Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

U.S. spot Bitcoin exchange-traded funds (ETFs) attracted $235.19 million in net inflows on Monday, marking a two-day streak of positive capital movement, according to data from SoSoValue.

Among the 12 ETFs tracked, Fidelity’s FBTC led the charge with $103.68 million in inflows.

Likewise, BlackRock’s IBIT, the largest spot bitcoin ETF by assets, saw $97.88 million in net inflows, recovering from zero flows reported last Friday.

More Funds See Inflows

Other notable entries include Bitwise’s BITB, which recorded $13.09 million in new investments, and Ark and 21Shares’ ARKB, which attracted $12.63 million.

VanEck’s HODL saw $5.37 million in inflows, while Invesco’s BTCO added $2.53 million.

Grayscale’s GBTC, the second-largest spot bitcoin ETF, along with six other ETFs, reported no inflows on Monday.

The total trading volume of the 12 bitcoin ETFs reached $1.22 billion on Monday, showing a slight increase from $1.19 billion on Friday and $1.13 billion on Thursday.

In contrast, U.S. spot Ethereum ETFs saw no inflows on Monday, following $7.39 million in net inflows on Friday and $3.2 million in outflows on Thursday.

The combined trading volume of the nine Ethereum ETFs dropped to $118.43 million, down from $148.01 million on Friday.

Amid these ETF movements, Bitcoin dipped 1.4% to $62,757, while Ethereum fell 2.09% to $2,442.

Digital Asset Investment Products See $147M Outflows

As reported, digital asset investment products recorded outflows of $147 million last week amid increasing investor caution in response to robust economic data.

Stronger-than-expected economic indicators have diminished hopes for significant interest rate cuts, dampening market sentiment.

Despite the cautious atmosphere, trading volumes for exchange-traded products (ETPs) edged up by 15% to $10 billion, even as broader crypto markets experienced lower activity.

Bitcoin was at the center of investor movements, experiencing outflows of $159 million.

However, products that short Bitcoin saw modest inflows of $2.8 million, indicating some hedging activity.

Ethereum followed the broader negative trend, registering $29 million in outflows as interest in the asset waned.

On the positive side, multi-asset investment products continued their winning streak, drawing $29 million in inflows, marking the 16th consecutive week of positive trends.

Since June, these products have attracted $431 million, accounting for 10% of assets under management, appealing to investors seeking diversified exposure across various digital assets.

After a rocky start, the “Uptober” narrative appears to be regaining strength, with Bitcoin stabilizing near levels seen last Monday, QCP Capital said in a recent note.

Strong Non-Farm Payroll (NFP) data and renewed interest from an upcoming HBO Bitcoin documentary have bolstered support around the $60,000 mark.

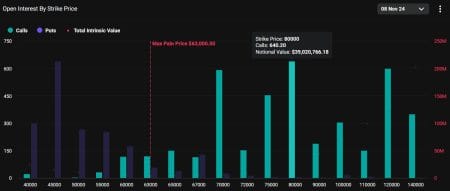

Despite last week’s volatility, options flows suggest a positive outlook for the fourth quarter, with notable interest in December BTC call spreads targeting the $75,000 and $95,000 levels, pushing the “Uptober” narrative further.

Expectations of further rate cuts and Bitcoin’s strong correlation with equities contribute to the market’s optimistic stance for a strong October performance.