Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Key Takeaways:

- Most consumers continue using cash or regular accounts rather than a digital euro.

- Established payment methods currently dominate over new digital alternatives.

- Shifting public behavior may require clear communication and education.

A recent European Central Bank (ECB) survey has revealed low consumer interest in the digital euro, raising concerns as the bank moves forward with its plans for a potential launch.

ECB Report Finds Minimal Consumer Interest in Digital Euro

The ECB’s Consumer Expectations Survey (CES) working paper, published on March 12, surveyed approximately 19,000 individuals across the euro area’s eleven largest economies.

Research shows Europeans prefer existing payment systems, seeing little benefit in a central bank digital currency (CBDC).

Participants were asked to hypothetically allocate €10,000 across various assets.

Results from the ECB report revealed consumers were reluctant to assign a significant portion to the digital euro, opting for traditional banking options like cash, checking accounts, and savings.

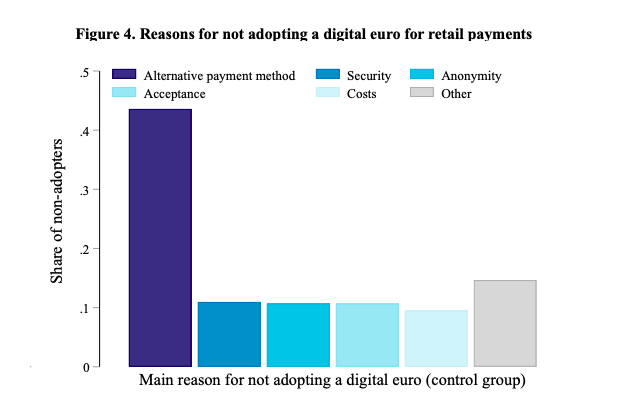

The ECB report highlights major hurdles to CBDC adoption, including deeply ingrained consumer habits and skepticism about the need for a new payment system.

According to the study, “A substantial portion of consumers report that they would likely not adopt the digital euro, primarily due to a strong preference for existing payment methods.”

Despite consumer reluctance, the ECB maintains that a digital euro would cause minimal disruption to financial stability.

However, the bank acknowledged that overcoming public resistance would require a strategic approach, particularly in consumer education.

ECB’s Efforts to Overcome CBDC Skepticism And Concerns from Lawmakers and Critics

The study found that educational initiatives, such as video-based content, could help familiarize consumers with CBDCs’ benefits.

However, even when offered free video materials, many participants chose not to engage further, signaling persistent resistance.

The ECB has been actively working to launch the digital euro, with the testing phase underway.

The project began in November 2023 and includes stakeholder discussions and rulebook development. The testing phase is set to conclude by October 2025.

Despite ECB President Christine Lagarde’s confidence in the project, skepticism remains among EU lawmakers.

A Reuters report from March 10 indicates that many policymakers question the feasibility and necessity of a CBDC.

Critics have also voiced concerns over government overreach and data privacy, fearing that the digital euro could be used to track financial transactions.

Some have labeled the project a potential “financial dictatorship.”

European Central Bank’s Two-Track Approach to Blockchain Integration

In addition to developing the digital euro, the ECB is also working to integrate distributed ledger technology (DLT) into central bank transactions as part of its broader digital finance strategy.

On February 20, the ECB Governing Council outlined a two-phase approach to facilitate this transition.

You might also like

The first phase focuses on establishing an interoperability link between blockchain-based transactions and the existing TARGET Services platform.

This connection is designed to ensure secure and efficient settlements using central bank money.

In the second phase, the ECB plans to develop a more comprehensive long-term infrastructure to accommodate a wider range of DLT-based financial operations, including foreign exchange settlements and other international transactions.

A detailed timeline for this initiative is expected to be released soon.

Yet, as the ECB moves forward, fundamental questions remain: Can educational efforts truly shift deeply ingrained consumer habits, and will policymakers manage to address the growing concerns around privacy and financial oversight?

As Europe contemplates this ambitious leap forward, the digital euro’s future depends not only on technological innovation but also on bridging the considerable gap between institutional ambition and public acceptance.

Frequently Asked Questions (FAQs)

Longstanding trust in cash and conventional banks, limited digital exposure, and privacy concerns all reinforce habits that make switching to digital euro less appealing.

Clear, simple education that highlights benefits and addresses privacy worries may gradually shift perceptions, building user confidence and encouraging a smoother transition.

Besides outreach, the ECB could strengthen privacy safeguards, improve user interfaces, and offer incentives that align digital payments with everyday routines.