Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. Read more

A takeover deal for the South Korean crypto exchange GOPAX has “practically fallen through,” casting doubt on its long-term survival.

Chosun Ilbo reported that progress has stalled on a deal that would see Megazone, a cloud service provider, take control of GOPAX. The latter is one of South Korea’s five fiat-trading crypto exchanges.

The deal is complicated by the fact that GOPAX is currently majority-owned by the global crypto exchange giant Binance.

GOPAX: Takeover Deal in Danger?

Binance bought a controlling stake in GOPAX in early 2023 as part of its bid to break into the high-volume South Korean market.

But South Korean financial regulators have blocked the move. They have ordered Binance to reduce the size of its stake in GOPAX from around 67% to 10%.

The media outlet wrote that “crypto industry” insiders said on December 24 that “negotiations between Megazone and Binance” over the sale of GOPAX “have not progressed since October.”

‘Nothing Has Been Confirmed’

Chosun wrote that Megazone “stated that nothing has been confirmed regarding the acquisition discussions with GOPAX.”

The company claimed that talks are “still in progress.” But it also suggested “there are currently no actual discussions or plans in place.” Chosun added:

“Megazone and Binance have not spoken directly of late. And industry sources have come to the conclusion that Megazone has effectively given up on the acquisition deal.”

A further wrinkle comes in the form of GOPAX’s debt to creditors as a result of the failure of its GOPAY crypto staking services.

Binance has expressed its willingness to clear the debt with its own capital if it is allowed to complete the takeover.

Megazone: Buyer Getting Cold Feet?

Megazone, meanwhile, had agreed a deal in principle to buy most of Binance’s shares.

However, as most of the GOPAY debt is in the form of crypto, the task of satisfying creditors has become increasingly daunting.

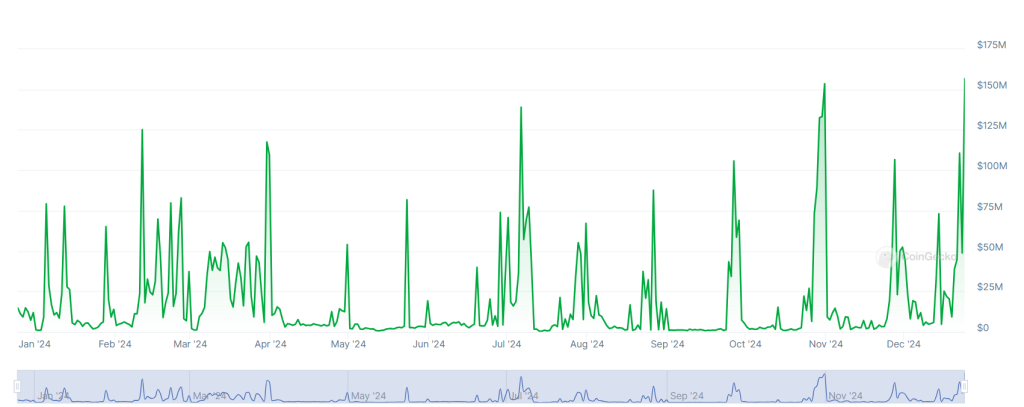

Bitcoin (BTC) prices have soared since the October talks, rising from just over $60,000 to an all-time high of above $106,000 in recent weeks.

GOPAX’s GOPAY woes began in 2022, with the collapse of the FTX exchange. This caused Genesis, GOPAY’s partner, to declare bankruptcy, saddling GOPAX with the resulting debt.

GOPAX has told creditors that it wants to repay unpaid balances “in cash based on the price at the time of the collapse.” But disgruntled creditors say they want their Bitcoin back “as-is.”

Chosun wrote that if Megazone “pulls out of the deal, the exchange will not meet financial authorities’ demands. And it explained:

“Not only is it extremely unlikely that a new buyer will emerge, but it is also obvious that Gopax’s debt will be a hindrance during takeover negotiations.”

On-site Inspection

GOPAX is one of only five domestic exchanges with a crypto-to-fiat trading permit. But its status may also be under threat.

The exchange has applied for a renewal of its Virtual Asset Service Provider (VASP) registration recently, with regulators visiting for an on-site inspection last week.

The firm received the all-clear, but the newspaper wrote:

“If the authorities do not accept the renwal application, citing the change in major shareholders as a problem, GOPAX will have to go through the process of closing down. And then repaying its debts will become even more difficult.”

Chosun quoted an unnamed industry insider as saying:

“GOPAX has fulfilled all the legal requirements it could. And all that remains is gaining regulatory approval. Fortunately, Binance is still willing to repay GOPAX’s debts and is communicating with the authorities. So there is still hope.”