Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Analytics firm IntoTheBlock has identified the cause of Litecoin’s prolonged consolidation, which has kept the LTC price ranging between $90 and $130 over the past three months.

Despite a 50% gain during this period, the top-ranking altcoin has struggled to break past the $130 level—a resistance zone that has capped its recent upside attempts.

That trend may be on the verge of breaking with today’s attempt on the consolidation’s upper bound, fueled by a 60% surge in trading volume to $175 million, driving a 9.7% price jump.

IntoTheBlock Reveals Why Litecoin Can’t Break Out

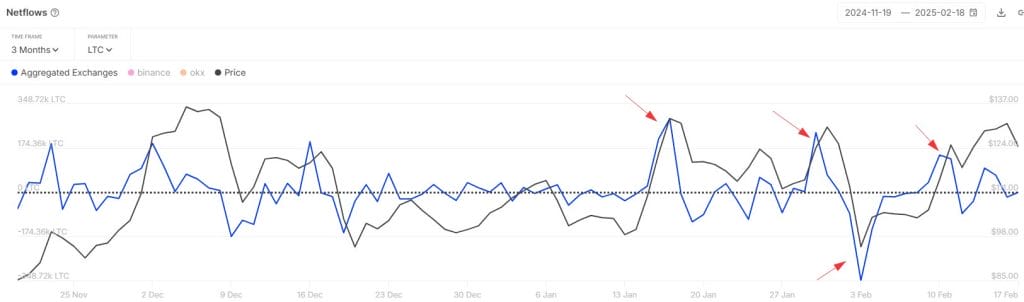

IntoTheBlock attributes Litecoin’s consolidation to whale manipulation, citing Exchange Netflow data.

A positive NetFlow indicates selling pressure, as holders move tokens to exchanges to sell. Conversely, a negative reading suggests accumulation, with holders withdrawing tokens from exchanges.

IntoTheBlock noted a clear pattern of “ramping up withdrawals and deposits to sell on spikes and buy on dips,” aligning with the $130 resistance and $90 support zones.

Given this trend, the LTC price may struggle to break out of this range if whales continue this trading behavior.

LTC Price Analysis: Where Could a Breakout Lead?

If a breakout materializes, it would validate a massive symmetrical triangle pattern that has been developing since early 2022, signaling the potential for a major price move ahead.

After a breakout in late November, the altcoin has been range-bound under whale manipulation.

While much of the post-breakout momentum has materialized, the pattern still sets a $180 LTC price target, signaling a potential 30% advance from current prices.

While the Relative Strength Index (RSI) is edging closer to the oversold threshold at 75, its current position at 65 leaves ample room to hit this target.

And it appears to have the means after the MACD line narrowly avoided a death cross, maintaining its position above the signal line— a sign that the bulls remain firmly in control.

Especially with fundamentals like a potential Litecoin ETF stacking in its favor.

Litecoin Might Not See the Best of This Bull Cycle

Those who jumped to Litecoin as an alternative to Bitcoin (BTC) may be forced to reconsider as Bitcoin Bull (BTCBULL) offers a new way to capitalize on the leading cryptocurrency’s tailwinds.

True to its name, Bitcoin Bull ties its tokenomics to Bitcoin’s price growth in a deflationary model.

The project burns BTCBULL tokens and distributes BTC airdrops whenever Bitcoin reaches key milestones—starting at $125,000 and triggering new rewards for every $25,000 climb thereafter.

With some analysts forecasting BTC highs of $250,000 this cycle, BTCBULL could become a Bitcoin Maxi’s best friend.

With over $2.3 million raised in the presale’s initial two weeks, the project is already gaining strong momentum—potentially credited to its 184% APY on staking that rewards early investors.

You can keep up with Bitcoin Bull on X and Telegram, or join the presale on the Bitcoin Bull website.