Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Layer-1 cryptocurrencies have experienced a price surge following the recent U.S. presidential election, showing market optimism about a potential pro-crypto administration, according to a CryptoQuant report.

Tokens like XRP, TRX (TRON), TON, ADA, and SOL have seen their prices increase sharply, supported by a rise in spot trading volumes.

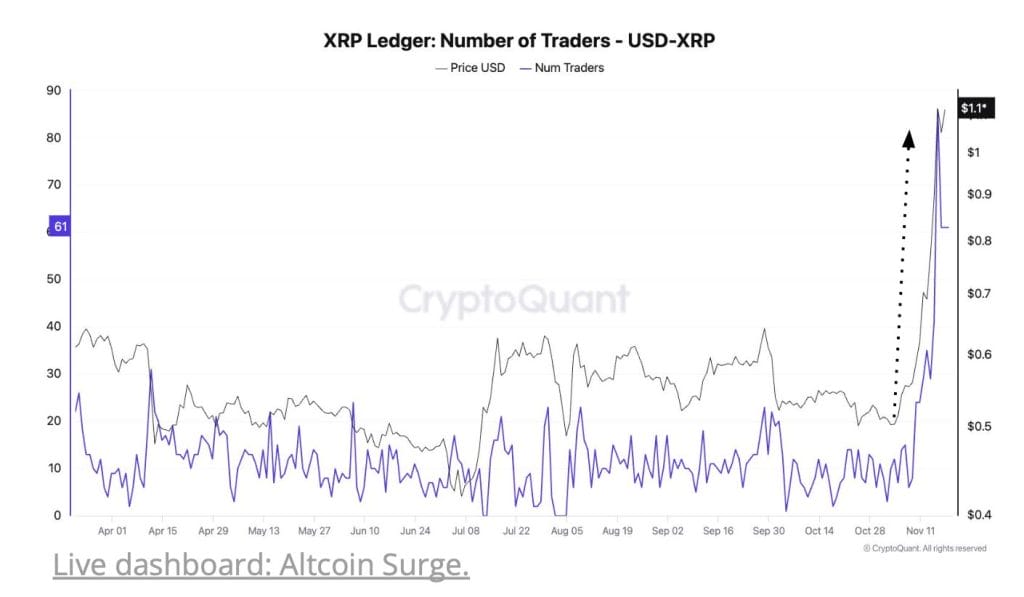

So far, XRP has led the rally, with its price rising 120% to $1.12, the highest since November 2021. This jump goes along with record-high decentralized exchange (DEX) activity on the XRP Ledger (XRPL).

XRP Surge Linked to DEX Activity on XRPL Network?

On November 15, DEX volume hit $3.5 million, marking a huge milestone for the new automated market maker (AMM) DEX launched in May 2024. The rise in XRP’s value shows renewed interest in XRPL with growing participation from traders and liquidity providers, reports CryptoQuant.

Total Supply of USDT on TRON Surpasses $60B

TRON (TRX) has also reached a new all-time high, buoyed by increasing transaction activity and widespread use of the USDT stablecoin on its network.

According to data from CryptoQuant daily transactions on TRON hit a record 10 million in 2024, highlighting its position as a preferred blockchain for stablecoin transfers. The total supply of USDT on TRON has passed $60 billion. This in turn further solidifies its dominance in stablecoin infrastructure.

TON has posted a 39% price increase since November 5, backed by strong network activity and growing stablecoin liquidity, according to the report.

Daily active addresses on the TON blockchain have surged from 60,000 at the beginning of the year to 1 million, driven in part by USDT integration. USDT, now one of the most active tokens (jettons) on TON, has seen its circulating supply grow to $1 billion since April 2024.

Altcoin Rally Triggers Renewed Interest in L1s

The altcoin rally signals renewed investor confidence in Layer-1 blockchains, which are important for decentralized finance (DeFi) and Web3 applications.

Many analysts attribute the optimism to expectations of favorable regulatory policies under the new U.S. administration. The election outcome has renewed hope for clearer guidelines and reduced uncertainty in the crypto space, creating a tailwind for projects with robust fundamentals.

It seems as spot trading volumes continue to climb, Layer-1 tokens like XRP, TRX, and TON are positioned to maintain momentum.