Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

The United States (U.S.) financial regulators are moving to bring cryptocurrencies under the same reporting requirements as traditional fiat currency, signaling a major step towards integrating digital assets into the mainstream financial system.

The U.S. Department of the Treasury, in its latest semiannual regulatory agenda, outlined plans to redefine “money” under the Bank Secrecy Act (BSA) to encompass cryptocurrencies and other digital assets.

Cryptocurrencies to Face Stricter Reporting Rules

The Board of Governors of the Federal Reserve System and the Federal Reserve and Financial Crimes Enforcement Network (FinCEN) are set to propose new rules clarifying what constitutes “money” under the Bank Secrecy Act.

This move aims to bring both domestic and cross-border cryptocurrency transactions under stricter financial reporting requirements.

The updated regulations will encompass a broad definition of digital assets, including those backed by traditional currencies and potential future central bank digital currencies (CBDCs).

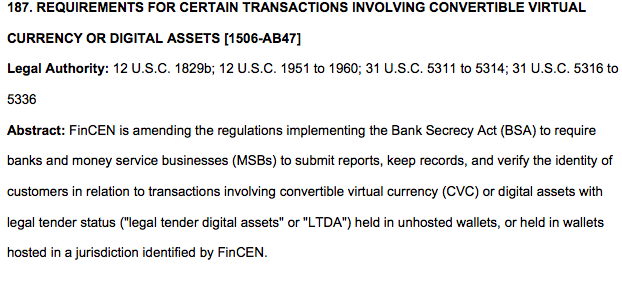

According to the agenda, FinCEN is also updating its rules to include stricter regulations for banks and money transfer businesses handling “convertible virtual currencies or digital assets with legal tender status”. These new rules require businesses to verify customer identities, maintain detailed records, and file specific reports for transactions involving these digital assets, especially those held in unhosted or foreign-hosted wallets.

The suggested updates to the BSA are likely to have far-reaching implications for the cryptocurrency industry. Compliance costs for crypto businesses could rise significantly as they adapt to new reporting requirements. Moreover, the broader definition of “money” could subject a wider range of digital assets to regulation, potentially impacting innovation in the sector.

The final rulemaking process is expected to take over a year, with a target date of September 2025.

Expanding Crypto Regulatory Push

The proposed changes are part of a broader government push to understand and regulate digital assets. On June 28, the Treasury Department and the Internal Revenue Service (IRS) issued final regulations outlining tax reporting requirements for cryptocurrency brokers.

Beginning in 2026, brokers will be required to report the total proceeds from cryptocurrency sales made in 2025. One year later, in 2027, brokers will also be required to provide information on the tax basis of certain digital assets sold in 2026.

The Treasury Department believes these rules will improve tax enforcement, particularly among high-net-worth investors, while simplifying the tax filing process for cryptocurrency holders. The final regulations were developed after extensive public input, including a public hearing and review of more than 44,000 comments.

US Government Continues Large-Scale Bitcoin Transfers

On Aug.14, the U.S. government transferred approximately 10,000 Bitcoin (BTC), worth around $594 million, to a new wallet address. According to blockchain analytics firm Arkham Intelligence, these funds were confiscated during the infamous Silk Road raid.

BREAKING: 10K Silk Road BTC ($593.5M) moved to Coinbase Prime

Wallet bc1ql received 10K BTC from a known US Government wallet 2 weeks ago. This BTC has just been sent on to 33J, a Coinbase Prime deposit wallet. pic.twitter.com/kNLsiJzL95

— Arkham (@ArkhamIntel) August 14, 2024

This is the second major Bitcoin movement by the government in recent weeks. On July 29, nearly 30,000 Bitcoin, valued at approximately $2 billion, were moved from government wallets to an unknown address. The U.S. government currently holds roughly 203,000 Bitcoin, representing a digital asset portfolio valued at approximately $12 billion.