If you stopped at THG’s announcement that it had terminated talks to sell itself to Apollo, you’re missing half the fun.

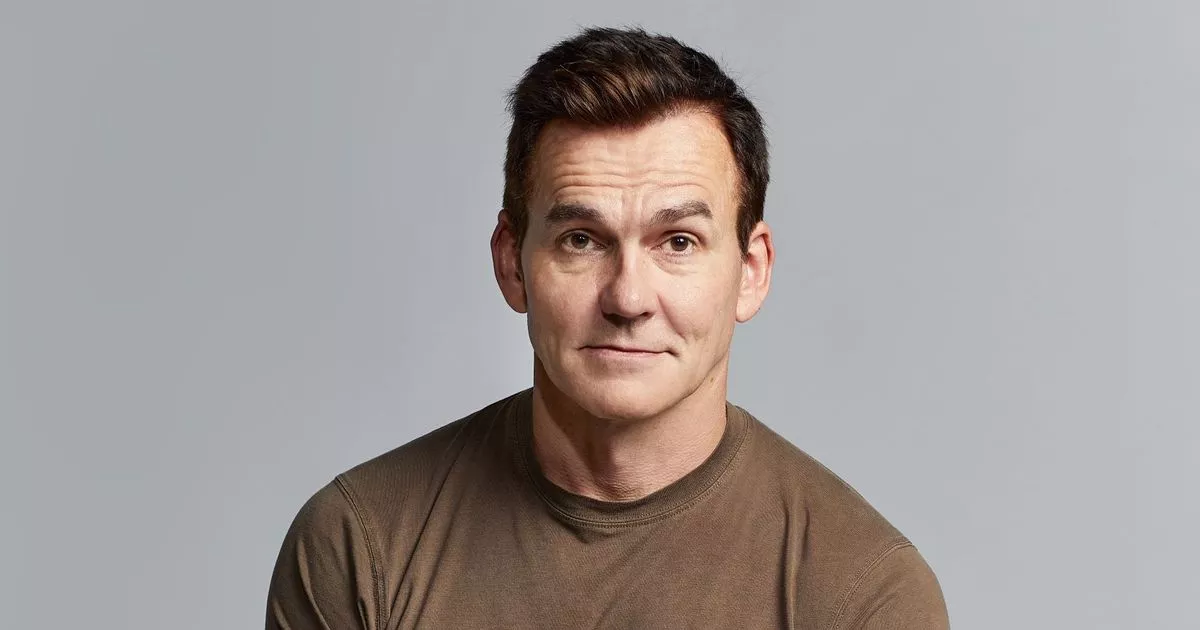

Matt Moulding, the increasingly embittered founder and CEO of the mascara-to-ping-meals conglomerate, has committed a very long LinkedIn post that explains the reasons why staying listed in London, in spite of its myriad failings, is still preferable to going private. Here are just a few highlights:

Just about every major PE firm has enquired about taking THG private. Usually, nobody finds out. But if there’s a leak, then the Takeover Panel forces an announcement. This is what happened with Apollo.

PE interest isn’t surprising. For the 3 years before IPO, THG shares traded at £3. Having doubled in size we then listed THG at £5 a share in Sep 20. They rose to £8 in the first-year post IPO but, after the Numis led short attacks when they weren’t made a Broker to THG, shares fell to as low as 30p in late 2022.

We’re checking with Numis whether it agrees with the characterisation here of “Numis led short attacks when they weren’t made a broker to THG”.

The last time THG shares traded at 30p was in 2009, when the Group had £80m Sales and only sold CDs! Today THG is 28 x bigger (and we haven’t sold CDs for years).

THG was a private company in 2009 so presumably he means the post-money valuation on a fundraising. A reminder that THG cancelled flotation plans two years later after discovering that its valuation had been inflated by fraud.

Like with all previous bidders, the Apollo bid wasn’t right for THG. Yes, it allowed existing shareholders to stay invested, with me continuing to run the Group. But Apollo also wanted PE controls, particularly across Beauty & Nutrition where they asked for controlling equity rights.

Like all previous bidders, Apollo were told their bid valuation and structure was unacceptable. Yesterday Apollo set out how they could raise their bid further, ahead of a deadline set by the Takeover Panel. Their latest view on Ingenuity had it as being significantly more valuable than the whole of THG the day before the bid leaked!

No shit! Ingenuity is great. But neither Apollo’s bid price, nor the structure proposed, are in the best interest of THG. Myself, Charles and the Board, supported by>50% of shareholders, all agreed on that.

The LinkedIn post comes with a photo of an injured Moulding that raises the possibility he has literally shot himself in the foot. Metaphorically, time will tell.

Further reading:— A short history of THG bid approaches (FTAV)

Notes from the CEO on another failed THG takeover approach