Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships.

Global Futures and Options Ltd. (GFO-X), a London-based crypto derivatives trading platform, has secured partnerships with prominent financial institutions including Standard Chartered Plc, Virtu Financial Inc., ABN Amro Clearing, and market maker IMC.

The platform, backed by M&G Investments, plans to officially launch in the first quarter of 2025 after multiple delays.

Can GFO-X’s Regulated Platform Redefine Crypto Derivatives for Institutional Investors?

The announcement was made on December 9, confirming these financial giants as key collaborators in GFO-X’s efforts to establish a regulated platform for crypto derivatives trading in the United Kingdom.

The exchange aims to handle trading in Bitcoin index futures and options, with transactions cleared through LCH SA, a clearinghouse majority-owned by the London Stock Exchange Group.

LCH has developed a specialized service, DigitalAssetsClear, to cash-settle GFO-X’s derivatives trades, ensuring secure and regulated operations.

This move follows LCH SA’s regulatory approval in April 2024 to clear Bitcoin index futures, a decision that came nearly a year after the firm announced plans to extend central clearing services for GFO-X’s platform.

GFO-X revealed that the platform is set to launch officially in the first quarter of 2025, with the aim of offering Bitcoin index futures and options tailored for institutional investors.

These products will operate through the DigitalAssetsClear service provided by LCH SA, a London-based clearing services firm.

Andy Ross, global head of prime and financing at Standard Chartered, expressed enthusiasm for the initiative, stating,

“We’re delighted to support the launch of GFO-X derivatives and to join LCH SA as a general clearing member to enable our clients to trade and clear.”

The GFO-X derivatives platform has also received backing from M&G Investments and regulatory approval from the U.K. Financial Conduct Authority (FCA) since 2022.

From GFO-X to BlackRock: Financial Titans Double Down on Crypto Amid Market Rally

The recent rally in digital asset prices, driven by Donald Trump’s re-election and his administration’s pro-crypto stance, has reignited institutional interest in the crypto market.

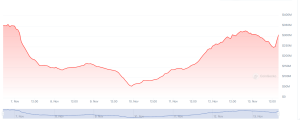

Bitcoin surged over 40% since the election, reaching an all-time high of $103,800 last week.

Arnab Sen, CEO of GFO-X, said:

“There are huge tailwinds post the US election. We’ve had multiple firms reach out, many of whom had previously been cautious about entering the space.”

Trump’s victory has fueled optimism among investors, who anticipate crypto-friendly legislation that could remove regulatory barriers and encourage greater participation from traditional financial institutions.

The launch of GFO-X’s platform is expected further to bolster institutional engagement in the crypto derivatives space.

Other financial giants are also increasing their involvement in cryptocurrency. Intesa Sanpaolo SpA recently expanded its digital assets desk to manage spot trades.

Standard Chartered has been actively expanding its presence in the cryptocurrency sector. In October, crypto exchange OKX selected Standard Chartered as its crypto custodian.

Meanwhile, BlackRock Inc., the world’s largest asset manager, has accumulated $58 billion in assets through its Bitcoin-backed exchange-traded fund.

BlackRock is also advancing efforts to make its money-market digital coin more widely accepted as collateral in crypto derivatives trades.

In August, the bank’s digital arm, Mox Bank, also launched the first spot cryptocurrency exchange-traded funds (ETFs) by a virtual bank.