Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

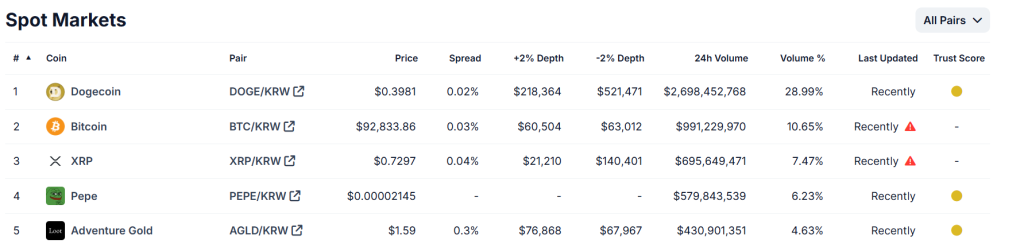

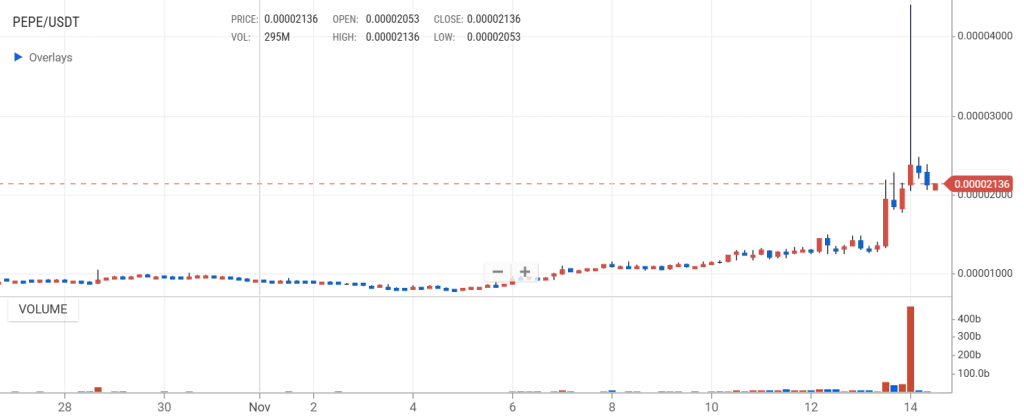

Pepe (PEPE) prices rose rapidly on South Korean crypto exchanges after Upbit listed the meme coin on November 14.

This led to a day-on-day price rise of 40% on the Upbit rival Bithumb, which had already listed the coin.

PEPE Prices Rise: Upbit ‘Listing Beam’

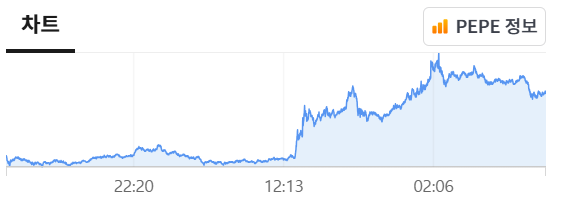

News1 reported that when Upbit announced it would begin offering fiat KRW trading for PEPE, “the price rose by 8.5% in the following minute on Bithumb.”

The outlet called this event an Upbit “listing beam” effect. In South Korean crypto communities, “listing beams” refer to the price spikes that follow the news of new altcoin listings on domestic exchanges.

Upbit launched PEPE fiat trading on November 14 at 11:30 am KST. The firm said that it had imposed short-term “restrictions” to limit “trading volatility.” These included the following:

- Buy orders limits for approximately five minutes after trading support began

- A minimum sale price restriction for the first five minutes of trading

- Order type restrictions for the first hour of trading

The media outlet said that “positive” bull market forces and the “listing beam” effect helped PEPE trading volumes on Upbit “exceed 70 billion won [$49,885,300] in the first three hours after it was listed.”

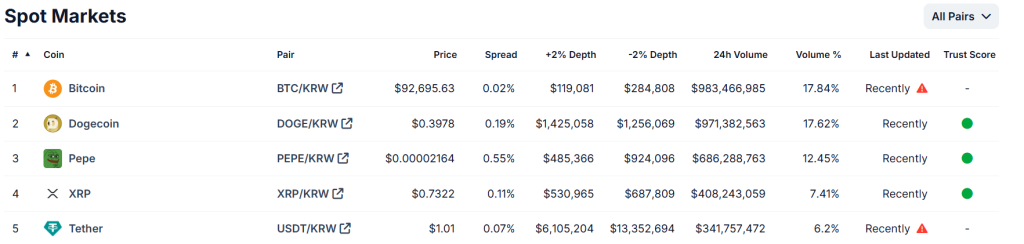

Activity Dies Down

Since the initial excitement, however, trading volumes and prices have both fallen on both exchanges.

Prices shrank back to a 20% rise on the previous day’s average, with global prices also falling back from a sharp peak in the early (GMT) hours of November 14.

The media outlet said that “investors’ sentiments toward cryptoassets has recently improved” due to “a surge in Bitcoin prices following Donald Trump’s victory in the US elections.