Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

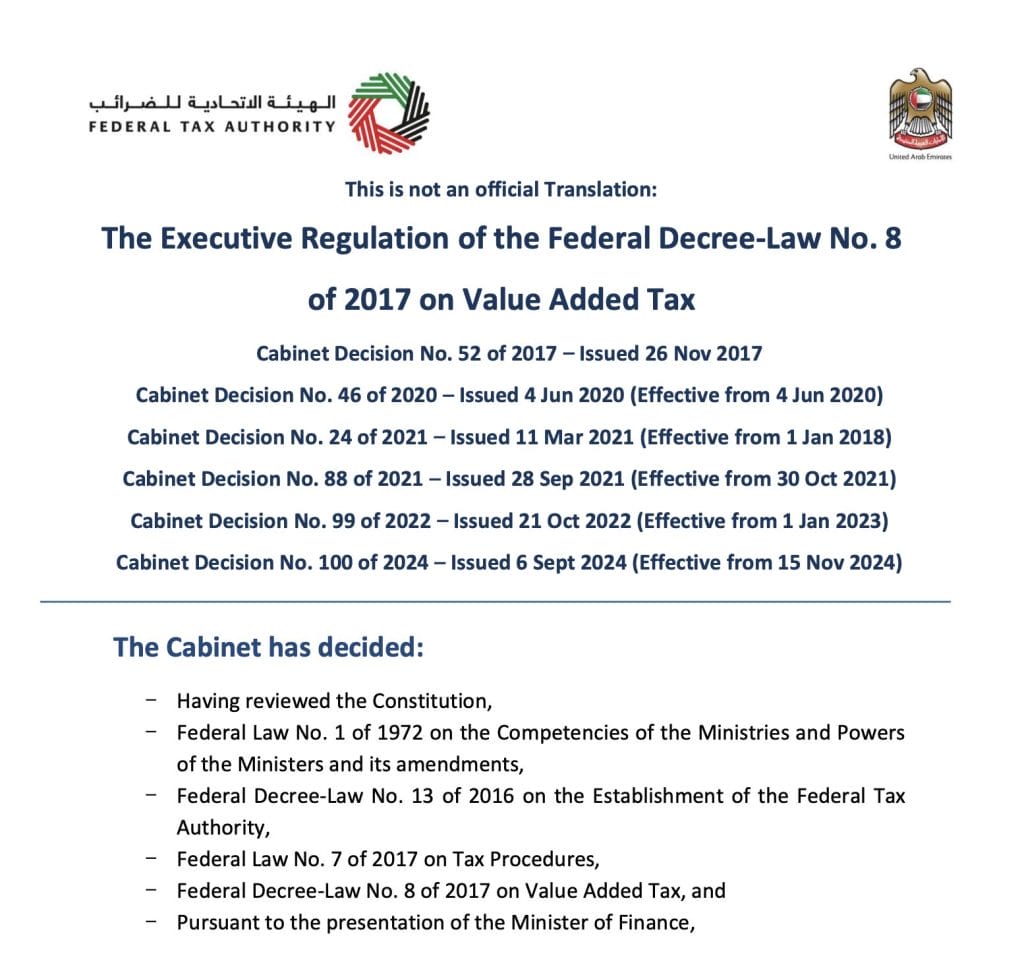

The United Arab Emirates (UAE) has made official the decision to exempt crypto transactions from value-added tax (VAT). This VAT exemption applies to the exchange and transfer of virtual assets.

Notably, the new rule is retroactive, meaning it covers crypto transactions from as far back as January 1, 2018. The official update was released in Arabic on October 2, 2024, followed by an English translation on October 4, 2024.

This VAT exemption provides significant relief to businesses and investors in the UAE’s cryptocurrency ecosystem.

UAE Exempting VAT: What Does It Mean For Crypto?

The Federal Tax Authority (FTA) published amendments that bring digital assets under the same regulatory treatment as traditional financial services, which have long been exempt from VAT.

This means that transfers and conversions of cryptocurrencies such as Bitcoin, Ethereum, and other digital tokens will no longer be subject to the country’s standard 5% VAT levy.

The retroactive nature of this regulation, dating back to January 1, 2018, could have significant financial implications for businesses.

Companies that previously paid VAT on crypto-related transactions may now be eligible to reclaim those taxes, opening the door for potential refunds.

This has prompted advisory firms like PwC to urge businesses to reevaluate their past VAT positions, particularly concerning input tax recovery.

Input VAT recovery allows businesses to claim back VAT paid on eligible purchases, which could be a complex process given the retroactive application of the new rule.

The exemption also extends to services related to managing investment funds and converting virtual assets, making it clear that the UAE is looking to bring the entire ecosystem of digital assets into a tax-free zone, much like traditional finance.

Crypto Global Adoption Looming

The VAT exemption is expected to have many impacts on the crypto ecosystem in the UAE, likely boosting both domestic and international interest in the country’s regulatory framework.

For companies already operating in the UAE, the exemption will reduce operational costs, providing them with a stronger competitive edge.

Blockchain enterprises, which have struggled with the complexities of VAT regulations in other parts of the world, now have a clear and favorable path to conducting business in the UAE.

This move could significantly ease the financial burden on these companies, especially those with high transaction volumes.

Additionally, this VAT relief could lead to a ripple effect in the financial services sector.

Traditional banks, which have been cautious in their dealings with cryptocurrencies, may now find it easier to integrate digital assets into their offerings.

With the removal of VAT on crypto transfers, banks, and financial institutions could look at partnerships with crypto companies to offer more seamless services, potentially spurring innovation and collaboration between the two sectors.

This tax relief could also lead to greater liquidity in the market, as investors may feel more comfortable holding and transacting with cryptocurrencies in a tax-free environment.

While the new VAT exemption provides a significant advantage for businesses, it also comes with challenges related to compliance.

As the exemption applies retroactively, companies will need to review their historical VAT filings and potentially adjust their tax returns.

Voluntary disclosures may be required to correct past VAT filings and ensure compliance with the new regulations.

In September 2024, VARA and the SCA agreed on a mutual supervision system for VASPs, allowing firms registered with VARA to serve clients across the broader UAE by being automatically registered with the SCA.

Following it, Standard Chartered launched its digital asset custody services in the UAE on September 10.