Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

The price of Ripple (XRP) has fallen by 1.5% today, dropping to $0.5672 as the wider crypto market loses by 4% in the past 24 hours.

XRP has declined by a smaller percentage than many other major tokens, with the news of Ripple’s partnership with SBI Holdings helping to shield the alt from more serious damage.

And while the coin is still down by 8% in a week, it remains up by 5% in a month, following Ripple’s lower-than-expected $125 million settlement with the SEC last week.

This settlement has freed Ripple to sign more partnerships with the likes of SBI Holdings, with the company – and its associated token – likely to enjoy faster growth in the coming months.

Ripple Teams Up with Japanese Giant: What This Means for XRP’s Future

This week’s news extends Ripple’s pre-existing relationship with SBI, which has previously announced plans to issue NFTs on XRP Ledger, as well as plans to collaborate on remittances in the Philippines, Vietnam and Indonesia.

This time, SBI Holdings has committed to promoting the use of XRP Ledger in Japan’s growing Web3 space, with the firm again focusing primarily on the issuance and trade of NFTs on XRP ledger.

While this new project doesn’t represent a massive departure from previous announcements, it’s nonetheless significant that it comes so soon after Ripple’s aforementioned settlement with the SEC.

Combined with another partnership in the past week, it underlines how Ripple has redoubled its expansion efforts now that it has a clean bill of legal health.

It bodes well for the future of XRP, which has stabilized rallying strongly last week.

As the chart above shows, its indicators have now settled into a very intermediate position, showing neither signs of particular strength or signs of particular weakness.

However, it would be reasonable to believe that, because XRP has declined since topping $0.62, it is now due to bounce back up.

This is reasonable partly because of XRP’s improving fundamentals, and partly because traders are expecting a market uplift in the next few weeks.

Fed rate cuts will be the main reason for such an uplift, with analysts expecting the central bank to cut its funds rate next month.

This will lift the cryptocurrency market as a whole, while Ripple could rise to $0.70 in the next one or two months.

New High-Potential Alts for Big Returns

Because XRP has responded steadily to positive news in recent months, it would be unwise to expect it to gain too dramatically in the future.

So if traders are looking for market-beating returns, they may have to turn to alternatives, such as small-cap tokens.

This includes new coins and presale tokens, which can often rally big once they list, particularly if they’ve had successful raises.

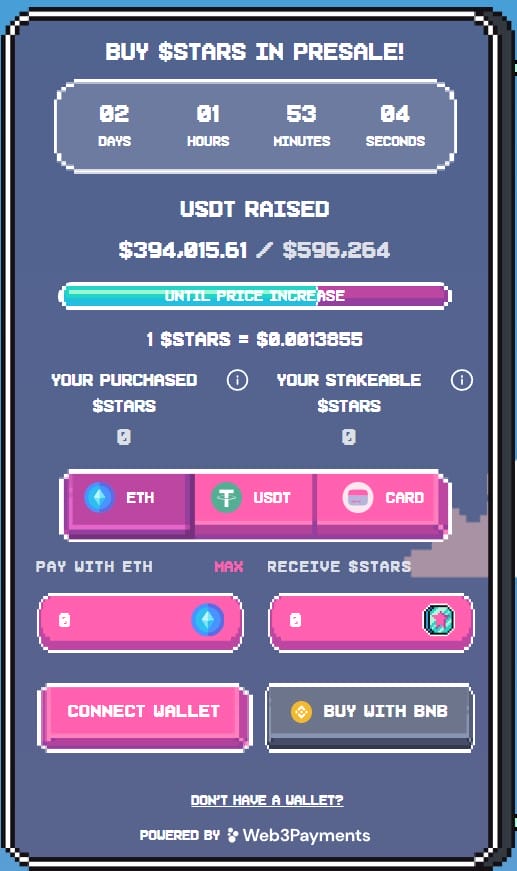

Not all presale coins will manage, but one example with good prospects is Crypto All-Stars (STARS), an exciting new Ethereum-based token that has already raised $400,000 in its sale.

Given that its sale opened only a few days ago, this is an encouraging early figure, hinting at how big STARS could become.

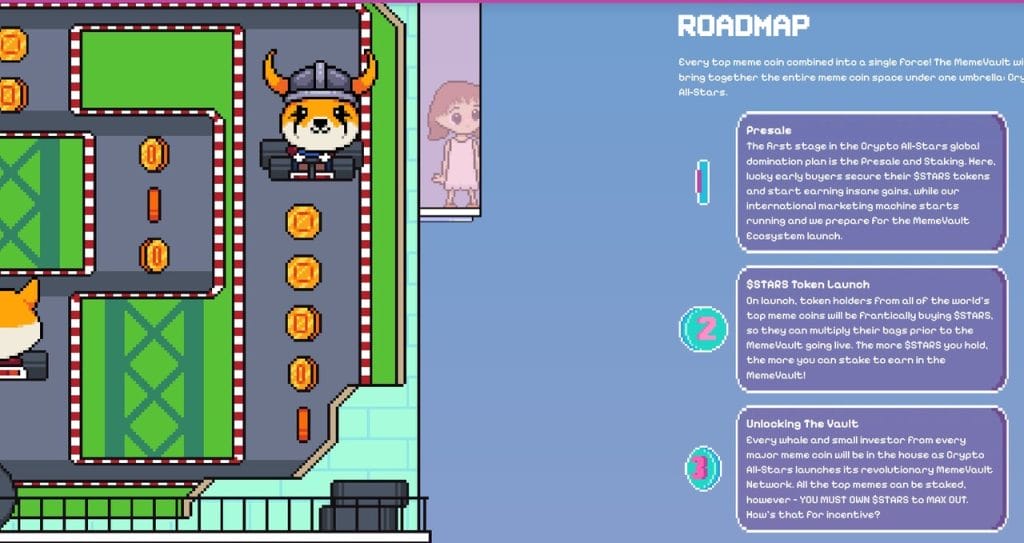

And the reason why Crypto All-Stars is already attracting attention is that it has unique fundamentals, offering a ‘MemeVault’ in which holders of all meme coins can stake their tokens.

By employing the ERC-1155 multi-token standard, Crypto All-Stars’ protocol works with all existing meme coins.

This will give it massive reach and accessibility, with holders of any meme token able to stake their coins with Crypto All-Stars and earn staking rewards.

Most bullishly, users who hold more STARS tokens will receive greater rewards, something which incentivizes long-term holding of the coin.

It will have a max supply of 42.069 billion, with 20% going to its presale and 25% going to staking rewards for people who stake STARS during the sale.

Investors can buy it now by going to the official Crypto All-Stars website, where 1 STARS currently costs $0.0013855.

This price is likely to explode once the coin lists, seeing as how quickly it has begun raising money.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.