Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

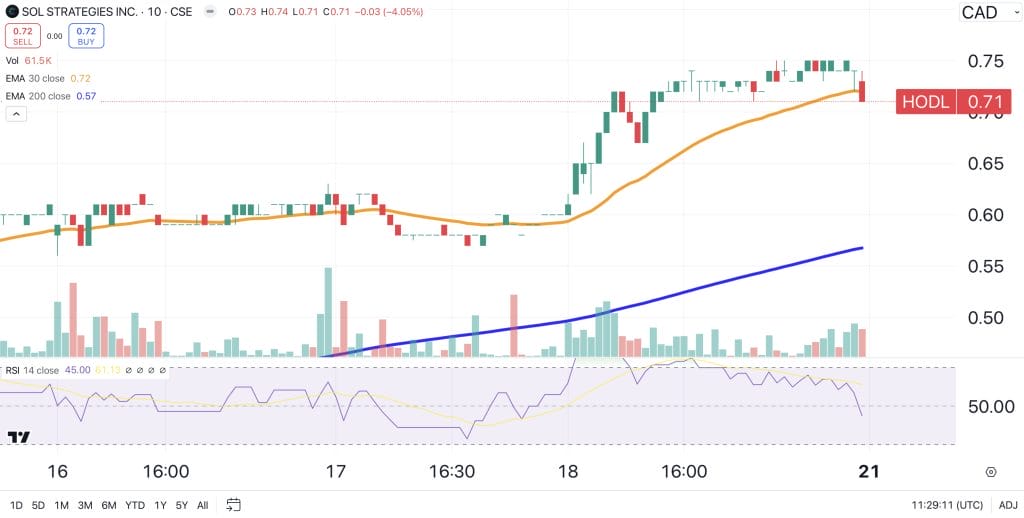

The stock of Sol Strategies (CSE: HODL) has posted a 270% monthly gain today, following the Canada-based Solana validator’s rebranding from its original name of Cypherpunk Holdings.

Sol Strategies announced its new name on September 13, revealing that the change is part of a general shift towards investing more heavily in Solana.

At the time, its stock had a price of approximately $0.16 on the Canadian Stock Exchange, but it began to rise dramatically after the firm began announcing expansions of its SOL holdings.

And with Solana itself riding an increasingly bullish cryptocurrency market, Sol Strategies’ stock could continue to rise strongly in the coming weeks.

Sol Strategies Price Spike: This Solana Validator’s Stock $HODL Is Up 270% In a Month

While HODL began to rise steadily in the immediate wake of the rebranding, it began to take off around October 10, when Sol Strategies tweeted that it had “significantly increased its SOL holdings.”

It bought 4,341.80 SOL, bringing its total hoard to just over 105,000 SOL, worth around $17.4 million in today’s prices.

Its recent SOL purchases are highly significant, in that it finds the company becoming a kind of ‘MicroStrategy for Solana.’

Yet it’s not only a purchaser of Solana, since the firm is also a major Solana validator, having delegated a total of 225,000 SOL to its validator for staking.

Again, this signals a massive vote of confidence in Solana, while it also tells the market that there’s a big player intent on supporting the price of SOL.

Indeed, SOL’s price has reacted positively to such signals, with the altcoin up by just over 4% today, and by 9% in a week.

It’s also benefitting from growing market bullishness, with investors boosted by improved polling for Trump, who has taken a more crypto-friendly stance than his election rival Kamala harris.

And given that several big investment firms have filed to launch Solana-based ETFs in recent weeks, it seems that Sol Strategies may have timed its rebranding quite wisely.

The Toronto-based firm had CAD $31,342,586 in total assets (including crypto and cash equivalents) as of March 31 of this year, as per its most recent financial statement.

This represented a rise of approximately 83% over the year previously, suggesting that it was growing before its rebrand.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.