Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Spot Ether exchange-traded funds (ETFs) in the United States have experienced their longest streak of outflows since their inception on July 23.

For five consecutive days, from August 15 to August 21, ETH ETFs saw outflows, which reached a total of $92.2 million, according to Farside Investors data.

The outflows have been largely attributed to the Grayscale Ethereum Trust (ETHE), which saw $158.6 million in withdrawals during the same period.

Grayscale Outflows Overshadow Inflows into Other Funds

Grayscale outflows have overshadowed the inflows into other recently approved spot Ether ETFs, including BlackRock’s iShares Ethereum Trust ETF (ETHA), the Fidelity Ethereum Fund (FETH), and the Bitwise Ethereum ETF (ETHW).

For one, ETHA managed to become the first spot Ether ETF to surpass $1 billion in net inflows on August 20, providing a slight cushion against the overall negative trend.

The Grayscale Ethereum Mini Trust (ETH), however, has bucked the trend, reporting no outflows since its launch and maintaining positive net flows of $231.9 million.

Meanwhile, the longest outflow streak comes after spot ETH ETFs experienced positive net inflows for the first time earlier this month.

At the time, the nine spot Ether ETFs recorded a combined net inflow of $104.8 million during the week starting on August 5.

They also collectively traded a total value of $1.9 billion, bringing their total net assets to $7.3 billion as of August 9.

Notably, ETF issuers are pushing to introduce options products for their spot ETH funds.

Just recently, the New York Stock Exchange (NYSE) American proposed a rule change to list and trade options for three Ether ETFs managed by Grayscale and Bitwise.

The move seeks to include options for the Bitwise Ethereum ETF (ETHW), the Grayscale Ethereum Trust (ETHE), and the Grayscale Ethereum Mini (ETH).

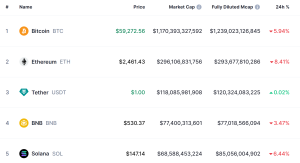

Spot Bitcoin ETFs Maintain Positive Flows

In contrast to Ether ETFs, spot Bitcoin ETFs in the U.S. have fared better, maintaining positive flows for eight out of the last ten days.

As of August 20, these ETFs saw an aggregate inflow of $88 million, with BlackRock’s iShares Bitcoin Trust leading the way with $55.4 million in net inflows.

Since their launch in January 2024, spot Bitcoin ETFs have accumulated net positive flows of $17.5 billion, showcasing a stronger investor appetite compared to their Ether counterparts.

Overall, the launch of spot BTC and ETH ETFs this year has attracted significant investments from major financial players, including Goldman Sachs and Morgan Stanley, who collectively invested over $600 million in these products during the second quarter.

As reported, a growing number of institutional investors are bolstering their Bitcoin holdings through spot ETFs, according to recent data from Bitwise.

In the second quarter of 2024, approximately 66% of these investors either maintained or increased their Bitcoin ETF positions.

Meanwhile, only 21% of institutional investors reduced their positions, and a smaller 13% decided to exit entirely.