Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

The US SEC on Thursday charged Chicago-based crypto market maker Cumberland with operating without registration as a dealer in securities transactions exceeding $2b.

Its complaint states that from March 2018 to the present, Cumberland has been engaging in the purchase and sale of crypto assets, classified as securities, for its own accounts without registration, as a routine part of its business.

Further, the complaint says that Cumberland conducts trades around the clock via phone or its Marea platform. Additionally, the SEC asserts that Cumberland routinely trades crypto assets, treated as investment contracts, on external exchanges.

More specifically, the complaint alleges that Cumberland facilitated the trading of numerous crypto assets that are considered investment contracts, and thus securities. Further, the agency mentioned assets like POL (formerly MATIC), SOL, FIL, ALGO and ATOM.

Cumberland Challenges SEC’s Securities Designation in Crypto Transactions

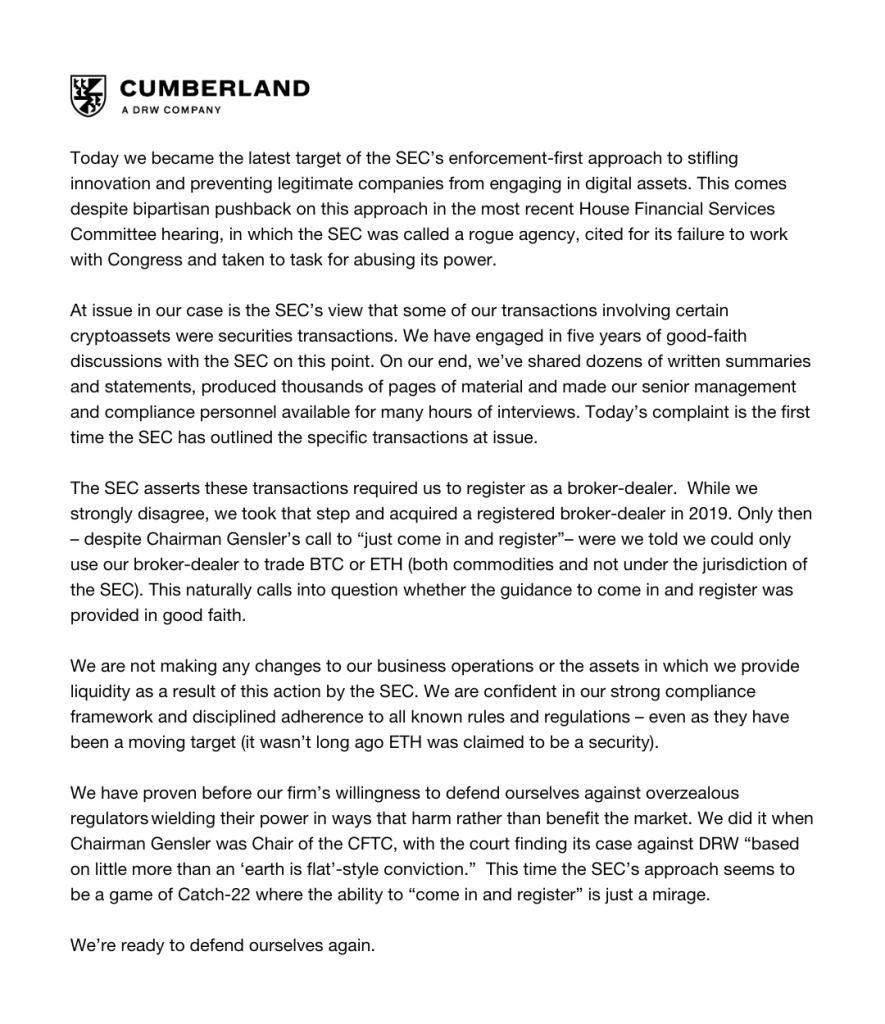

Cumberland responded to the SEC’s charges by criticizing the agency’s enforcement-first approach, arguing it had become the latest target in an effort to stifle innovation. The company specifically disputed the SEC’s classification that certain crypto asset transactions are securities.

“We have engaged in five years of good-faith discussions with the SEC on this point,” the firm said. “On our end, we’ve shared dozens of written summaries and statements, produced thousands of pages of material and made our senior management and compliance personnel available for many hours of interviews. Today’s complaint is the first time the SEC has outlined the specific transactions at issue.”

Additionally, Cumberland declared that it would continue its operations without alteration in response to the SEC’s action.