Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Recent decisions by US President Donald Trump have had a severe impact on the crypto mining industry, even on the largest Bitcoin miners, pushing them into the net-negative realm.

Trump has caused a cascade of events with his global tariffs across industries. Crypto mining was not spared. The tariff news triggered a broad market sell-off, which in turn triggered a Bitcoin hashprice drop.

Bitcoin’s hashprice is a measure of mining profitability. This week, it has fallen back below $40/PH/s, a level last seen in September 2024, according to the latest Miner Weekly report by BlocksBridge Consulting.

Then, Trump changed his mind yet again and announced a temporary 90-day pause on the global tariffs. The market somewhat recovered, but Bitcoin’s hashprice remained just above $42/PH/s.

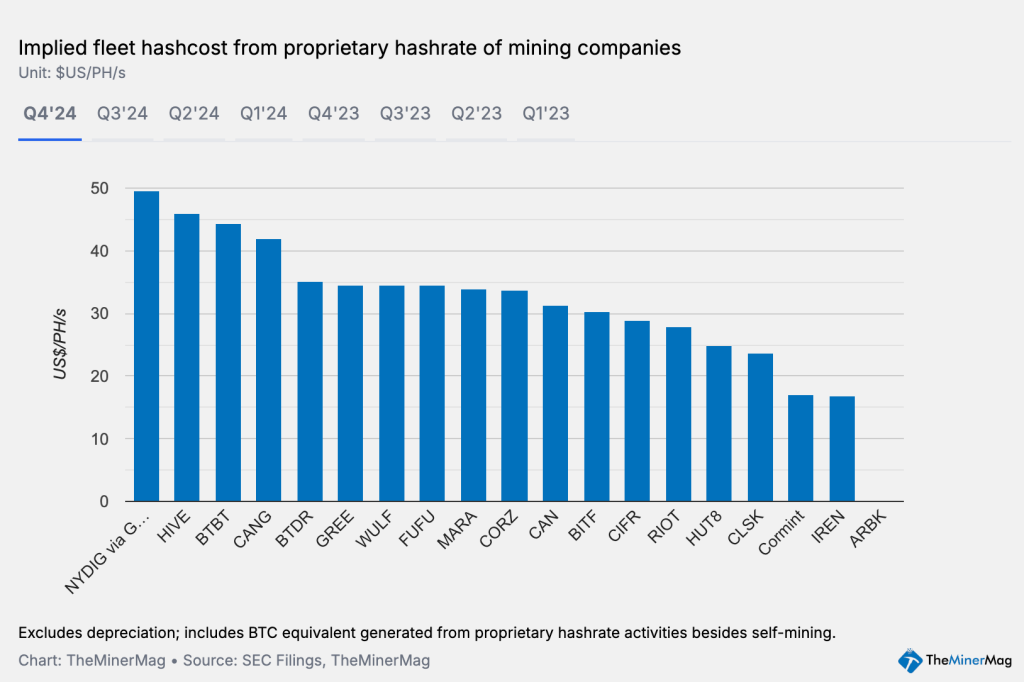

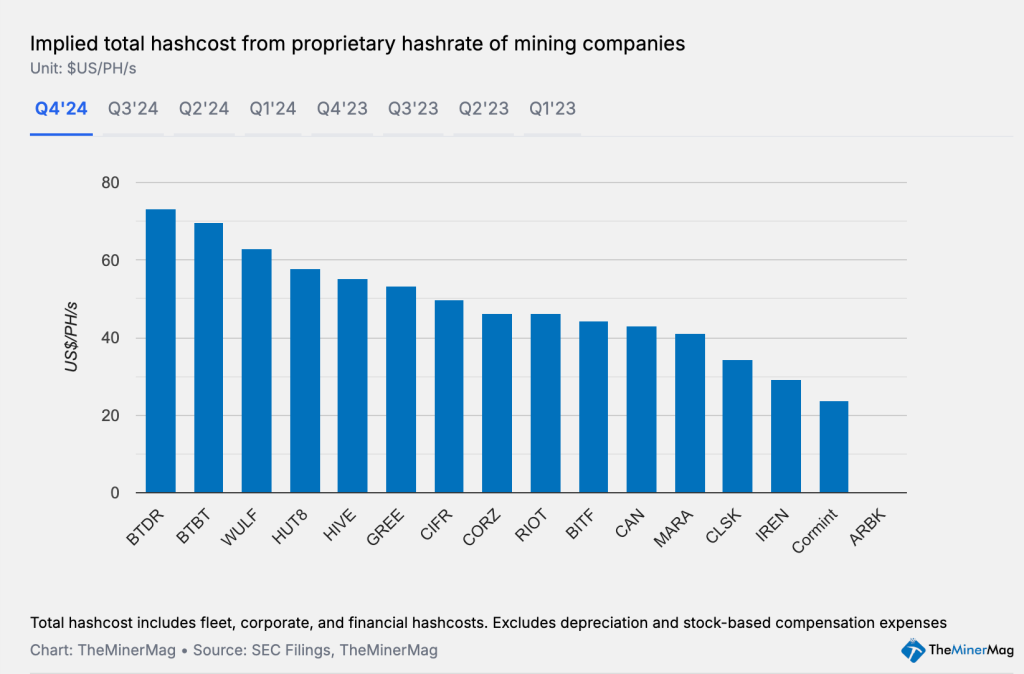

Notably, TheMinerMag’s analysis of Q4 earnings has found that “the $40/PH/s mark is a critical gross margin breakeven point for many public mining companies.” This is based on the fleet hashcost, that is, the direct cost of running mining operations, minus corporate overhead and financial obligations, says the report.

While hashprice is at breakeven levels, it also means that any further costs beyond the fleet hashcost, including corporate overhead and interest payments, are “pushing almost all these firms into net-negative territory in terms of their proprietary mining segment.”

Meanwhile, Trumps are involved in the crypto mining industry as well. A couple of weeks ago, energy infrastructure platform Hut 8 Corp. announced the launch of American Bitcoin Corp. This is an industrial-scale Bitcoin mining venture, in partnership with Trump’s sons Eric and Donald Jr.

You might also like

Many Miners Facing Shutdowns

The report went on to say that “the economics are especially bleak” for operators that are still running S19 Pro-class machines. However, these account for half of the network’s hashrate, per Coin Metrics.

Importantly, these miners are already “marginal in profitability” following the Bitcoin halving in April 2024. Now, it’s likely they will “face accelerated shutdowns or redeployments in the weeks ahead.” To avoid this, hashprice would need to see “a meaningful rebound.”

Furthermore, as mentioned above, hashprice hit $40/PH/s last time in mid-September 2024. At the time, BTC’s price was at the $64,000 level. Now, BTC trades around the $80,000 level, while “miners are worse off.”

There are two key reasons for this phenomenon, the report argues. First, Bitcoin’s 7-day average hashrate has seen a massive surge, and this “relentless rise” is diluting mining revenue.

Second, while the hashrate surges, transaction fees are plunging. Monthly block transaction fees have been setting record lows this year, the analysts found.

As for the BTC price, it has been moving under and over the $80,000 mark for several days now.

At the time of writing, BTC is trading at $82,586. It appreciated 2% in 24 hours, while it decreased less than 1% in a week and less than 2% in a month.

Overall, in the past year, its price has increased by 18%. BTC hit its all-time high of $108,786 in January 2025, dropping 24% since.

You might also like