Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships.

Ethereum’s recent 12% drop has not shaken analysts’ confidence in its long-term potential. Currently trading at $3,38, Ethereum has shown resilience amidst market volatility, supported by trading volumes of $28.68 billion.

Despite short-term bearish sentiment, two key models—the Block Subsidy Model and the Mayer Multiple—indicate that Ethereum could still achieve significant growth in this cycle, with price targets ranging from $7,200 to $11,433.

Block Subsidy Model Highlights $11,433 Target

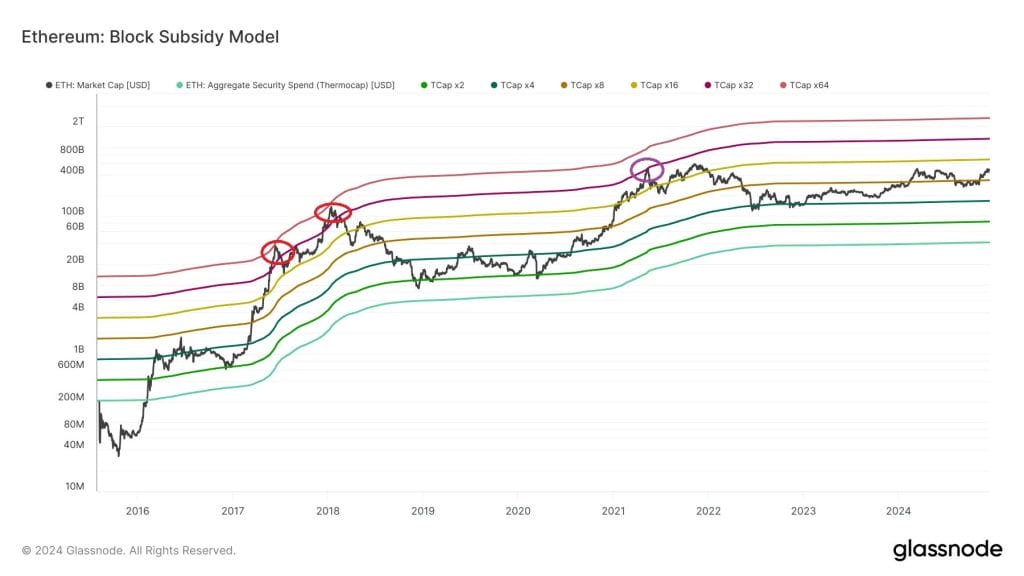

The Block Subsidy Model evaluates Ethereum’s value relative to its thermocap, or the cost of production. Previous cycles revealed Ethereum’s highs reached multiples of its thermocap—64x in its first cycle and 32x in the second.

If this diminishing returns trend continues, the current cycle’s peak is projected at 16x the thermocap.

Currently trading between the 8x and 16x thermocap multiples, Ethereum has historically initiated its steepest growth phase upon breaking above the 8x level.

Analysts calculate this level at $5,716, while the 16x multiple sits at $11,433. This model suggests Ethereum has ample room to grow, with the likelihood of setting new all-time highs during this cycle.

Mayer Multiple Indicates Expansion Phase

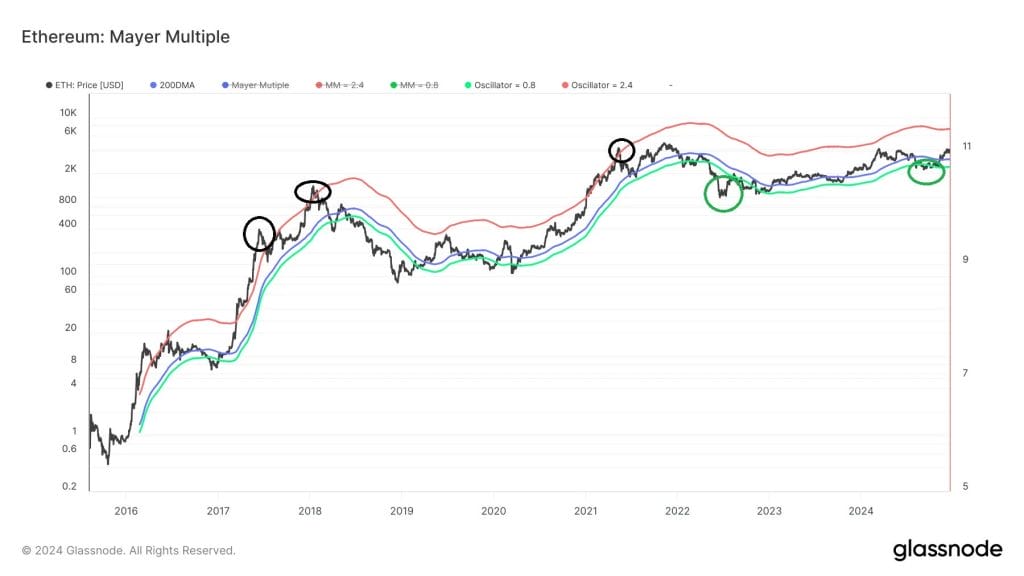

The Mayer Multiple tracks Ethereum’s price against its 200-day moving average (MA), using multipliers to identify overbought or oversold conditions. Previous cycles saw Ethereum’s peaks above the 2.4x multiplier and lows below the 0.8x multiplier.

ETH has already tested the 0.8x level twice during this cycle—in June 2022 and September 2024—mirroring patterns from previous cycles. The current 2.4x multiplier, set at $7,200, acts as a significant milestone. Should Ethereum follow historical trends, this level will serve as a benchmark for a new all-time high.

Ethereum (ETH/USD) Short-Term Technical Outlook

While long-term growth indicators remain positive, Ethereum’s short-term outlook faces hurdles. A persistent downward trendline is capping bullish momentum near $3,400.

This trendline intersects with a supply zone at $3,500 to $3,555, previously a support level but now acting as resistance.

Immediate support lies at $3,252, with additional levels at $3,097 and $2,940. Breaking above $3,555 could trigger bullish momentum, while a failure to breach this level might lead to further consolidation or declines. The RSI stands at 41, signaling a neutral-to-bearish sentiment.

Key Insights:

- Resistance Levels: $3,555 supply zone and downward trendline limit immediate upside potential.

- Support Levels: Key support at $3,252, with further safety nets at $3,097 and $2,940.

- Long-Term Outlook: Models project Ethereum’s peak between $7,200 and $11,433.

$BEST Wallet Raises Nearly $5.30M: Time-Sensitive Investment Opportunity

Best Wallet is transforming the Web3 space by supporting thousands of cryptocurrencies across 50+ major blockchains, including Bitcoin and Ethereum. The platform’s user-friendly tools allow for the buying, selling, and swapping of both same- and cross-chain assets—without the need for KYC verification—making it a preferred choice among crypto users.

The $BEST token presale has now raised an impressive $5.30 million, with just less than 24 hours remaining before the next price increase. Tokens are currently priced at $0.0233, presenting an accessible entry point for early investors.

Why Invest in $BEST?

- Utility-Driven: Designed for DeFi, staking, and seamless token claims.

- Expanding Ecosystem: Partnerships with trending platforms like Pepe Unchained.

- Engaged Community: Active participation across Twitter and Telegram.

Best Wallet combines practical features with a growing ecosystem, positioning itself as a standout player in Web3. Secure your $BEST tokens before the price increases!

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.