Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

A crypto whale has made a significant move, accumulating 347 Wrapped Bitcoin (WBTC) worth $16 million just 7 hours ago.

Over the past week, this whale has amassed a total of 1,953 WBTC, valued at $118 million, from Binance at an average price of $58,853 per WBTC.

This aggressive accumulation signals strong confidence in Bitcoin’s future. The big question now is: How will Bitcoin’s price respond to this substantial buying activity?

A recent tweet by Tron (TRX) founder Justin Sun has sparked speculation that China may consider lifting its long-standing ban on cryptocurrencies.

Sun’s cryptic message, along with large Ethereum transactions linked to PlusToken wallets and rumors on Chinese social media platform Weibo, has generated excitement within the crypto community.

These developments suggest China might be softening its stance on digital assets, potentially reopening avenues for Bitcoin mining and broader crypto engagement.

- Caution: No official confirmation from the Chinese government; these rumors remain speculative.

If China eases its crypto restrictions, analysts predict the global market could experience significant shifts.

This could attract over 100 million new users by 2024, boosting trading volumes and cryptocurrency values. Increased competition between the U.S. and China in Bitcoin mining could also influence the industry’s future.

However, caution is advised as the likelihood of a policy shift remains uncertain. If China does lift the ban, Bitcoin’s price could surge due to increased market participation and renewed global interest.

Bitcoin Struggles Below $60,000 Amid Bearish Momentum

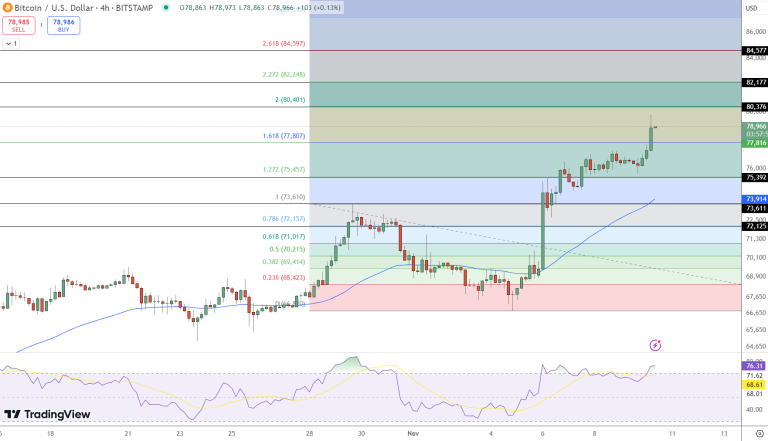

Bitcoin (BTC/USD) is trading below $60,000, signaling that bears might be taking control. Although the price action has formed an ascending triangle, typically a bullish pattern, the current downward trend suggests the pattern is struggling to break higher.

The key resistance is around $61,800, while support lies near $58,000.

The 50-day Exponential Moving Average (EMA) at $59,365 is an important level to watch. If Bitcoin drops below this EMA, it could lead to more selling pressure.

The Relative Strength Index (RSI) is at 45, indicating neutral to slightly bearish momentum.

Conclusion: If Bitcoin stays below $60,000, selling might be considered. However, a move above $60,000 could shift the trend back to bullish.

You might also like

Memegames ($MGMES) Presale: An Exciting New Meme Coin on the Horizon

In just a few days, Meme Games ($MGMES) has raised over $376k, reflecting strong investor interest in this new meme coin. Priced at $0.0093 per token, $MGMES is already creating significant buzz in the crypto community.

As meme coins continue to capture the market’s imagination, Meme Games promises to be a standout contender.

Join the Meme Games – Competitive Spirit

Inspired by the Olympics, Meme Games features virtual competitions among top meme coins. Characters like Doge the OG, Pepe the Versatile, Wif the Trendsetter, Brett the Conqueror, and Turbo the Speedster compete in various events, with participants earning $MGMES tokens as rewards.

To join the action, secure your $MGMES tokens now during the ongoing presale. The current price of $0.0093 per token will increase soon, so act quickly to take advantage of this opportunity.

Presale and Future Prospects

Meme Games is set to list on decentralized exchanges (DEX) by September 10. As the listing date approaches, the token price is expected to rise significantly.

The presale offers a great entry point for investors looking to capitalize on this potential growth. With a market cap target of $792,208, the $MGMES presale is well on its way to success.

Don’t miss out on the Meme Games presale. Secure your $MGMES tokens now at $0.009 each before the price increases.

Visit the Meme Games website to participate in the presale and stay updated on the project’s progress by joining their community on X and Telegram. The smart contract has passed a full audit by SolidProof, ensuring the security and reliability of your investment.

Buy Memegames Here

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.