Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Bitcoin mining company Riot Platforms announced on September 5 its August 2024 production and operations updates.

Over 10K Bitcoin Held Despite Low Mining

In August 2024, Riot produced 322 Bitcoin, reflecting a 13% decline from July’s 370 Bitcoin and a 3% drop compared to August 2023’s 333 Bitcoin. The company’s average Bitcoin production per day also decreased to 10.4, down from 11.9 in July.

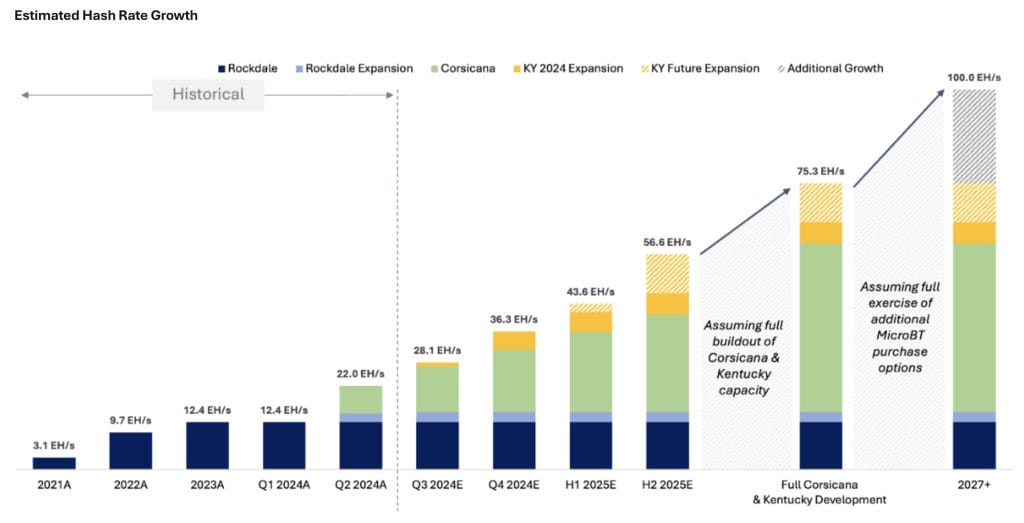

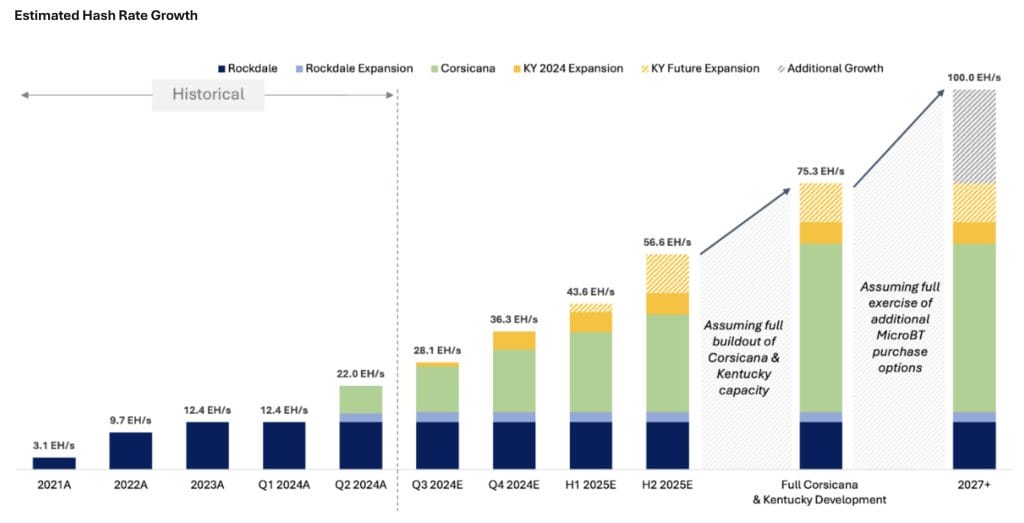

Riot’s overall deployed hash rate remained stable at 23.5 exahashes per second (EH/s), a 1% increase from July and a notable 128% jump from the previous year. This hash rate is distributed across its facilities in Rockdale, Corsicana, and Kentucky.

However, the average operating hash rate decreased by 7% to 14.5 EH/s in August, impacted by high temperatures, operational curtailments due to demand response programs, and maintenance at the Rockdale facility.

Riot’s strategy of being a flexible power consumer was crucial in mitigating operational costs. The company participates in demand response programs, which allow it to reduce power usage during peak demand periods and earn credits.

In August, Riot earned $6.4 million in total power credits, a 90% increase from July. This approach enables Riot to consume power when it is low-cost and abundant and curtail usage when demand is high, providing stability to the grid and lowering energy costs.

Riot’s Massive Infrastructure Expansion

Riot is making substantial progress in expanding its mining capacity, particularly at its Corsicana facility. The company is currently developing Phase 1 of this facility, which will, once completed, total 400 megawatts (MW) of mining capacity.

Riot is advancing the development of Building B1, its third 100 MW building at Corsicana, and has started deploying miners there. Building B1 is expected to be fully operational by the end of September.

Additionally, development is underway on the final 100 MW building, Building B2, with miner deployment planned to begin in September.

In addition to its progress at Corsicana, Riot is enhancing its hash rate capabilities at its recently acquired Kentucky facilities.

Riot’s infrastructure development is complemented by its participation in ERCOT’s Four Coincident Peak (4CP) program, which allows large power users to curtail usage during peak demand periods.

This participation not only helps Riot achieve future cost savings but also optimizes power usage and contributes positively to the stability of the ERCOT grid.

Notably, the dispute between Riot and Bitfarms is still ongoing. Riot recently sent an open letter to Bitfarm criticizing past executive decisions and describing them as destructive to the company.