Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

The XRP price is ripping higher – up 29% in the past seven days to $1.47 – on the back of mounting positive news flow, and could hit $40 in three months.

If the XRP price pattern repeats the behavior last seen in 2017, then it could breach $40 – 28x move from the current price, according to one crypto trader.

A steady stream of bullish news for Ripple and its liquidity token suggests that such an XRP price prediction, although at the extremes, is possible.

Here’s the news that’s propelling the XRP price higher today

XRP issue Ripple’s investment in an exchange-traded product and its involvement in the tokenization of real-world assets (RWA) in the form of a money market fund has added to XRP price momentum. And that’s not to mention the continued afterglow from the news that SEC chairman Gary Gensler is stepping down on January 20.

News that Ripple is investing in the newly rebranded European XRP ETP, which will henceforth be known as the Bitwise Physical XRP ETP, saw the price of XRP jump 7.3% yesterday to $1.49.

Ripple CEO Brad Garinghouse commenting on the news said: “Global demand for exposure to the crypto asset class has exploded in 2024, fueled by a growing interest in crypto-backed investment offerings.

“With the US regulatory environment for crypto finally becoming more clear, this trend is poised to accelerate, further driving demand for crypto ETPs, such as the Bitwise Physical XRP ETP.”

He added: “As one of the most valuable, liquid, and utility-driven digital assets, XRP is at the forefront of this momentum, standing out as a cornerstone for those seeking access to assets that are resilient and have real-world utility.”

In a sign of the burgeoning interest in crypto ETFs beyond bitcoin and Ethereum, WisdomTree recently filed with the Securities and Exchange Commission to register an XRP ETF.

In the European Union crypto exchange-traded products have been available to retail and institutional investors for some years.

Ripple invests $5 million in tokenized money market fund built by Archas on the XRP Ledger

The news of Ripple’s planned investment in the Bitwise Physcial XRP ETP follows on from another major development.

On Monday, UK-regulated crypto exchange Archas opened access to a tokenized version of a money market fund from asset manager Abrdn.

Although the extent of Ripple’s investment in the ETP has not been disclosed, the company did reveal that it is investing $5 million in the new tokens for Abrdn’s US dollar Liquidity Fund (Lux). Archax and Ripple have been in a business relationship since 2022 and the tokenized version of the Abrdn fund will run on the XRP Ledger blockchain.

According to McKinsey, the tokenization of money market funds now exceeds $1 billion in assets under management. Furthermore, Boston Consulting Group and digital assets manager 21Shares estimate that tokenized assets could be an addressable market of $16 trillion by 2030.

The fractionalization of financial assets, as well as other assets like fine art and classic cars, can deliver operational efficiencies and greater liquidity, especially in those types of alternative investments traditionally harder to access.

Ripple and XRP at the forefront of a new breed of crypto killer apps that tokenize real-world assets

“Financial institutions are understanding the value of adopting digital assets for real-world use cases,” said Graham Rodford, CEO, Archax.

“There is now real momentum building for tokenized real-world assets, and Archax is at the forefront of tokenizing assets such as equities, debt instruments and money market funds.

“In collaboration with Ripple, we are excited to help our clients such as abrdn, which manages over half a trillion pounds in assets (as at Q2 2024), to bring them to the XRPL using Archax’s tokenization engine. Institutional buyers can now purchase abrdn’s Lux fund directly from Archax in token form.”

The good news just keeps on coming for Ripple’s technology and its XRP liquidity token

In other price-supportive news for XRP, online broker Robinhood recently announced that along with Solana (SOL), Pepe (PEPE) and Cardano (ADA), it would be relisting XRP. A number of crypto assets had been removed by the brokerage for regulatory reasons, as a result of the SEC considering them to be unregistered securities.

On the technology side, XRP Ledger Server v2.3.0 was released three days ago and brings Multi-Purpose Tokens (MPTs) to the blockchain. These are special types of fungible tokens that can be used for more than one transaction, such as for paying recurring bills.

Other XRP Ledger upgrades relate to improving the operations of Automated Market Makers, transaction replay options and better NFT functionality.

How high will the XRP price fly?

XRP touched a near-term high of $1.60 on November 23 but has since been rangebound between $1.30 and $1.50, 61% below its all-time high of $3.84.

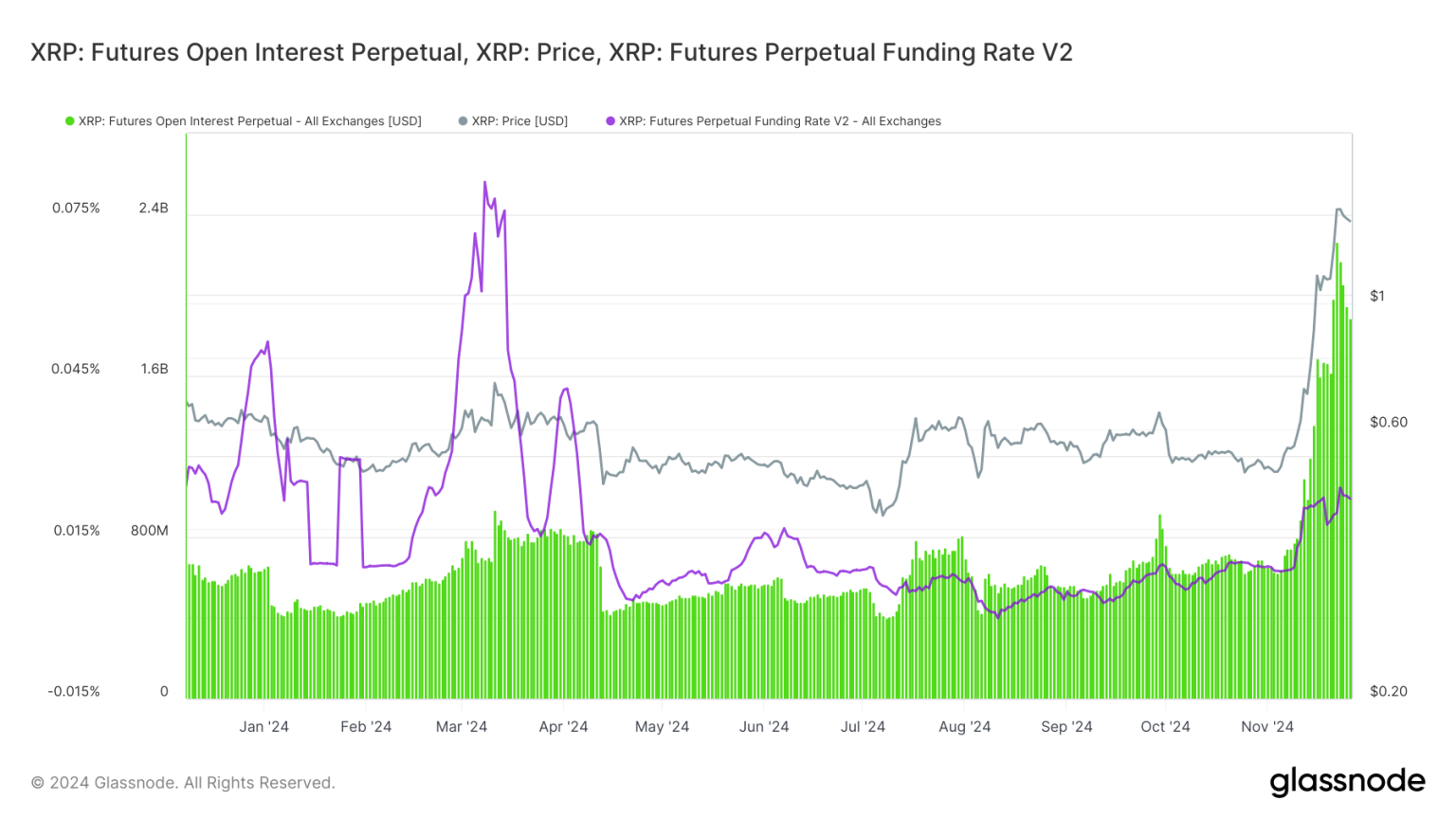

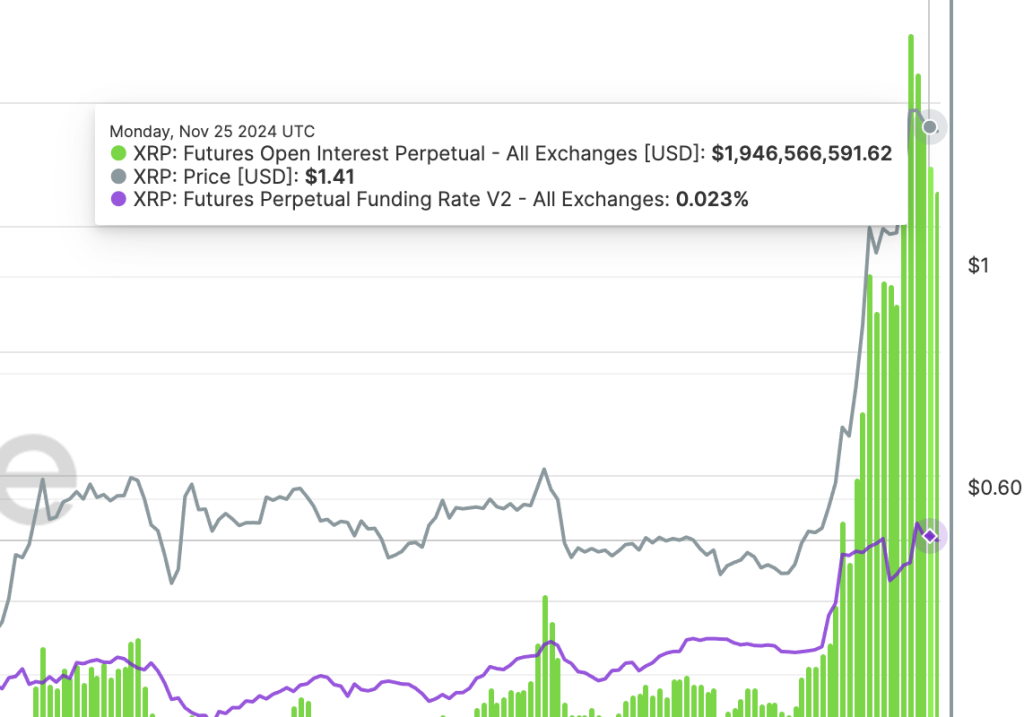

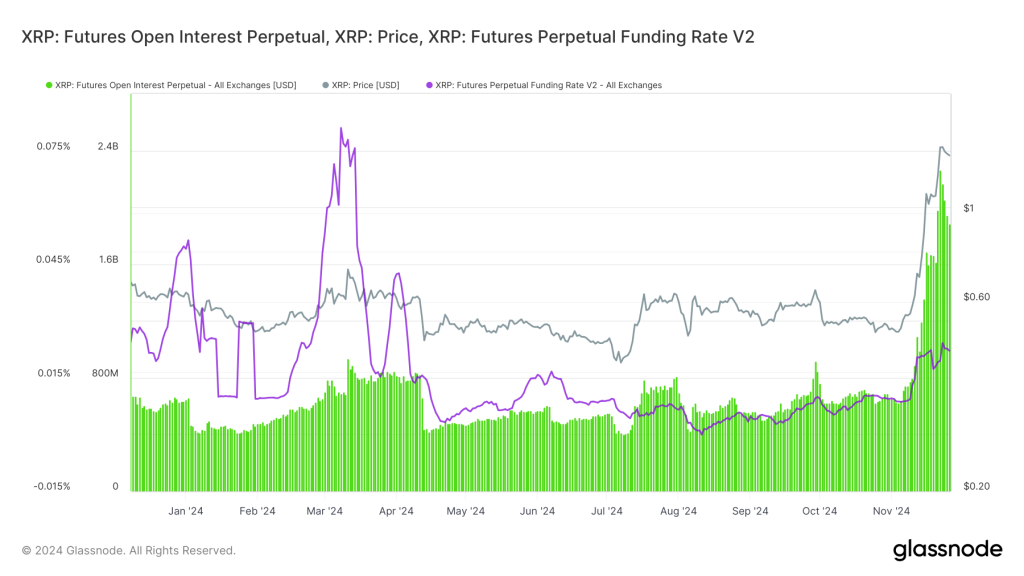

Perpetual futures open interest has reached record levels, reading $1.8 billion on Tuesday 26th in a strongly bullish signal, and had spiked as high as $2.26 four days earlier.

Since late August, the XRP futures funding rate, averaged across all exchanges, has been printing higher lows. In November, it rose to its highest levels since April, hitting 0.023% on November 25.

The funding rate determines how much interest each side of the trade pays. A positive figure means that the longs pay the shorts.

However, when it is in positive territory, it also means that buyers are confident that the price will rise, hence their willingness to pay the positive funding rate. But if the funding rate is too high, it cuts into profits and heightens the risk for those holding long contracts.

The volatility in the funding rate in Q1 2024 reflects the uncertainty surrounding the SEC lawsuit. On March 25, for example, the SEC proposed a settlement, which would have involved Ripple paying almost $2 billion in penalties.

Since then, as we know, there has been a historic US presidential election, and XRP market sentiment has changed markedly. Although the lawsuit is still there, the chances of the SEC winning it have shrunk considerably.

XRP price prediction – could the CFTC pick be the news that blasts XRP on a journey $40?

XRP price predictions must take into account the fast-moving development at Mar-a-Lago. Although it is not yet known who the SEC chairman will be, Trump is likely to put in place someone who is pro-crypto.

Bloomberg reports today that the new administration could do what the crypto industry has always wanted, which was to entrust regulation to the Commodity Futures Trading Commission.

Most or all the names that have been circulating as potential contenders to replace Rostin Behnam as head of the derivatives regulator would likely be friendly toward the roughly $3 trillion crypto market. Republican commissioners Summer Mersinger and Caroline Pham have been considered, according to people familiar with the discussions. Others include Joshua Sterling, Jill Sommers and Neal Kumar — former CFTC officials who have worked with digital-asset firms, the people said.

Bloomberg, November 27, 2024

Thanksgiving Day is now upon us. The holiday period could usher in bullish trading patterns, with the traditional financial markets all closed in the US.

Open interest and the funding rate both point to powerful buying energy when the XRP uptrend resumes.

An XRP price that smashes the previous ATH is still in play by the end of the year, with $5, or even $10, a possibility going into the new year, especially if the positive newsflow from Ripple continues and we hear more crypto-friendly news from the incoming administration.

This is borne out by the volume profile (see chart immediately below), which provides a window on the buying (and selling) interest at chosen price points. The point of control (red line) coincides with the current price, which means we are at a price level of maximum interest since the period from November 5 , when the election was held, to today.

As far as relative price performance goes, the only top alt that has beaten XRP since the election is Cardano (ADA), where Charles Hoskinson’s closeness to the possible new policy council that the Trump team may be putting together, has helped ADA to outperform.

| XRP price returns as of November 28, 2024 | ||||

| Period | vs USD | vs BTC | vs ETH | vs DeFi |

| 24H | 2.40% | 0.82% | -1.05% | -1.18% |

| 7D | 30.15% | 32.67% | 20.77% | 5.30% |

| 1M | 181.31% | 103.44% | 97.07% | 82.41% |

| 3M | 152.61% | 58.68% | 76.59% | 43.51% |

| 1Y | 140.82% | -5.85% | 35.46% | 1.52% |

If you are on the hunt for a token to invest in this altcoin season, then XRP probably has the most upside and the lowest risk of the majors.

Its technology is robust, and its price has been underperforming since the SEC lawsuit mess of the past four years, so it has lots of catching up to do, and it has an army of token holders that will keep it front and center of the crypto bull market story going into the new year and beyond.

For other crypto picks to power up your portfolio, take a look at the best crypto to buy now.

Disclaimer: This article is not investment advice and is provided for informational purposes only. Capital at risk