Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

The stock market-listed Japanese firm Remixpoint will use its balance sheet to buy $3.2 million worth of Bitcoin (BTC).

Per an official Remixpoint release and a report from the Japanese-language media outlet CoinPost, the company said it will spend 500 million yen on BTC purchases before the end of the year.

Remixpoint Buys Bitcoin, ETH, and Altcoins

In September this year, the company spent around $5.3 million on BTC, Ethereum (ETH), Solana (SOL), and Avalanche (AVAX) holdings.

It has also amassed smaller Dogecoin (DOGE) and XRP holdings as it looks to diversify its portfolio.

The firm is the former owner of the BITpoint crypto exchange, which it sold to the securities and crypto giant SBI in 2023.

Remixpoint said that it would make a full disclosure if the new BTC purchase “has a significant impact on [its] consolidated financial results.”

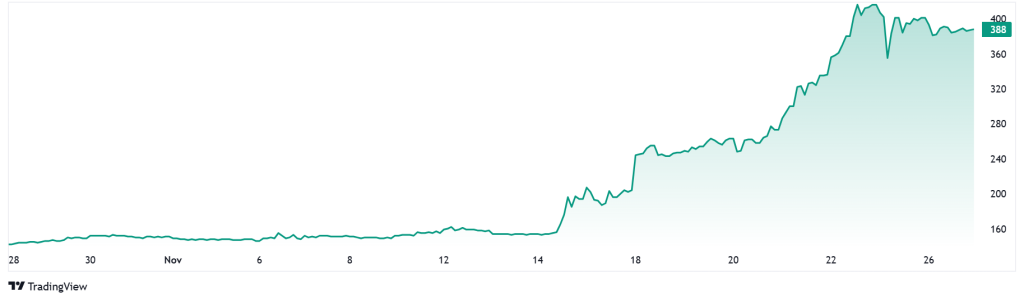

The firm said it was responding to “upward price trends” following the Bitcoin halving event earlier this year. It also wrote:

“We expect more institutional investors to enter the market following the approval of crypto spot ETFs.”

Shareholder Approval

The firm’s shareholders approved the crypto-buying strategy earlier this year, claiming that it would help the company fight the rising risk of yen depreciation.

It spoke of the need to diversify and “reduce” its “exposure to yen-denominated assets.”

The company’s documentation shows that Remixpoint’s unrealized gains on its entire crypto portfolio have already reached the $5.3 million mark.

Earlier this year, the company explained that it wanted to use its crypto-buying strategy to offset “the risk of fluctuations in the value of the currencies it holds.”

The firm was founded in 2004 and floated on the Tokyo Stock Exchange in 2006. It began life as a software firm, but in more recent years has pivoted toward electricity and automobile trading.