Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

A wave of interest has swept in the cryptocurrency industry as a flurry of filings for spot Solana exchange-traded funds (ETFs) have been submitted to the U.S. Securities and Exchange Commission (SEC).

The Cboe BZX Exchange submitted four 19b-4 filings for asset managers to list spot Solana ETFs on Nov. 21.

If approved, these Solana ETFs, issued by Bitwise, VanEck, 21Shares, and Canary Capital, will be listed on the Cboe BZX Exchange.

Cboe has filed 19b-4s w/ SEC for…

Canary Solana ETF

Bitwise Solana ETF

VanEck Solana ETF

21Shares Core Solana ETF

— Nate Geraci (@NateGeraci) November 21, 2024

Bitwise Enters the Solana ETF Fray

The 19b-4 filings inform the SEC of a proposed rule change by a self-regulatory organization like a financial regulatory body or stock exchange. This is different from S-1 registration statements, which VanEck and 21Shares submitted for their Solana ETFs in late June, and Canary Capital filed in October.

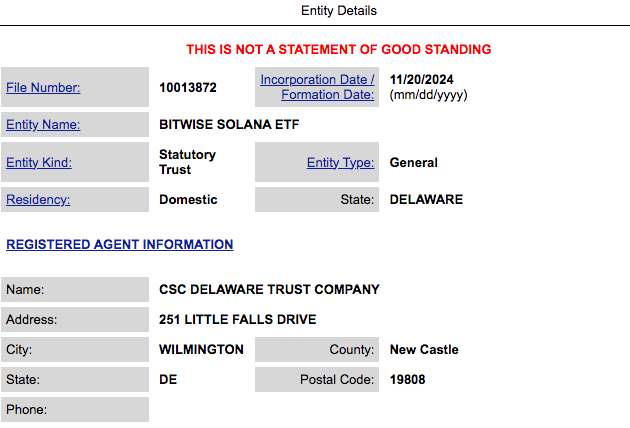

Bitwise also joined the race, registering a statutory trust in Delaware for a spot Solana ETF on Nov. 20 and filing its S-1 on Nov. 21.

The timing of these filings is particularly intriguing, coinciding with the announcement of SEC Chair Gary Gensler’s resignation on the same day. Many in the crypto industry expect a more favorable regulatory climate under new leadership, which could accelerate the approval process for other crypto ETFs.

Solana ETFs: A New Dawn for Crypto Investing?

According to a Nov. 21 X post by Fox reporter Elenor Terret, discussions between the SEC and several issuers seeking approval for spot Solana ETFs have intensified significantly.

Terret also reports that ETF issuers have now pointed out that “the recent engagement from staff, coupled with the incoming pro-crypto administration is sparking a renewed sense of optimism that a Solana ETF could be approved sometime in 2025.”

🚨SCOOP: Talks between @SECGov staff and issuers looking to launch a $SOL spot ETF are “progressing” with the SEC now engaging on S-1 applications, according to two people familiar with the matter. These people say there’s a “good chance” we’ll see some 19b4 filings from…

— Eleanor Terrett (@EleanorTerrett) November 21, 2024

The next step in the approval process is the filing of 19b-4 forms by exchanges like the Cboe on behalf of the issuers. These filings request the SEC’s permission to list the proposed ETFs. Once the SEC confirms receipt of a 19b-4 filing, a 240-day period begins during which the agency must decide whether or not to approve the product.

The price of Solana’s native token SOL initially reacted positively to the news, reaching a new all-time high of $262 on Nov. 22. The token is currently trading near $257 at the time of writing, which represents a daily gain of 6.6%.