Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

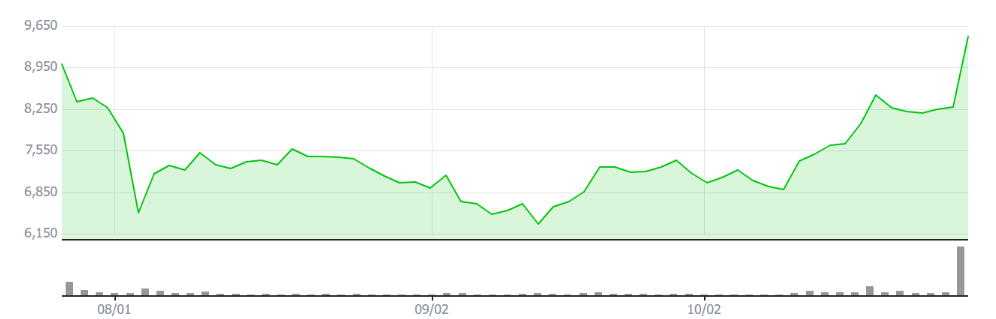

South Korean crypto-related stocks are rising fast as Bitcoin (BTC) prices climb toward a new all-time high.

No crypto exchange has yet floated on the Korea Exchange. However, several listed firms own minority stakes in domestic crypto operators.

These include Woori Technology and Hanwha Investment & Securities, which both own shares in Dunamu, the operator of the Upbit exchange.

Woori Technology’s share price rose by over 14% on October 29, with Hanwha Investment & Securities closing the trading day up 7.53%.

The former is an investment firm that has backed a range of fintech and blockchain-related startups since its 2022 inception.

Hanwha Investment & Securities, meanwhile, is an affiliate of the Hanhwa Group, one of the nation’s biggest conglomerates.

It specializes in wealth management and asset management services, including real estate investment.

There were also big price moves for WIZIT, a display and semiconductor manufacturing equipment parts provider.

The firm’s subsidiary T Scientific owns shares in Bithumb Korea, the company that runs the Bithumb trading platform. WIZIT stocks also rose 7.76% on October 29.

S Korean Firms Make Gains: US Elections Driving BTC Excitement?

There were also big gains (10.66%) for Galaxia Moneytree, a financial services provider. The firm is working on security token operations.

In April 2021, Galaxia Moneytree co-launched the nation’s first Bitcoin-powered payments service.

Trading volumes on Upbit have also risen, moving toward the $2 billion mark. Bitcoin accounts for over 17% of the trading volume on the platform at the time of writing.

South Korean media outlets like CNB Journal have attributed the rise in BTC prices – and associated South Korean share prices – to events in Washington.

They believe that excitement over the US Presidential Elections is bouying the markets. Both leading candidates, Kamala Harris and Donald Trump, have made a series of crypto-related manifesto pledges.

The media outlet wrote:

“Positive changes are expected in the cryptoasset market regardless of who wins, no matter if the Republican candidate Donald Trump or the Democratic candidate Kamala Harris clinches victory.”