Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

The United States spot Ether exchange-traded funds (ETFs) witnessed a surge in inflows as the crypto market experiences a robust rally following Donald Trump’s election victory.

On November 11, the ETFs recorded a staggering $294.9 million in inflows, far surpassing their previous high of $106.6 million on launch day in July, according to data from SoSo Value.

Leading the inflows was the Fidelity Ethereum Fund (FETH), which attracted $115.5 million, marking a record for the fund.

More ETH ETFs See Inflows

The BlackRock-issued iShares Ethereum Trust ETF (ETHA) followed closely with $100.5 million.

The Grayscale Ethereum Mini Trust ETF (ETH) secured the third spot, pulling in $63.3 million, while the Bitwise Ethereum ETF (ETHW) posted $15.6 million.

Notably, all other U.S. spot Ether ETFs reported zero inflows during the same period.

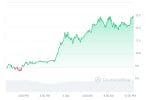

The inflows coincided with an 8.4% spike in Ether’s price, which reached a 14-week high of $3,384 on November 11, as per CoinGecko data.

The rise mirrored a broader market uptick, with cryptocurrencies experiencing a near 10% overall increase.

However, Ether is still trailing behind top-performing assets like Bitcoin and Solana during this bull cycle, according to Rachael Lucas, a crypto analyst at BTC Markets.

“Ethereum, after lagging for much of this cycle, is finally gaining traction,” Lucas noted, attributing part of this momentum to the growing popularity of spot Ether ETFs.

She also highlighted that Ether’s staking returns, though unavailable in U.S. spot ETFs, could attract traditional investors seeking to capitalize on its bullish prospects.

“There’s no reason to believe ETH won’t perform well,” Lucas added.

Meanwhile, Bitcoin broke through the $88,000 mark for the first time on Monday, setting the stage for BlackRock’s spot Bitcoin ETF to achieve a record-breaking daily trading volume.

According to Bloomberg Senior ETF Analyst Eric Balchunas, the ETF generated $4.5 billion in trading volume in a single day.

The surge follows Donald Trump’s victory in the U.S. presidential election, which has fueled optimism across the cryptocurrency market.

Just days after Trump’s win, BlackRock’s spot Bitcoin ETF also achieved a record $1.1 billion in net inflows in a single day.

Digital Asset Products Attracted Almost $2 Billion

Last week, digital asset investment products attracted a robust $1.98 billion, marking the fifth consecutive week of inflows.

The influx brings the year-to-date figure to a record $31.3 billion, according to a recent report from CoinShares.

The surge in investments has pushed the global assets under management to a new peak of $116 billion.

Bitcoin led the charge with inflows totaling $1.8 billion, buoyed by a favorable macroeconomic environment and recent US political shifts.

Ethereum also showed signs of recovery, registering its highest inflow since the ETF launches in July, with $157 million last week.

Additionally, a variety of altcoins including Solana, Uniswap, and Tron experienced notable inflows, while blockchain equities attracted $61 million, indicating a broadening base of investor confidence across the digital asset spectrum.