Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

SOL Strategies Inc. completed several expansion initiatives in March 2025, increasing its position within the Solana staking ecosystem.

The publicly traded Canadian firm released its operational update for last month on April 7, highlighting a month defined by strategic expansion, infrastructure upgrades, and governance involvement.

SOL Strategies Expands Stake Through Validator Acquisitions

The company’s most transformative move was acquiring three prominent Solana validators, including the highly respected Laine validator and the validator analytics platform Stakewiz.com.

The $24 million transaction was finalized on March 17 and marked a 102% increase in the company’s total SOL stake, which now stands at 3,351,617 SOL (approximately $388 million).

Accompanying the acquisition was the addition of Laine’s founder, Michael Hubbard, to SOL Strategies’ executive team as Chief Strategy Officer.

Hubbard, known for his technical expertise in the Solana ecosystem, is now spearheading the expansion of validator infrastructure and high-value institutional partnerships.

The validator acquisition also introduced key performance enhancements.

SOL Strategies reported 99.955% uptime across all validators and delivered an average APY of 7.41% to delegators, outperforming the network average.

Key Validators Align Behind SIMD-228, but Proposal Falls Short

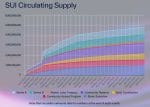

Beyond validator operations, the company actively participated in the vote on SIMD-228, a pivotal proposal to reduce Solana’s inflation rate from 4.5% to 0.87%.

SOL Strategies publicly confirmed that all its validators voted in favor of the proposal.

While the proposal secured 61.4% support, it fell short of the two-thirds threshold needed for adoption.