Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

The Open Network (TON) has solidified its position as one of the leading Layer 1 solutions during the recent months.

In September, TON captured over 50% of all Layer 1 transactions, outperforming competitors such as Ethereum (ETH) or Avalanche (AVAX), according to CryptoQuant data.

The Open Network (#TON) is emerging as a leading Layer-1 solution

“In the past month… $TON captured over 50% of all Layer 1 transactions during this period, largely driven by several major token launches.” – By @JA_Maartun

Read more 👇https://t.co/0Er9EerVrc pic.twitter.com/hEI4feAwnM

— CryptoQuant.com (@cryptoquant_com) September 30, 2024

The success of TON can be attributed to several token launches. DOGS, one of the first major projects on the network, attracted a massive 28 million monthly active users (MAU). CatizenAI and Rocky Rabbit, both with 18 million MAU each, also gained significant attention. Watbird and Hamster Kombat further contributed to TON’s growth, with Watbird attracting 12 million MAU and Hamster Kombat reaching an impressive 110 million MAU.

Solana Maintains Lead

However, CryptoQuant has excluded Solana (SOL), BNB Chain (BNB) and NEAR Protocol (NEAR) from its overall analysis.

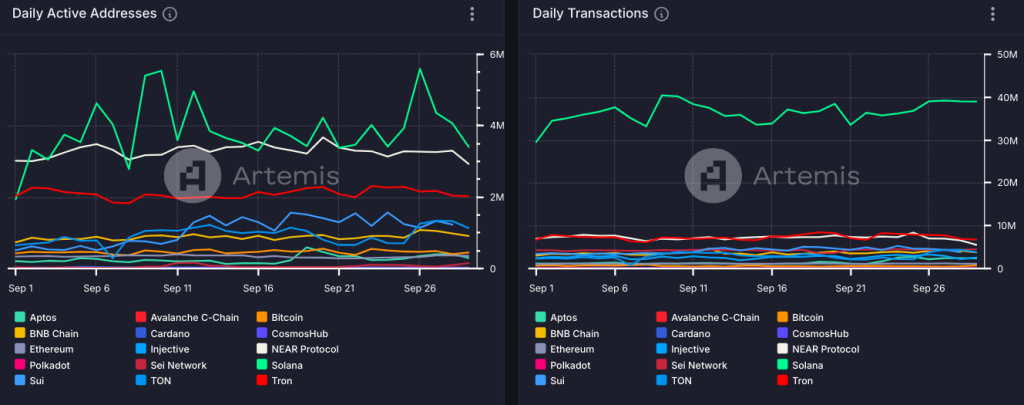

Based on the Artemis data and the additional chains included in the analysis, Solana continues to lead all Layer 1 chains in terms of transaction count and daily active wallets. As of Sept. 30, Solana had processed over 1.1 billion transactions for the month and had gained 3.9 million daily active addresses.

In comparison, TON has performed well but has been overtaken by Solana in both categories. TON has reached 212.5 million transactions so far in September, securing second place in terms of transaction volume. However, in terms of daily active wallets, TON was overtaken by both Solana and NEAR Protocol, with 2.1 million daily active addresses (all data from Sept. 30).

Bitget Predicts TON’s De-Telegramization

Bitget, a cryptocurrency exchange and major investor in the Open Network Foundation, outlined bullish predictions for the TON ecosystem in its latest September report.

One of the key predictions in the report is a potential “de-Telegramization” of the TON ecosystem. As Telegram faces increasing regulatory scrutiny, Bitget suggests that TON may need to distance itself from the messaging app to mitigate associated risks. While TON will likely continue to rely on Telegram‘s user base in the short term, the report forecasts a long-term trend towards greater independence.

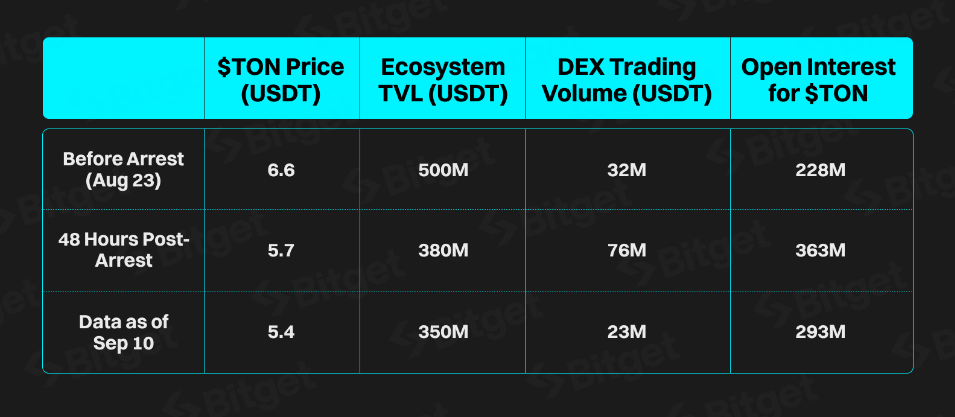

“The news of the arrest [of Pavel Durov, CEO of Telegram, on Aug. 25] has had a significant impact on the TON ecosystem. As a result, the price of the TON token has dropped over 17.6% in the week following the arrest. Furthermore, the TVL on the TON chain has also seen a sharp decline, with a single-day drop exceeding 60%.”

As of Sept. 30, TON’s total value locked (TVL) is approximately $427 million, down 45% from its peak of $776 million in July 2024.

In terms of token performance, Bitget predicts that Toncoin, the native cryptocurrency of the TON blockchain, will outperform Bitcoin’s spot returns in a bullish market. The report also anticipates increased institutional interest in TON, with many institutions favoring over-the-counter (OTC) purchases.

Despite a significant drop following the arrest of Telegram CEO Pavel Durov in August, Toncoin has still managed to achieve a remarkable 149% return since the beginning of the year. The price has risen from $2.27 on January 1 to $5.82 at the time of writing.

Meanwhile, Bitcoin (BTC) has experienced a more modest 51% increase during the same period, rising from $43,835 on January 1, 2024, to $64,029 at the time of writing.