Say hello to the newest member of Italy’s super-rich, Andrea Iervolino. He’s a multi-billionaire of sorts.

Iervolino makes films. His producer credits last year included Lamborghini — The Man Behind The Legend, Johnny Puff: Secret Mission, and Tell It Like A Woman (Oscar-nominated in the best original song category). This year’s slate includes Kid Santa, Sherlock Santa and A Day With Santa.

One of Iervolino’s many companies, AMBI Group, launched a $200mn film fund in 2015 shortly after buying remake and sequel rights to hit movies including Donnie Darko, Sliding Doors and Cruel Intentions. Backing came from Raven Capital Management, a New York alternative asset manager known for its esoteric investments.

A year later he irritated the Vatican by announcing that Pope Francis would be appearing as himself in Beyond The Sun, a family adventure based very loosely on the Gospels, and irritated Christopher Nolan fans by announcing a remake of Memento (2000). The latter project hasn’t progressed past development, whereas the Pope Francis film has all but disappeared following an inconspicuous release in 2017.

In addition to making films, Iervolino is an entrepreneur. As founder, CEO and president of Space 11, he intends to put a stadium and TV studios into orbit in 2028 on “the first space station dedicated to entertainment”. The site’s first production, a zero-gravity fighting tournament-cum-reality show called Galactic Combat, is already in the works.

Another of Iervolino’s companies, ILBE, joined Italy’s junior stock market in 2019 then added a secondary listing last year on the growth segment of Euronext Paris. ILBE is a film and TV studio he co-owns with long-term business partner Monika Bacardi, the widow of rum scion Luis Adalberto Facundo Gomez del Campo Bacardi.

ILBE (also known as Iervolino & Lady Bacardi Entertainment) had a market value of €21mn on May 11, most of which stems from two web-friendly cartoon strands, Puffins and Arctic Friends. Here’s the share price chart:

Then there’s Tatatu, a social media app maker that joined Euronext Paris by direct listing last October. Iervolino is its founder and CEO:

Tatatu’s market value peaked in January at €8.5bn and has since drifted back to around €6bn. Iervolino owns 96.5 per cent of the shares via a holding company, IA Media, meaning his personal wealth is hypothetically on par with Miuccia Prada, Piero Ferrari and Silvio Berlusconi.

The company’s eponymous app bundles together a waterfall of short TikTok-style videos and a menu of professionally produced content, most of which comes from ILBE’s roster. Users are rewarded with tokens based on how often they watch, share and interact. These tokens can be used as part-payment for clothes and accessories in a dedicated webstore, or to bid in the two or three in-app auctions that run each day.

On its launch in 2018, Iervolino said that Tatatu would be a blockchain-powered Netflix killer and immediately announced a $575mn private Initial Coin Offering that had apparent celebrity backing:

Tatatu then abandoned crypto. The IPO prospectus makes no mention of blockchain and the ethereum-based TTU tokens it sold in 2018 have no function whatsoever, either inside or outside the app. Their total current value, according to Etherscan data, is nil.

Iervolino’s decision to go public in Paris was to “increase Tatatu’s visibility worldwide” and access capital markets “with the ambition to become one of the world’s must-use social media and entertainment platforms”, he said in October:

I am confident that we will build a vast and loyal TaTaTu community, enhancing social media engagement thanks to our unique proposition and raising social and environmental awareness through original media content.

No new money was raised.

Tatatu’s maiden results showed a €9mn net loss for 2022, which it said was “mainly attributable to the non-recurring costs incurred for the IPO.” Core revenue was €104.8mn — though there’s a very important footnote here about “barter equivalent transactions”.

How it works is that Tatatu (via a Hungarian subsidiary) swaps video rights for advertising space on its platform, then books a cash-equivalent value as revenue using “an accounting policy developed by the company based on the IFRS15 standard”. This can be done as a straight swap or by “barter equivalent”, whereby clients take ad space in exchange for put options to supply videos later. Whichever way, revenue is booked as receivables and squared off against payables, but no money ever has to change hands.

“Barter contracts are necessary to create a library of content to attract users,” a Tatatu spokesman told us. “This methodology has saved money on the purchase of video content. However, as shown in the cash flow statement, these revenues do not generate cash, as the business is financed by equity and bank debt.”

At the time of its flotation, according to the prospectus, Tatatu’s revenues were “entirely related to non-cash advertising based on bartering arrangements in place”.

Five anchor clients are named in Tatatu’s prospectus as making use of these ads-for-content swaps. By far the most important is The Worldwide Production Services LLC (WWPS), a Toronto-based film company that holds digital distribution rights to the ILBE-produced Puffins and Arctic Friends series. The two shows provide the bulk of Tatatu’s professional content — though viewing is blocked in Italy, where Iervolino keeps his interests ringfenced to protect a tax break given to independent film producers.

WWPS was co-founded by Fabio Varlese, an Italian-Canadian doctor specialising in geriatric and internal medicine. He’s on the board of Ambi Gala Foundation, a Canadian charity founded by Iervolino and Bacardi to host A-list fundraisers, is named among the executive producers on the Iervolino-produced crime caper The Ritual Killer (2023), and keeps a framed photo of Iervolino in his office.

Emails to WWPS and to Varlese’s address at The Toronto Clinic, asking about his professional relationship with Iervolino and potential conflicts of interest, received no response. Tatatu’s spokesman said:

Since Iervolino is the producer of some of the content distributed by WWPS and therefore being confident of the quality, he also wanted to enter into a distribution agreement with WWPS [to] ensure these high quality products [are] in the Tatatu platform. This demonstrates confidence and commitment to the quality of the content that the company wants to broadcast.

The structure of the agreement is exactly the same used by the major platforms and by all the other suppliers of Tatatu. Obviously after the initial phase, the offer of video content will be diversified in many providers.

Have we mentioned the food markets yet? We should mention the food markets.

A few months before its float, Tatatu bought a 75-per-cent stake in Mercato Metropolitano, an operator of four Italian-themed London food markets. Iervolino has been adding film studios to its sites in partnership with music producer David Tickle, who is the other co-founder of WWPS.

Mercato Metropolitano’s Andrea Rasca last year swapped control of his business for £600,000 cash and a 1-per-cent stake in Tatatu, paid for in newly minted shares. Their agreement put a pre-money value on Tatatu of €1.6bn. Private placements earlier in 2022 had raised just over €5mn from investors including Swiss boutique bank Crédit des Alpes at the same price of €2 per share, which the company said had been set with the help of “a consulting firm of international reputation” it did not name.

Rasca’s sale of Mercato Metropolitano included a clause that if Tatatu floated below the €2 apiece needed to support a €1.6bn valuation, the company would make up the difference by giving him more equity. It wasn’t needed. Tatatu shares joined Euronext at €2 as planned and ended their first trading day at €3.35.

Day two: €7.

Day three: €8.50.

Day four: €10.

But while the stock price soared, volumes dwindled. Daily trading was in the low- to mid-1000s of shares at first sessions then dropped sharply, often to single figures. On more than 40 trading days so far this year, according to Bloomberg data, a single share has changed hands:

All this is fine according to the Euronext Growth Markets Rule Book. To join the junior market a company needs a minimum free float of just €2.5mn and there are no subsequent liquidity tests. Tatatu’s debut value of €1.6bn meant it cleared the free-float hurdle easily, even though 99.39 per cent of its shares were held by directors and connected parties:

Soon after flotation, another slug of stock went to director Eduardo Teodorani-Fabbri, a former Fiat boss who became tabloid-famous in 2009 while dating Tara Palmer-Tomkinson.

Tatatu minted new shares in January to give to Anivad Consulting Ltd, a company owned by Teodorani-Fabbri and his wife Davina de Forest (née Cornish). The award was for “certain scouting activities” and was worth €2.65mn at the subscription price of €2 per share, which included a €2.5mn bonus triggered by Tatatu’s flotation. At the time, the market mid-price on Tatatu shares was €8.40.

It’s a question that may seem beside the point given all of the above but we’ll ask it anyway: what (aside from its chronic lack of free float) might make Tatatu a multibillion-euro company?

Tatatu’s abbreviated full-year results statement in March revealed that 906,000 users had “completed the registration process for Tatatu’s web or mobile app” by the end of 2022, up from 95,000 at the end of January. Its float prospectus identifies non-current assets worth just €14.2mn, mostly intangible, of which €2.5mn is for the app and €4.3mn is for the brand trademark. Its Google Play store listing shows approximately 100,000 downloads and 1,240 reviews, 29 per cent of which are one-star.

A common complaint among users is that tokens are easy to earn but difficult to spend usefully. The same Dsquared2 bum bag that costs $229.24 plus tokens “equivalent to $95.76” in Tatatu’s web store can be ordered from Harrods for £209, for example. Meanwhile, the winning bids on daily auctions have nominal values — $10,250 for a Calvin Klein handbag; $850 for Tatatu-branded earphones; $675 for a sweatshirt signed by actor Gabriel Garko; $11,500 for a mystery box that might contain Tatatu-branded earphones — that suggests a token’s purchasing power is far below its $0.25 face value.

Asked about the strategy around tokens, Tatatu said its discount system “is still in the start-up phase.” Asked for active user metrics, and about increasing share liquidity, Tatatu did not respond. Asked about whether Iervolino had used his Tatatu stake as collateral for personal loans, we were told this was “not an information that is available from company’s management.”

We didn’t ask about Iervolino’s space station, nor his recent investment in Miami FC, since those themes have already been covered adequately by other media.

Iervolino has an agreement in place not to sell any Tatatu shares for two years from the IPO date, so unless the condition is waived he is locked into being a paper billionaire until October 18, 2024. Other insiders have lock-ups lasting until at least October 2025 so, whatever happens from here, everyone should have plenty of time to enjoy Tatatu’s high quality products:

Further reading:— To Tinseltown the hard way (FT, 2017)— Selena Gomez gets close with Italian film producer (Daily Mail)— I became the world’s richest man for seven minutes (YouTube)

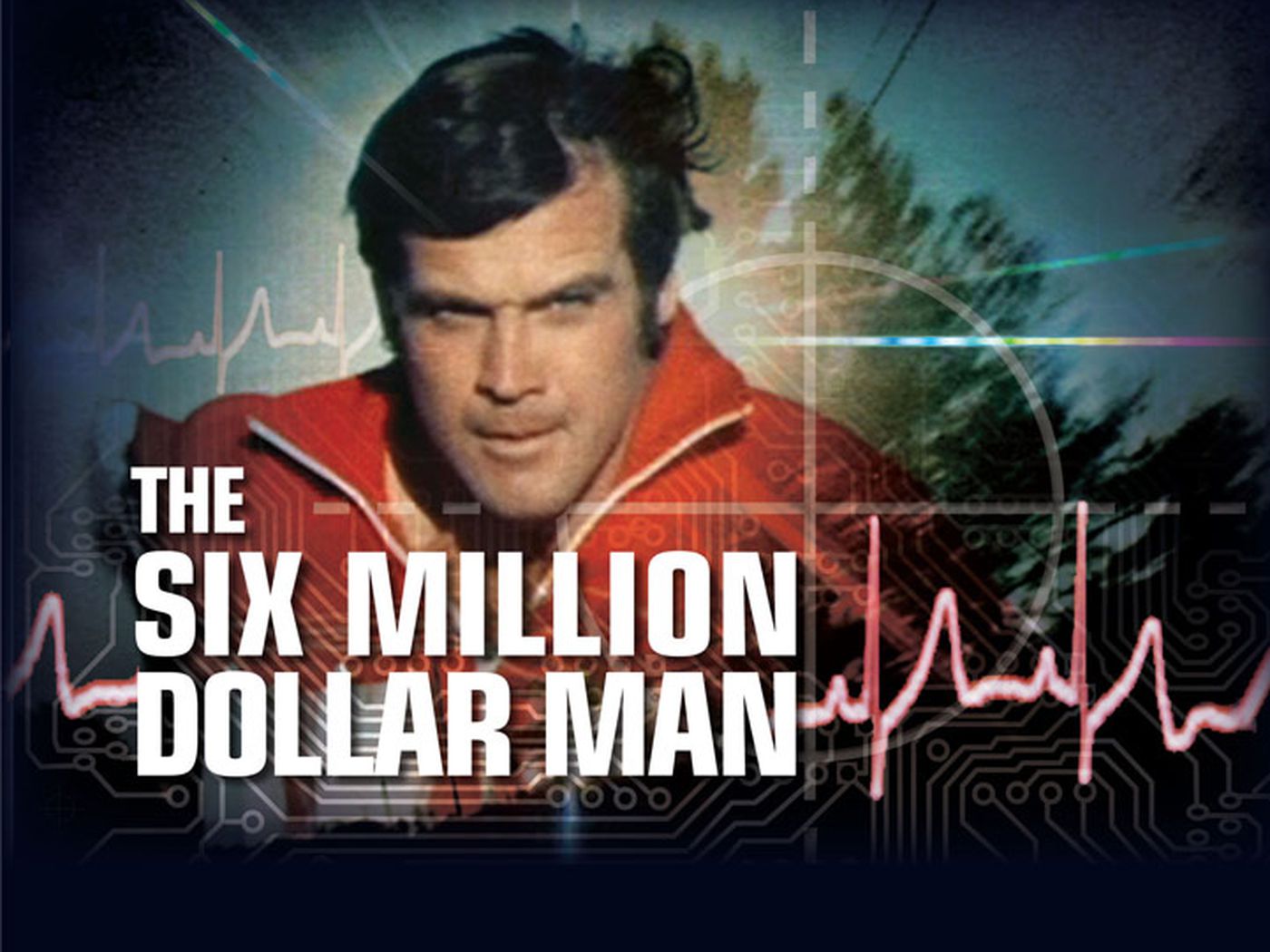

The six-billion-dollar man you’ve probably never heard of