Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

A major Russian stock exchange has denied reports that it is on the verge of launching a state-run crypto trading platform.

Earlier this week, unnamed insiders reportedly told major Russian news outlets that the Saint Petersburg and Moscow exchanges were ready to roll out crypto exchange services.

But in a statement on its website, the Saint Petersburg Currency Exchange (SPVB) stated that it does not have any plans to provide “any services related to cryptocurrencies.”

Russian Stock Exchange: We Have No Crypto Plans

The SPVB said it was responding to “reports in a number of media outlets.” And it refuted claims that it has any “plans” in place regarding crypto.

“The reports that appeared in a number of media outlets that the St. Petersburg Currency Exchange plans to become one of the platforms for trading crypto assets are not true. Our approved development strategy is focused on developing our own products and services in the money and stock markets. They do not involve the provision of any services related to cryptocurrencies.”

Saint Petersburg Currency Exchange

However, it appears that there is no smoke without fire. Senior Moscow politicians have been talking up the idea of launching a state-run crypto exchange for the past few weeks.

This follows the approval of laws that will, from September 1, legalize industrial crypto mining and green-light the use of crypto as a payment tool in international trade.

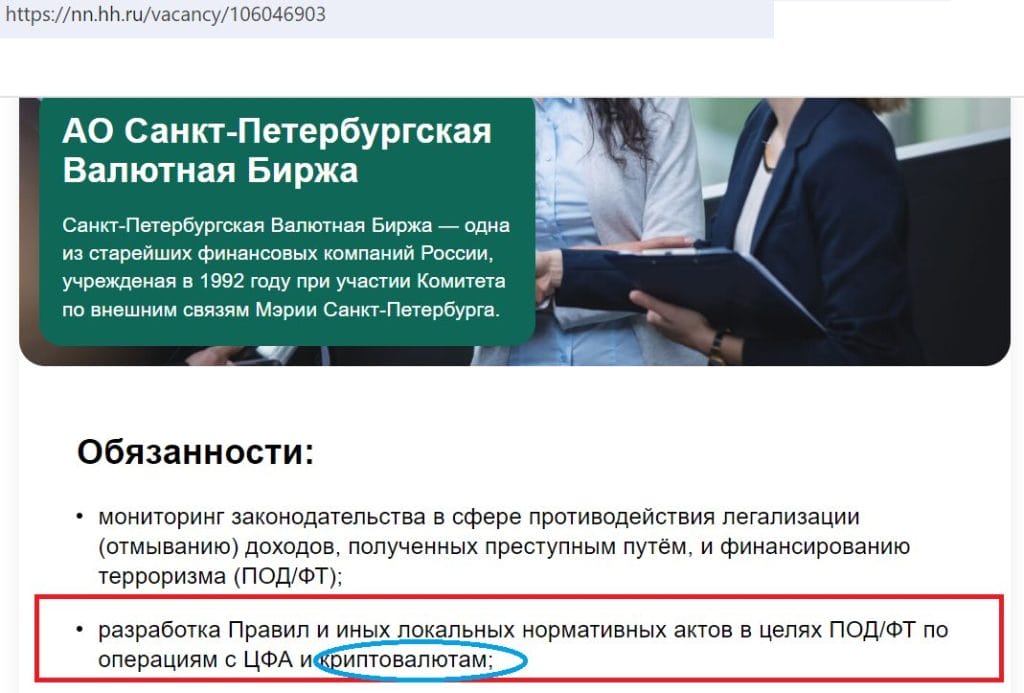

The SPBV is also seeking a new head of anti-money laundering operations with crypto skills. The exchange posted a vacancy on the Headhunter (HH) recruiting site.

The posting reads that the new hire will be responsible for “developing AML/CFT rules for “transactions with digital financial assets and cryptocurrencies.”

Alternatives for a ‘National Crypto Exchange’

Meanwhile, should plans to roll out national crypto exchanges in Moscow and St. Petersburg come to naught, other regions appear keen to step in.

Business Online quoted Yakov Tenilin, the founder of the crypto project Crypto-Polygon, as stating that the Republic of Tatarstan’s IT Park has a plan in place.

The park is supported by Tatarstan’s Ministry of Digital Development of Public Administration, Information Technology, and Communications.

Tenilin said Tatarstan-based entities had already created a “digital platform for a national crypto exchange.”

He also claimed that the exchange was ready to “start working at any moment, and had been “tentative named” the “Tatarstan National Crypto Exchange.” Tenilin said:

“In Russia, cryptocurrency is not a means of payment. The latest legislation confirms this to be the case. So the best thing we can do is to control the inflow and outflow of cryptocurrency to and from Russia.”

The crypto industry insider said that the exchange would help boost transparency. He explained:

“As soon as customers want to convert cryptocurrency into fiat rubles, they will have to do this through a designated crypto exchange. Then, it will be clear what you have received, and how much tax you should pay.”

The Tatarstan government is also reportedly discussing the launch of a “regional crypto mining operator.”

Tenilin said that this operator would allow “large industrial companies based in Tatarstan” to “conduct cross-border payments in cryptocurrency.”

Reports circulating on Friday, August 23 claimed that Russian stock exchanges were planning to launch stablecoins pegged to the Chinese yuan and other BRICS nations’ fiats.

Miners and senior banking officials are also involved in talks with the government as politicians look for a solution.