Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Solana (SOL) continued its growth trajectory in Q3 2024, with a surge in investment activity despite a dip in on-chain usage.

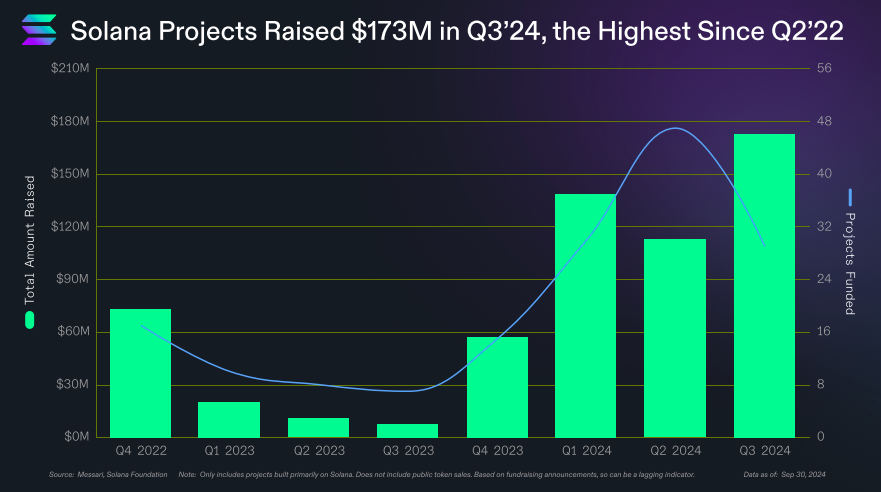

According to the ‘State of Solana: Breakpoint Edition’ report, 29 projects built on the Solana blockchain secured $173 million in private funding during Q3 2024, the highest level since Q2 2022. Each month in Q3 2024 saw sequential growth, with September’s $103 million marking the strongest month since June ’22.

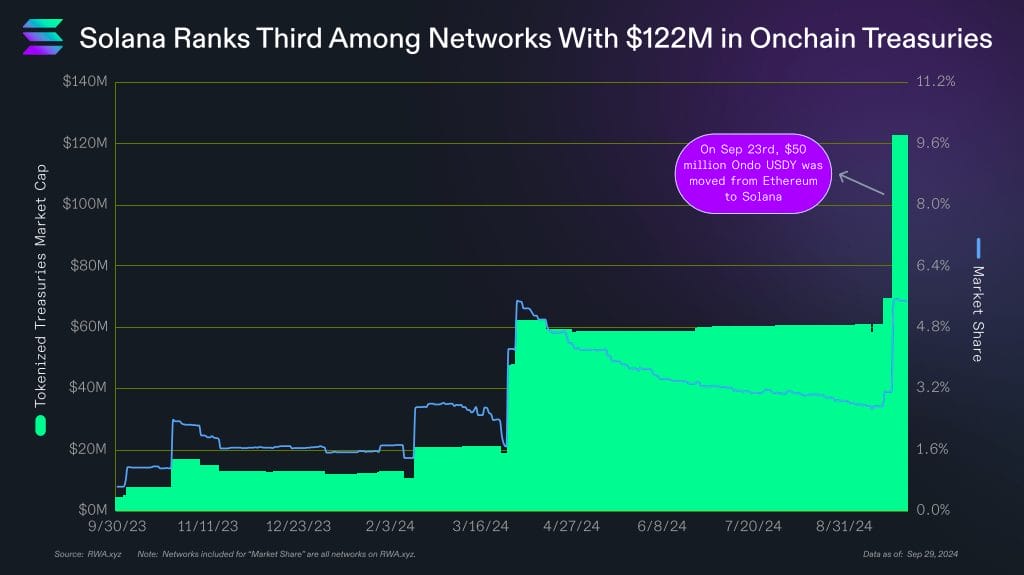

Solana’s Tokenized Treasury Market Flourishes

Solana’s tokenized treasury market has also seen massive growth, doubling the total value to $123 million in just 30 days. The surge was primarily fueled by a $50 million influx of USDC from Ethereum (ETH) on September 23.

Although Solana currently ranks third in tokenized treasuries behind Ethereum ($1.6 billion) and Stellar ($422 million), recent developments suggest growth potential.

In late July, Hamilton Lane, an alternative investment management firm, launched the first private credit fund on the Solana blockchain.

Franklin Templeton, a leading global asset manager with $1.7 trillion in assets, plans to launch a money market fund on Solana. Once live, Franklin Templeton will become the first asset manager to issue securities on Solana through a public registration statement with the SEC.

At the Breakpoint conference in late September, Securitize, a digital asset securities firm, announced that it would add native support for Solana, allowing its tokenized assets to be deployed on the network.

In May 2024, BlackRock partnered with Securitize to launch its tokenized fund, the BlackRock USD Institutional Digital Liquidity Fund (BUILD). The fund currently has over $522 million in assets under management (AUM). One-third of BUIDL’s on-chain supply is used as reserves for Ondo’s OUSG fund.

Ondo, a decentralized finance protocol, expanded to Solana at the end of 2023 and could help drive the adoption of BUIDL on the network.

Solana’s On-Chain Activity Declines Despite Institutional Interest

Despite increased institutional interest, Solana’s on-chain activity has declined during the last six months. Monthly transaction fees have dropped by 66% from their March 2024 peak, although they remain significantly higher than a year ago, increasing by nearly 1,900%.

Although Solana’s monthly transaction fees peaked in March, its market share of fees steadily grew until July, reaching a notable 25%. Before this, Solana’s market share had never exceeded 1.5%.

Over the past six months, Solana’s transaction fees totaled $260 million, ranking third behind Ethereum ($752 million) and TRON ($268 million).

According to the report, the total fee figure was driven by transaction volume rather than high individual transaction fees. Over the same period, Solana’s average transaction fee was $0.02, lower than Ethereum ($3.58), TRON ($0.22), BNB Chain ($0.13), and Base ($0.05).

As of Oct. 7, Solana’s total locked value is $5.6 billion, and it has been steadily increasing since January 2024.

SOL, Solana’s native cryptocurrency, is currently at $148, up over 15% in the last 30 days.