Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

South Korean crypto exchange Upbit’s partner K Bank has failed in its IPO bid. And media outlets are speculating that the parties’ deal may have been to blame.

According to Maeil Kyungjae, K Bank withdrew its initial public offering (IPO) application just days before it was due to float on the Korea Exchange.

K Bank IPO: Postponed or Scrapped?

The neobank had hoped to go public on October 31 in what most stock market analysts in the nation had called “the biggest public offering in the second half of 2024.”

And the media outlet claimed that the IPO failure was a messy process, with low demand in the run-up to the launch.

“We have decided to withdraw this public offering as the recent institutional investor demand forecast did not indicate sufficient demand for a successful listing.”

K Bank

The outlet said that one of the main “issues” that derailed the listing was the fact that K Bank “is heavily dependent on Upbit.”

Upbit Partnership to Blame?

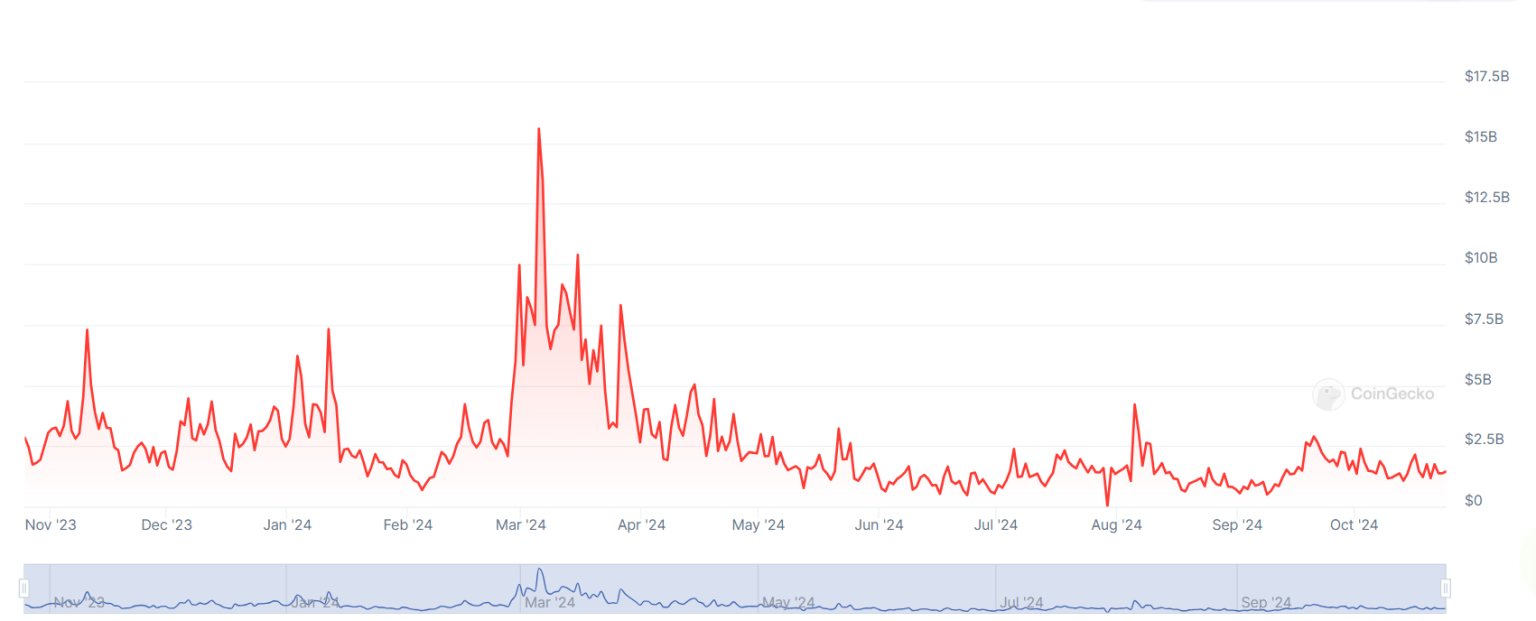

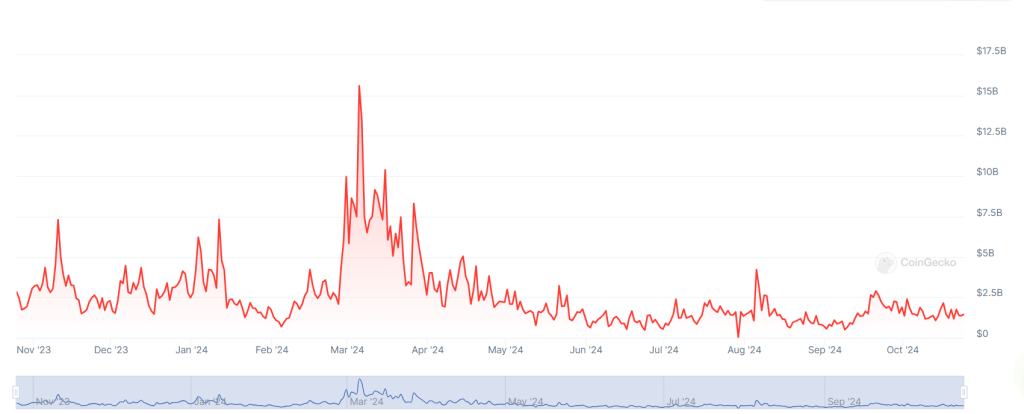

K Bank provides exclusive fiat on/off banking services for Upbit, which remains South Korea’s biggest crypto exchange.

The neobank had denied that its Upbit partnership was problematic in the countdown to the IPO.

But regulators and lawmakers alike claimed this was not the case. One lawmaker even warned of the dangers of a potential “bank run” if Upbit customers were to desert the crypto market en masse.

In a recent audit, the head of the regulatory Financial Supervisory Service (FSS) Lee Bok-hyun said:

“We will investigate to determine whether K Bank appropriately disclosed [Upbit-related] risks to its investors during the IPO process.”

Lawmaker Hits Out at IPO Bid

Some 17% of K Bank’s deposits were Upbit-related at the end of the first half of this year, Maeil Kyungjae noted.

Lee Kang-il, a lawmaker for the Democratic Party of Korea, hit out at the partnership, calling it an “abnormal situation.”

“I doubt that K Bank can survive on its own without Upbit.”

South Korean lawmaker Lee Kang-il

K Bank, meanwhile, has claimed that its IPO withdrawal is a “temporary delay,” and has said it will try again next year.

However, this is the second time that K Bank’s IPO plans have fallen through. The bank received preliminary listing approval in 2022.

But it ultimately withdrew its listing in February 2023 following a coronavirus pandemic-linked market “slump.”

K Bank to Try Again Next Year

K Bank said that it “plans to proceed with the listing process early next year” after improving its “public offering structure.”

The bank noted that its preliminary listing approval “will remain in effect for six months, expiring in February 2025.”

However, the media outlet claimed that the industry’s “response” was “not favorable.”

It cited a “decline in trust” and the nation’s only stock market-listed neobank, Kakao Bank.

Kakao Bank raised around $2.2 billion when it went public in 2021. But share prices dropped sharply shortly after its listing, and have remained mostly stagnant ever since.

An unnamed official from the securities industry told the media outlet:

“Nothing will change in the next six months.”

The media outlet concluded that if K Bank fails to turn its potential investors’ heads before February next year, “the stigma of having suffered two IPO setbacks is likely to follow K Bank around.”