Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Bitcoin recently reached an all-time high of $99.6k, but on-chain data suggests the bull market may still have room to run, according to CryptoQuant data.

Despite a recent price correction to $91k, key valuation metrics indicate that Bitcoin has yet to hit the overvalued levels that typically signal the end of a bull cycle.

Bitcoin’s Price Top Target Is Currently at $146k

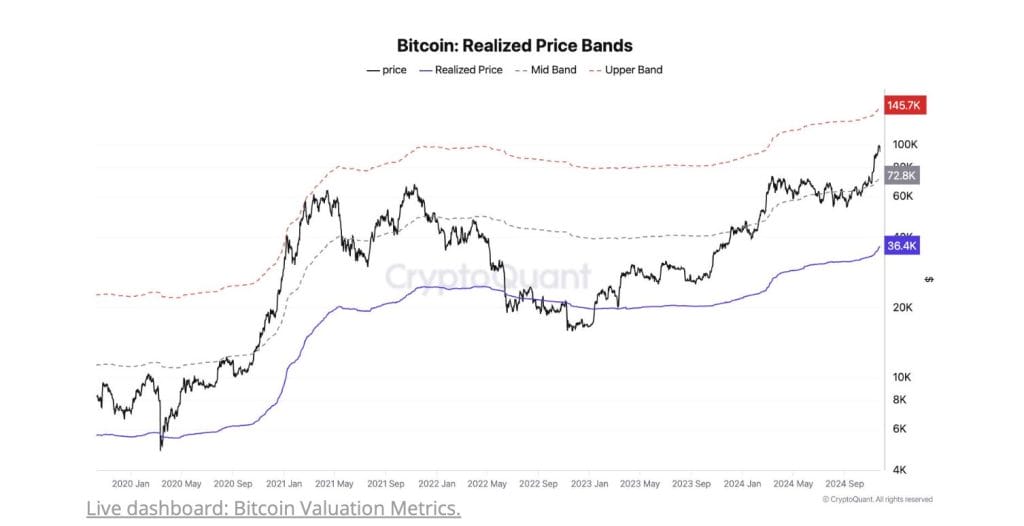

According to CryptoQuant, Bitcoin’s realized price valuation — a metric that calculates the average purchase price of all circulating Bitcoin — sets a potential price ceiling at $146k.

Historically, this price band has marked market cycle tops, as seen during the April-May 2021 and January 2021 peaks. With Bitcoin currently trading below this threshold, analysts believe the market remains in bullish territory.

Analysts note one notable indicator supporting this outlook is the distribution of Bitcoin holdings among investors. New Bitcoin holders currently control just over 50% of the total invested value. This is lower than at previous market tops, where new investors accounted for over 90% in 2017 and 80% in 2021.

In bull market peaks, the amount of new retail investors buying at inflated prices often drives the total value they hold to extreme levels, signaling overbought conditions. In contrast, retail investor activity remains subdued in the current market. Since October, retail investors have reduced their holdings by 41,000 Bitcoin.

Whales Have Added More Bitcoin to Their Portfolios

Meanwhile, large investors, often referred to as “whales,” have added 130,000 Bitcoin to their portfolios. This accumulation by institutional and long-term investors is typically a bullish signal, as it suggests strong confidence in Bitcoin’s future price potential.

The absence of frenzied retail activity, which often shows market cycle tops, shows the possibility that Bitcoin’s current rally has more room to grow.

Bitcoin’s Trajectory Matches With Macro Trends

CryptoQuant analysts point out that Bitcoin’s trajectory also matches with macroeconomic trends favouring digital assets. Factors such as increasing institutional adoption, Bitcoin exchange-traded fund (ETF) approvals, and a supportive U.S. regulatory environment are creating favourable conditions for further price growth.

With Bitcoin holding steady in its bull cycle and its realized price valuation suggesting a potential target of $146k, analysts from CryptoQuant believe the cryptocurrency could soon break through the $100k milestone. For now, on-chain data supports the view that Bitcoin’s rally is far from over.