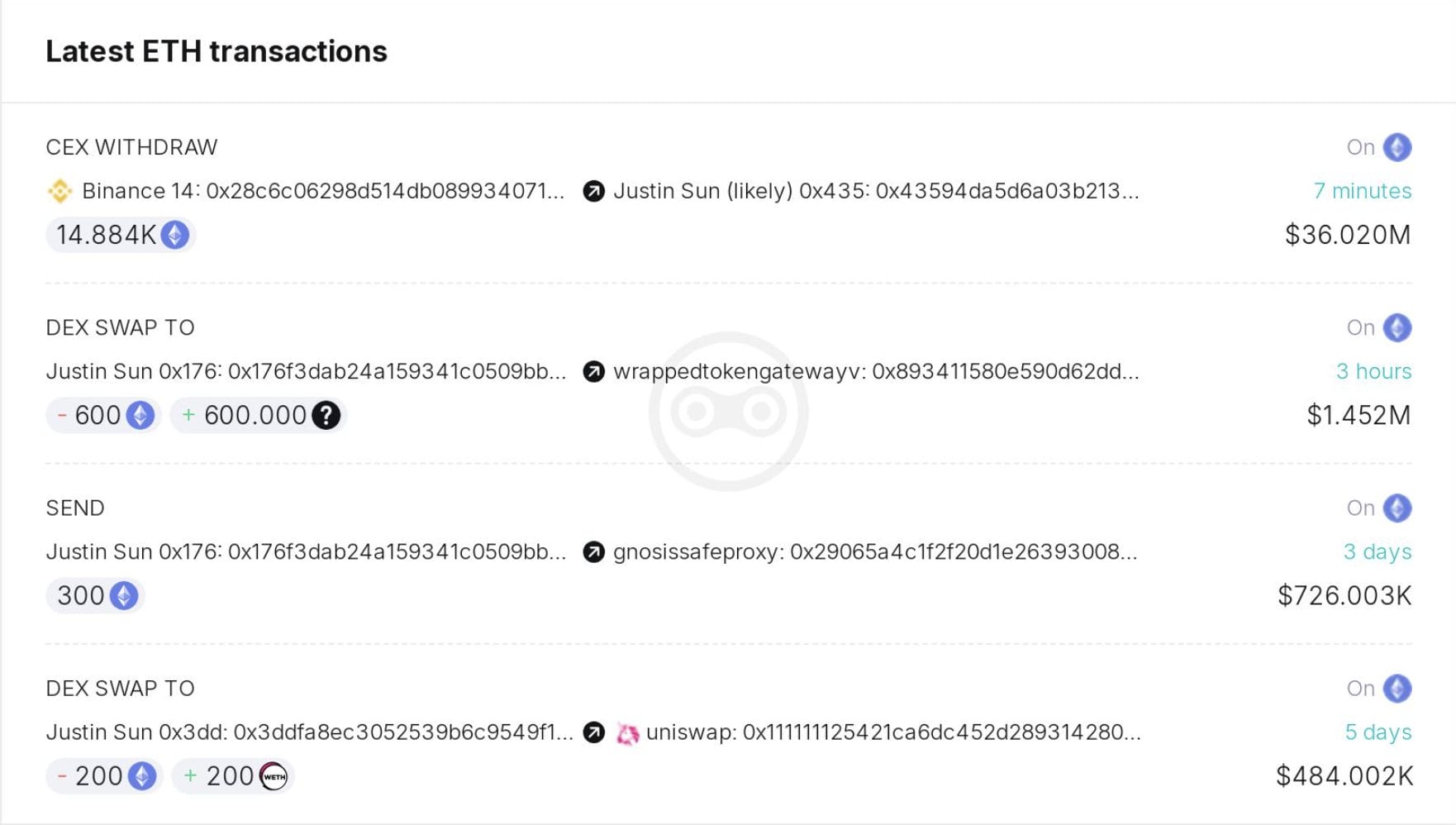

Tron founder Justin Sun has further cashed out 14,884 Ether (ETH), on Monday, from Binance exchange, according to Spot On Chain.

Justin Sun (@justinsuntron) withdrew 14,884 $ETH ($35.97M) from #Binance 10 hours ago!

This brought the total amount of $ETH he accumulated since Feb to 392,474 $ETH (est. cost: $1.19B, now worth: $995M).

Note that Justin Sun also deposited a net amount of 49M $USDT to #HTX in… pic.twitter.com/43dHfK4U74

— Spot On Chain (@spotonchain) August 6, 2024

The Ether withdrawn is worth $35.97 million and adds up to Justin’s total ETH holdings, that he has been accumulating since February. With the addition, Justin now holds 392,474 ETH, with an estimated cost of $1.19 billion, now valued at $995 million.

His withdrawal arrives the same day as he denied rumors about liquidation of his position, calling it “false.” As the ETH price dipped below $2,000 on Monday, strong rumors circulated that more than $200 million in Justin Sun’s leveraged long positions were liquidated.

Justin, on Monday, also criticized leveraged trading strategy, writing that they do not significantly benefit the industry.

Further, Justin has also deposited a net amount of $49 million worth Tether (USDT) to HTX in the past 3 days.

ETH Slightly Recovers from Market Bloodbath, Trades Above $2,500

The crypto market, after experiencing the worst crash in 2024 during the last 48 hours, is slowly rebounding today. Bitcoin surged to a high of $56,000, while, Ethereum rose to $2,525.

Ethereum gained a crucial support level and rallied over 10% to reach a daily high of about $2,547.

Along with crypto market, major global stock indexes crashed on Monday. This has led Ethereum’s fear and greed index to drop to as low as 17 percent, representing extreme fear.

Ethereum Fear and Greed Index is 17 — Extreme Fear

Current price: $2,419 pic.twitter.com/YbAp5yi1gX— Ethereum Fear and Greed Index (@EthereumFear) August 6, 2024

However, per on-chain data analysis, whale investors such as Justin Sun had seized the opportunity, pulling out Ether. Notably, another whale had withdrawn 16,236 ETH, worth about $40 million, from the HTX exchange.

A whale withdrew 38M $USDT from #HTX, then spent 37M $USDT to buy 16,236 $ETH($40.76M) at $2,279 9 hours ago.

Currently, the unrealized profit is $3.76M!https://t.co/MQsz6EEpLH pic.twitter.com/f369C3yIBk

— Lookonchain (@lookonchain) August 5, 2024

Meanwhile, Ethereum is currently trading at $2,503 at press time.

Additionally, the recently approved US-based spot Ether ETFs, registered a net cash inflow of about $1.64 million on Monday. This is led by VanEck’s ETHV and Fidelity’s FETH.