Get your daily, bite-sized digest of blockchain and crypto news today – investigating the stories flying under the radar of today’s news.

In crypto news today:

- Crypto Black Monday – Why is Crypto Down Today?

- Hackers Buy ETH Dip Using Stolen Funds

- Jump Crypto Liquidates ETH Holdings

- DeFi Liquidations Hit Yearly High

__________

Crypto Black Monday – Why is Crypto Down Today?

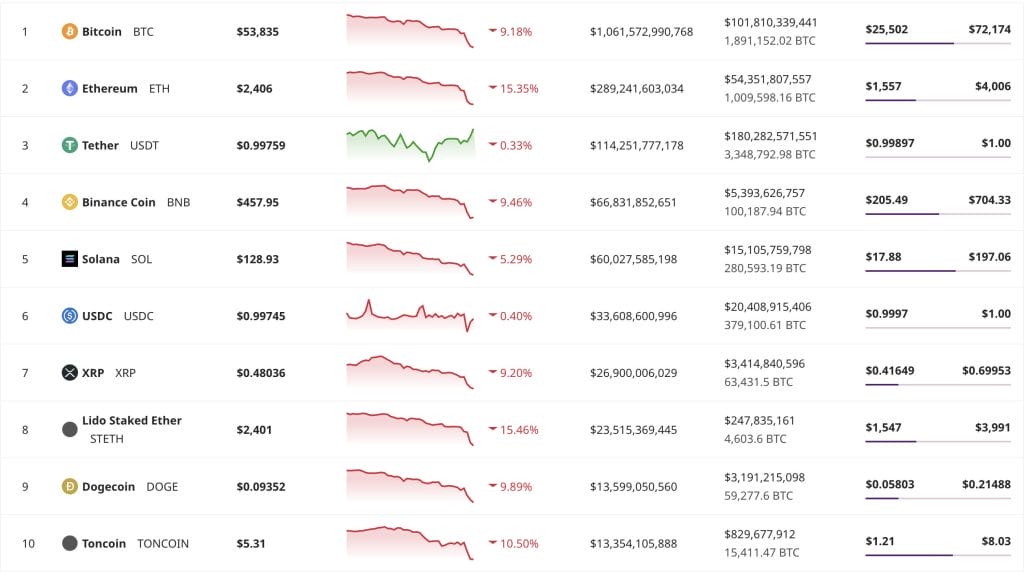

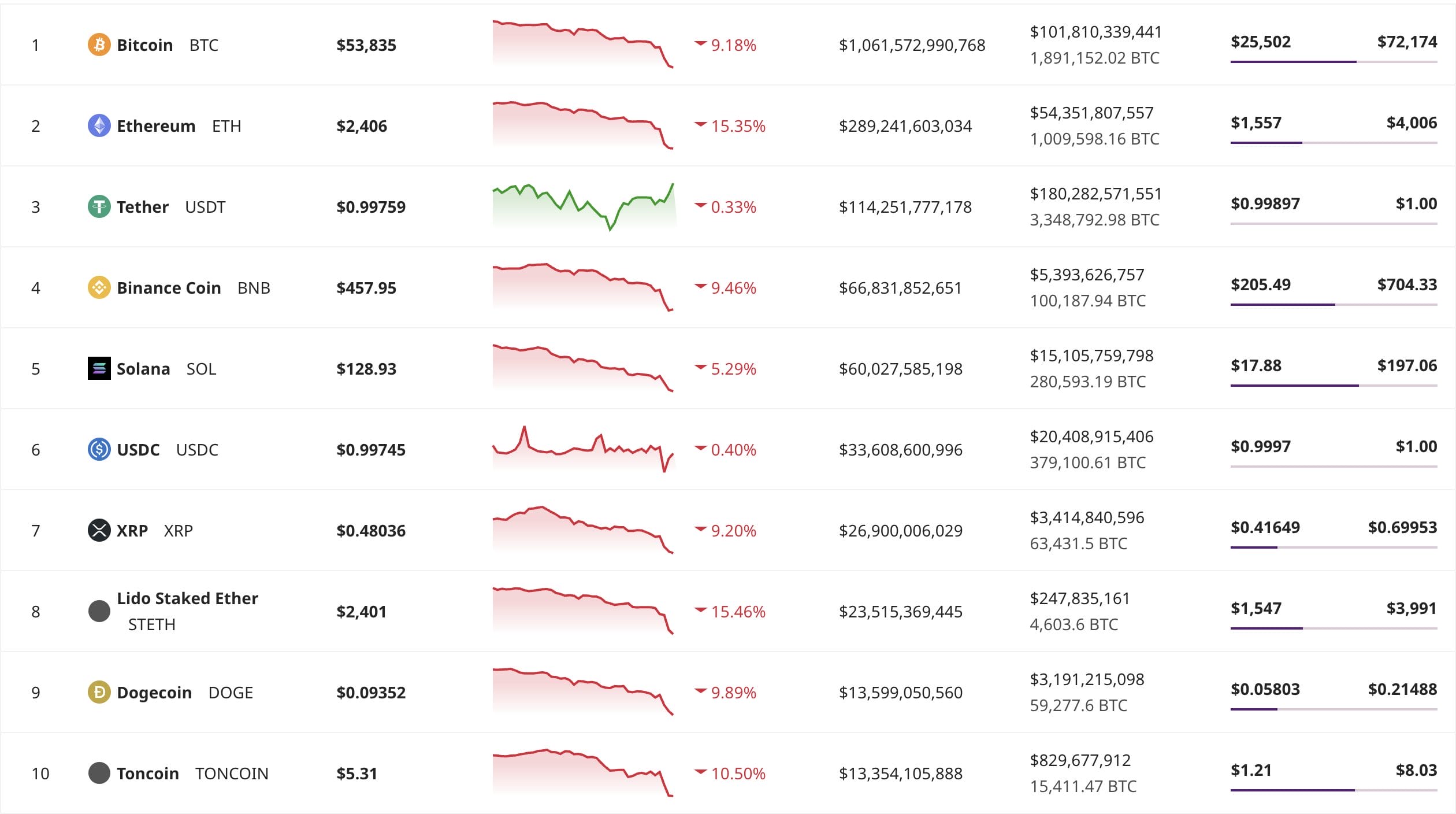

Today, already dubbed crypto black Monday, the market plummeted amid a global market sell-off driven by recession fears.

Bitcoin’s price dropped over 13%, hitting $50,963.57 and briefly falling below $50,000 for the first time since February.

This marks an 18% loss since Saturday, following a peak of $69,982 a week prior.

🚨 CRYPTO BLOODBATH: OVER $1B IN LIQUIDATIONS, FEAR INDEX PLUMMETS

Hold tight, crypto punks! The market just got nuked with over $1.13 billion in liquidations.

BTC and ETH tanked hard, taking down 308,000 traders with them.

The Crypto Fear & Greed Index is deep in the red,… pic.twitter.com/ypis7bl6yB

— Mario Nawfal’s Roundtable (@RoundtableSpace) August 5, 2024

Ether experienced even steeper losses, dropping 17% to $2,271.21, wiping out its 2024 gains with a three-day loss of 24%.

Crypto-related stocks were also severely impacted, with Coinbase falling 13%, MicroStrategy nearly 17%, and mining stocks seeing double-digit declines.

The broader market sell-off began last week after a weaker-than-expected July jobs report heightened recession concerns.

The tech-heavy Nasdaq Composite entered a correction, and Japanese stocks fell into a bear market with a 12% drop, marking their worst one-day sell-off since 1987.

On top of economic and geopolitical concerns, crypto investors have been contending with sell pressure from Mt. Gox distributions and decreasing odds of a second Donald Trump presidency.

Hackers Buy ETH Dip Using Stolen Funds

In crypto news today, hackers saw the ongoing crash market as an opportunity to buy up heavily discounted Ether using stolen funds from previous heists.

On Monday, Nomad Bridge Exploiter spent 39.75 million DAI to acquire 16,892 ETH.

Hackers bought $ETH at the bottom after the market dropped!

The #Nomad Bridge Exploiter spent 39.75M $DAI to buy 16,892 $ETH an hour ago and is depositing $ETH to https://t.co/11PfRBP2j2.https://t.co/8pwhTFSnLw

Crypto bridge #Nomad was exploited for ~$200M on Aug 2, 2022.… pic.twitter.com/9id6bxBR14

— Lookonchain (@lookonchain) August 5, 2024

The Nomad Bridge exploit was a huge event in the cryptocurrency world in August 2022.

The security breach involved the Nomad Bridge, a cross-chain protocol that facilitates the transfer of assets between different blockchains.

The vulnerabilities in the bridge’s code were exploited, leading to the unauthorized withdrawal of over $190 million worth of crypto.

Jump Crypto Liquidates ETH Holdings

Further fueling the cryptocurrency crash, Jump Crypto, the crypto firm of Jump Trading, has liquidated huge amounts of Ethereum on centralized exchanges such as Binance, OKX, Bybit, Coinbase, and Gateio.

Data from blockchain analytics platform SpotOnChain indicates that in the past 24 hours alone, Jump Crypto has moved 17,576 ETH, or over $46.78 million, to these exchanges.

The latest transfers bring Jump Crypto’s total exchange deposits to $277 million worth of Ether over the past 10 days.

“The reason for the crazy crypto sell-off seems to be Jump Trading, who are either getting margin called in the traditional markets and need liquidity over the weekend, or they are exiting the crypto business due to regulatory reasons (Terra Luna related),” said Dr. Julian Hosp, co-founder of DeFi platform Cake Group.

The reason for the crazy crypto sell off seems to be Jump Trading, who are either getting margin called in the traditional markets and need liquidity over the weekend, or they are exiting the crypto business due to regulatory reasons (Terra Luna related). The sell-off is… pic.twitter.com/7OAhBdO8hH

— Dr. Julian Hosp (@julianhosp) August 4, 2024

DeFi Liquidations Hit Yearly High

In other crypto news today, DeFi protocols on Ethereum have witnessed a surge in on-chain liquidations, hitting a new yearly peak of over $350 million in the last 24 hours.

The market turbulence, coupled with a broader crypto selloff, contributed to this spike.

Notably, major assets like ETH, Aave, wstETH, and wBTC were significantly impacted, with ETH collateral bearing the largest liquidation burden at $216 million, followed by wstETH at $97 million, and wBTC at $35 million.

__________

For the latest crypto news updates, bookmark this page and subscribe to our newsletter!