Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Solayer, a Solana-based staking platform, launched sUSD, a synthetic stablecoin backed by real-world assets (RWA), on October 29 to offer a decentralized, user-owned alternative to existing stablecoins.

Unlike traditional stablecoins, which are pegged to a fiat currency held by a central authority, sUSD is backed by a basket of low-risk assets such as Treasury bills and government bonds issued by the United States Department of the Treasury.

“Anyone with $5 can access tokenized real world assets, starting with the U.S. Treasury Bill, now live on Solana”, the Solayer team said in its X post.

The U.S. Treasury Bill is the first asset onboarded in partnership with OpenEden, a tokenization platform that offers a tokenized U.S. Treasury product with an “A” rating from Moody’s.

In the future, Solayer plans to onboard “other low-risk real-world instruments,” such as oil and gold.

A Decentralized Approach to RWA-Backed Stablecoins

Using Solayer’s non-custodial request-for-quote (RFQ) marketplace, sUSD allows users to mint and redeem directly without relying on centralized institutions.

With a minimum entry point of $5, anyone can access sUSD and earn a portion of the yield generated by the underlying RWAs. This yield is automatically distributed in USDC, similar to earning interest in a traditional savings account.

sUSD offers instant redemption back to USDC, addressing the liquidity concerns often associated with RWA holdings on-chain.

Additionally, according to Solayer’s blog post, sUSD can be used as collateral for proof-of-stake (PoS) consensus mechanisms, adding an extra layer of security to decentralized networks like Solana and Ethereum.

“Stablecoins Should Be User-Owned”

The creators of sUSD, Solayer Core, said they envision a future where crypto and traditional finance seamlessly integrate.

“Most stablecoins are tethered completely to traditional banking infrastructure, drifting away from crypto’s core promise of individual freedom,” Solayer Core said. “To create the ultimate open internet platform, stablecoins should be decentralized and user-owned – an automated asset that no one can create, destroy, or freeze besides the user themselves.”

Similar to an automated market maker (AMM), the Solayer RFQ protocol allows anyone to create quotes, and qualified tokenizers can become RWA liquidity providers.

Stablecoins Take Center Stage

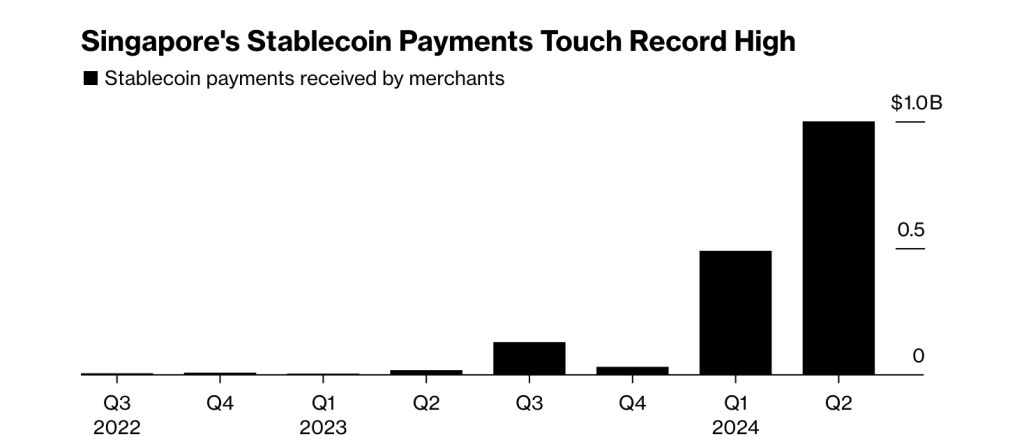

Once a niche asset, stablecoins are now in the spotlight due to their increasing global adoption and various use cases.

According to Artemis, the demand for stablecoins continues to surge, with daily transaction volumes exceeding $66.77 billion in the past 24 hours, marking a 73% increase.

Over the past 30 days, the total transaction volume for stablecoins has surpassed $2 trillion, nearly doubling from the previous month.

Tether (USDT) and USD Coin (USDC) remain the dominant players in the market, with $112.4 billion and $33.5 billion in transaction volume, respectively, over the last 30 days.