Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Solana-focused publicly traded holding company Sol Strategies (CSE: HODL) (OTC Pink: CYFRF), today announced it has acquired four validators from Cogent Crypto.

Cogent saw 99% of its slots successfully included in the blockchain, placing it among the highest-performing validators operating within the Solana ecosystem. In comparison, the ninth largest validator, Jupiter, has a 98% slot success rate.

The acquisition increases the amount of SOL delegated to Sol Strategies-owned Solana validators to 948,804 SOL (CAD $285,866,889 / USD $203,658,793), an increase of 699,012 SOL (CAD $210,570,732), enabling Sol Strategies to earn validation commission on this delegation.

Cogent is the 100th ranked validator on the network by amount staked. After the acquisition Sol Staregies is currently in 174th position but after completion of the acquisition moves up to 83rd place.

Sol Strategies’ shares had been subject to a trading halt prior to the announcement at which time the stock was priced at $1.20. The resumption of trading is expected to see the stock price jump.

Sol Strategies is becoming a bigger player in crypto’s second-busiest blockchain

The Solana blockchain is the second most used after Ethereum, as measured by transaction volume. Its cheap fees and fast speed have seen its popularity soar. It has become the blockchain of choice for launching meme coins, the fastest-growing category of cryptocurrency.

Sol Strategies will buy the assets of three other validators, this time on the SUI, MONAD, and ARCH networks, with cumulative delegations of CAD $181,444,889.40.

Validators are the ‘miners’ of the proof-of-stake protocols and are responsible for verifying transactions and maintaining the health of the blockchain network. Validators earn a yield from staking.

Sol Strategies CEO Leah Wald, commenting on the deal said: “For this next phase of Sol Strategies, we are focused on making the Company’s first acquisition to advance the Company’s long-term growth strategy.

“This acquisition will meaningfully expand Sol Strategies’ staking capabilities, which underpins Solana’s reputation as a next-generation blockchain for institutional and decentralized applications alike.

“By building on Cogent Crypto’s established role in the ecosystem, Sol Strategies is positioned to support the future of decentralized finance and drive long-term value creation for shareholders.”

Sol Strategies will pay USD $1,000,000 in cash on closing the deal with the rest of the consideration covered by the issuance of 1,162,000 common shares at close valued at CAD $1.20 and the issuance of 18,592,000 common shares valued at CAD $1.20 per over a period of three years from closing the acquisition agreement.

Sol Strategies share price ready for take-off after pullback

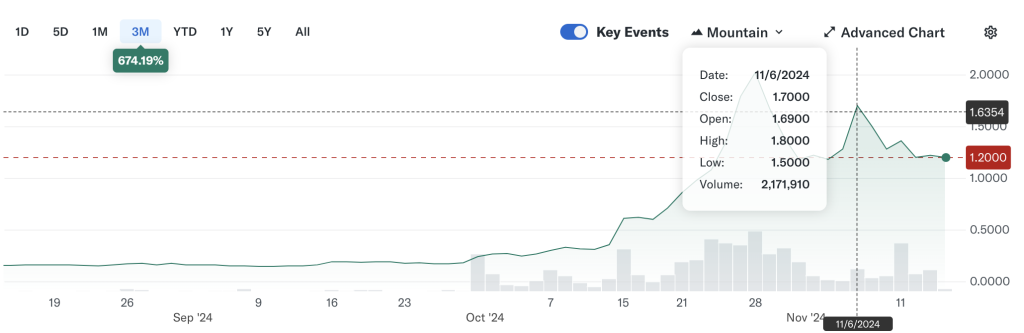

Sol Strategies has seen its share price take a volatile turn, but it has now found a floor around $1.10-$1.20 in the Canadian market.

Listed on the CSE as HODL and OTC in the US as CYFRF, the price has been on a parabolic run that predates the melt-up of the crypto market following the Trump win in the US presidential election.

However, the forward march of the share price, spured on by Solana’s outperformance against bitcoin and top altcoins in recent weeks, came to a shuddering halt on November 6. On that day the company’s largest shareholder, Chairman Antanas Guoga aka TonyG, sold 4 million shares, reducing his holding from 36% to 33% of the outstanding shares.

The sale was related to the announcement the previous week of a revolving credit line of $10 million. TonyG was simply raising funds as part of that loan process.

Although it was far from being a vote of no confidence in the business, some market participants interpreted it as such and began selling in serious fashion.

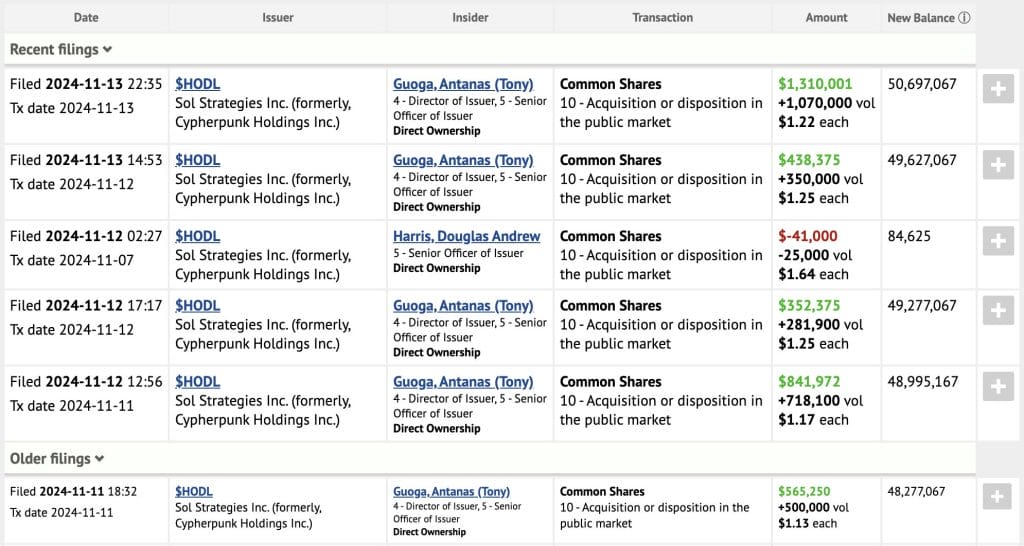

TonyG’s stock sales took place between October 31 and November 6, as can be seen on the System for Electronic Disclosure by Insiders (SEDI) and reproduced below:

As the chart below shows, the impact of the disposals was brutal. The HODL price fell 29.4%, from $1.70 to $1.20. As of November 7 the chairman’s holding had fallen to 47,777,067 shares of a total capitalization of 145.96 million shares.

The shorts were having a field day – short interest in the shares is 3.15%. Short interest below 10% of outstanding shares is considered healthy for the Canadian Stock Exchange. Nevertheless, the bearish bias in hindsight was a leading indicator of what happened in the US market yesterday, where crypto stocks like Coinbase, Riot and MicroStrategy fell heavily despite bitcoin at one stage trading above $93,000.

As new fast money flows into crypto stocks in search of outsized alpha, more volatility (beta) is perhaps to be expected. The bulls can’t have it both ways – over the past 12 months Sol Strategies (it changed its name from Cypherpunk Holdings in September 12 2024) has gained 990% .

But TonyG was not walking away from the stock; far from it. On November 11 he started buying in furious fashion:

And he was back in the market again the following day, taking his holding back above 50 million, as shown in the SEDI filings below:

The intervention doubled-down on TonyG’s skin-in-the-game commitment to the company, stabilizing the price at around the $1.20 level after having fallen as low as $1.06 in intraday trading.