Trading platform Robinhood reported positive earnings for the second quarter, with revenues reaching $682 million, marking a 40% increase year-over-year due to a resurgence in Meme stocks.

Robinhood’s earnings report stated a huge increase in crypto transaction-based revenues showing a 161% year-over-year rise, amounting to $81 million in the second quarter.

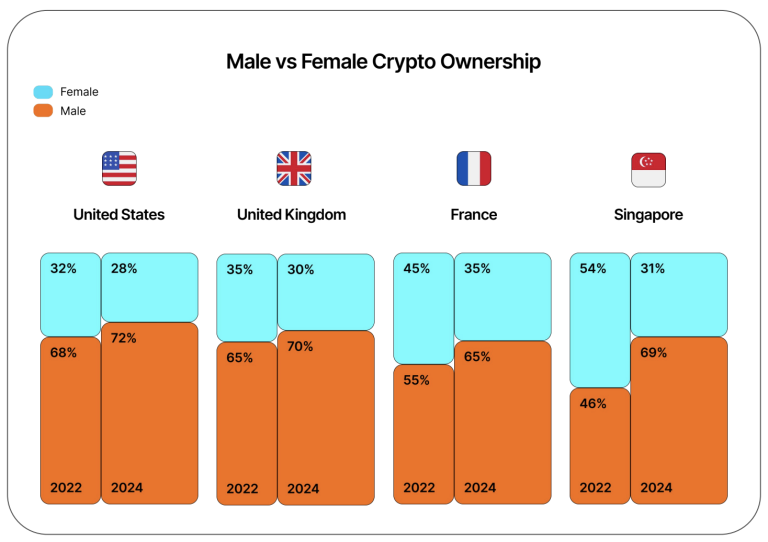

The surge was driven by increased trading volumes, showing there is once again renewed interest in crypto among retail investors.

Overall transaction-based revenues also saw growth, climbing 69% to reach $327 million. Robinhood said it has grown its role in retail trading across a diverse range of assets.

Robinhood Markets, Inc. just announced its financial results for the second quarter of 2024. Find our full performance and listen to our earnings call today at 5 PM ET at https://t.co/llL7qN2nEf

Here are the highlights from @vladtenev: pic.twitter.com/SFIkqi56Ja

— Robinhood (@RobinhoodApp) August 7, 2024

“This quarter, we kept up the pace with rapid product launches and a relentless drive to provide top value for our customers,” said Vlad Tenev, CEO and co-founder of Robinhood.

Robinhood Acquisition of Crypto Exchange Bitstamp

Robinhood said its strategic acquisitions have strengthened its position in the market. In June, the company agreed to acquire Bitstamp, Ltd., a leading crypto exchange with an extensive international presence.

According to the earnings report, this acquisition expanded Robinhood’s capabilities and reach, leveraging Bitstamp’s 50 active licenses and registrations across the EU, UK, US, and Asia.

The trading company also acquired Pluto Capital Inc., an AI-powered investment research platform, in July. Robinhood said the acquisitions align with its goal of broadening its service offerings and enhancing its technological infrastructure.

In May, Robinhood launched industry-leading margin rates, ranging from 5.7% to 6.75%, which contributed to a more than 20% increase in margin balances, reaching a two-year high of $5.0 billion by the end of the second quarter.

Robinhood said it is actively returning value to its shareholders. In May, its board of directors authorized a $1 billion share repurchase program, which started in July 2024. The company plans to execute this program over the next two to three years, demonstrating its confidence in future growth and commitment to shareholder returns.

Earlier this week, Robinhood reported a temporary suspension of its overnight trading services due to issues with its execution venue. The trading platform cited problems with Blue Ocean ATS, the third-party firm that handles round-the-clock trading for Robinhood, as the reason behind the decision.