Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Asset issuance chain Noble and on-chain fiat issuer Monerium have announced a partnership to bring the EURe stablecoin to the Cosmos and Inter-Blockchain Communication Protocol (IBC) ecosystem.

Now, EURe will be available natively on over ninety Cosmos blockchains and the broader IBC ecosystem.

Leveraging Noble’s issuance platform, one can integrate Monerium’s EURe with all Cosmos and IBC appchains and modular rollups.

This, the teams said, will enable “fast and efficient transactions.”

Within Monerium’s framework, each user gets a unique IBAN number. The number connects to their self-custodial Noble address for instant transfers between a bank account and the IBC ecosystem.

According to the press release shared with Cryptonews,

“This user experience […] effectively allows a wallet to become a bank account (and vice-versa) and opens up a wide range of uniquely-tailored applications, including for payments, foreign exchange, swapping, etc.”

The Monerium EURe is the first authorized stablecoin in Europe and the most used on-chain Euro-backed stablecoin by transaction volume.

Additionally, it’s self-sovereign and the only stablecoin that’s directly transferable between bank accounts and Web3 wallets.

EURe is also available on Ethereum, Gnosis, Polygon.

This will enable “seamless, efficient transactions across multiple blockchains, offering greater flexibility and utility for users,” remarked Gísli Kristjánsson, co-founder of Monerium.

You might also like

EURe Leads the EUR-Pegged Stablecoin Race

Monerium is the first Electronic Money Institution (EMI) to comply with the EU’s Market in Crypto-Asset (MiCA) regulations. It has been authorized to issue e-money on blockchains in Europe since 2019.

EURe is collateralized by Euro-denominated deposits held in segregated accounts.

Furthermore, it’s a part of Europe’s Single Euro Payments Area (SEPA) framework, thus enabling near-instant transfers of EUR between on-chain custody solutions and custodial bank accounts.

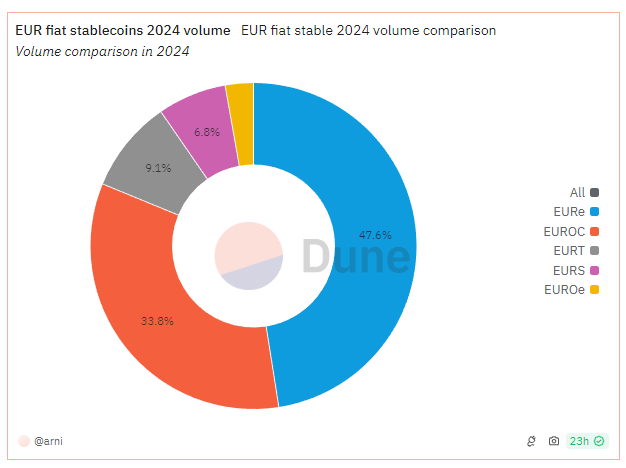

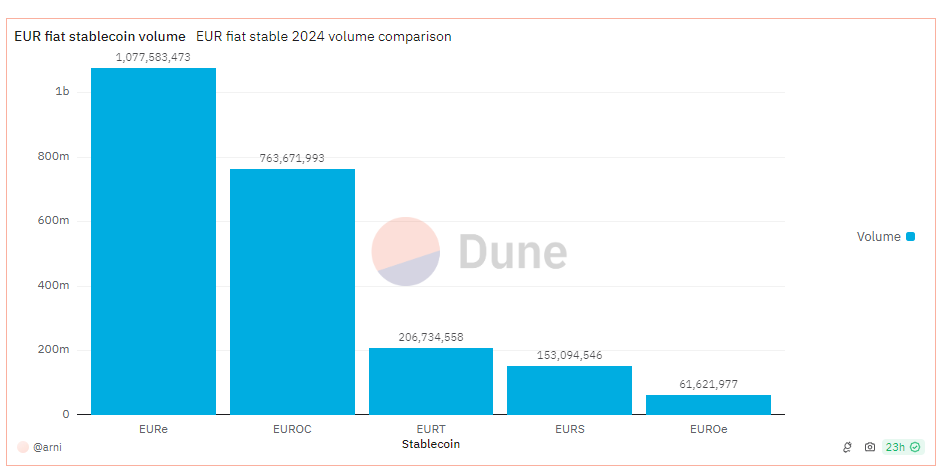

So far this year, the stablecoin has recorded nearly €1.1 billion in volume, per Dune Analytics.

Also, looking at the volume comparison between various EUR-pegged stablecoins for 2024, EURe leads with a 47.6% market share, as seen below.

Monerium was founded in 2015 to provide on-chain fiat as infrastructure for Web3 builders. Besides EURe, it also issues GBPe and USDe, the first EU-authorized on-chain sterling and dollar, respectively.

Meanwhile, Noble is a blockchain for integrating and transferring native assets to sovereign blockchains, enabling a seamless flow of stablecoins and other real-world assets (RWAs) between ecosystems.

It’s the native asset issuer of USDC, USDY, and USYC for the Cosmos ecosystem.

The team said that, since its launch in September 2023, Noble recorded over $280 million in total assets issued and over $3 billion in IBC transfer volume.

Jelena Djuric, founder of Noble, commented that “a Noble-powered ecosystem starts with developers seamlessly tapping into deep stablecoin and RWA liquidity to build the next generation of applications, from payments to DeFi and beyond.”

Djuric argued that EURe’s native Noble integration will enable a variety of novel use cases, given that users’ wallets are their bank accounts.

She also indicated that the two partners will collaborate “on other fiat-backed assets and the prospect of bringing such seamless UX [user experience] to other jurisdictions.”

You might also like