: Earn Bitcoin Rewards with the Hottest Crypto Presale

BTC Bull ($BTCBULL) is making waves as a community-driven token that automatically rewards holders with real Bitcoin when BTC hits key price milestones. Unlike traditional meme tokens, BTCBULL is built for long-term investors, offering real incentives through airdropped BTC rewards and staking opportunities.

Staking & Passive Income Opportunities

BTC Bull offers a high-yield staking program with an impressive 119% APY, allowing users to generate passive income. The staking pool has already attracted 882.5 million BTCBULL tokens, highlighting strong community participation.

Latest Presale Updates:

- Current Presale Price: $0.00243 per BTCBULL

- Total Raised: $4.1M/ $4.5M target

With demand surging, this presale provides an opportunity to acquire BTCBULL at early-stage pricing before the next price increase.