Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

The two Estonian nationals extradited to the US last year pleaded guilty yesterday to operating a multi-million-dollar fraud.

The US Attorney’s Office for the Western District of Washington described the operation as “a massive, multi-faceted cryptocurrency Ponzi scheme that victimized hundreds of thousands of people” in the US and globally.

Sergei Potapenko and Ivan Turõgin (40) each pleaded guilty to one count of conspiracy to commit wire fraud. They agreed to forfeit assets valued at over $400 million that they had obtained while running the scheme.

Scheduled to be sentenced in May, each faces a maximum penalty of 20 years in prison.

The FBI Seattle Field Office investigated the case, with the help of the US Justice Department’s Office of International Affairs in the investigation and the extradition processes. Additionally, the Cybercrime Bureau of the Estonian Police and Border Guard assisted with the investigation, while the Estonian Prosecutor General and Ministry of Justice and Digital Affairs helped with the extradition.

The Estonian government renewed the US extradition of the two fraudsters in January 2024.

“The size and scope of the alleged scheme is truly astounding,” commented Nick Brown, US Attorney for the Western District of Washington. “These defendants capitalized on both the allure of cryptocurrency and the mystery surrounding cryptocurrency mining, to commit an enormous Ponzi scheme.”

You might also like

Digital Bank That Never Was

Potapenko and Turõgin operated the crypto mining service HashFlare. Their customers were supposed to receive a share of the mined coins.

However, when investors asked to withdraw their mining proceeds, the duo could not pay it out as promised, a case summary states. They either resisted making the payments altogether, or paid using the coins they bought – not what they mined.

Between 2015 and 2019 when it closed, HashFlare’s sales totaled more than $577 million. Yet, the company didn’t have the computing capacity necessary for mining. Their equipment “performed Bitcoin mining at a rate of less than one percent of the computing power it purported to have.”

Also, HashFlare’s web-based dashboard that was supposed to show investors their mining profits showed falsified data, the documents say.

Instead of paying investors, Potapenko and Turõgin bought real estate and luxury vehicles and maintained investment and cryptocurrency accounts. The forfeited assets will be used to compensate the victims.

Besides HashFlare, Potapenko and Turõgin also face charges for the Polybius scheme. According to an FBI press release from November 2021, the two launched this ICO in 2017, collecting some $31 million to create a digital bank. Instead, Turõgin and Potapenko used much of this money for personal gain.

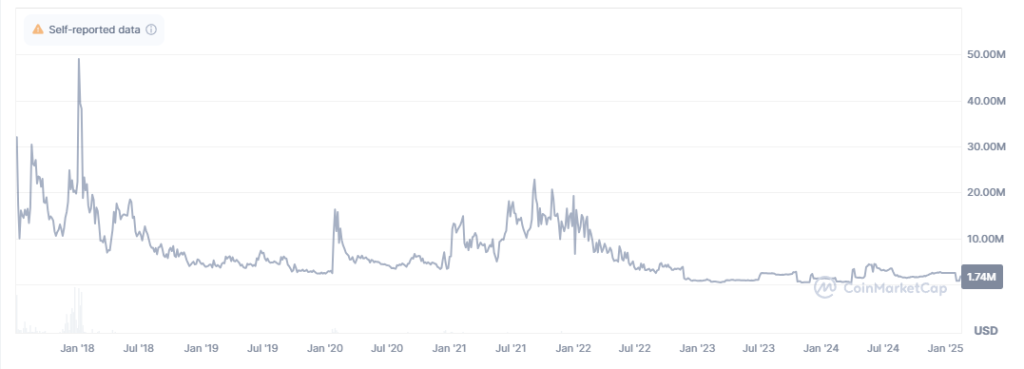

At the time, Polybius issued an ERC-20 token PLBT. Peaking at $12.8 in January 2018, the coin plummeted to $0.43 seen today – a nearly 95% drop.

Similarly, in the same timeframe, its market capitalization fell from $49 million to $1.74 million.

The deceitful duo advertised the sale of PLBT tokens, promising a 20% dividend from the profits generated from the digital bank. None of this ever materialized.

You might also like