Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

A Bloomberg report revealed that Japan is gearing up for a comprehensive crypto regulatory review, which could reshape its digital asset landscape.

The Financial Services Agency (FSA) will assess whether the current framework, which regulates cryptocurrencies under the Payments Act, is still suitable given digital tokens’ evolving role.

The review could lead to lower taxes on crypto gains and significant changes in how cryptocurrencies are treated in Japan. One possibility is to reclassify them as financial instruments under the nation’s investment law.

Japan Crypto Regulatory Review: A Bullish Outlook?

The FSA’s review, which will likely continue through the winter, aims to determine whether the Payments Act adequately protects investors, as cryptocurrencies are now predominantly used for investment rather than as a medium of exchange.

If reclassified under the Financial Instruments and Exchange Act, cryptocurrencies would be subject to stricter investment laws.

Yuya Hasegawa, a market analyst at Bit Bank Inc., noted that such a shift could bring “dramatic changes” to Japan’s crypto market.

It could potentially lower the tax rate on crypto gains from as high as 55% to 20%, aligning them with other financial assets such as stocks.

Lowering taxes has been a long-standing goal for Japan’s crypto executives, who have argued that the current tax rates stifle growth and increase operational costs.

The FSA could provide much-needed relief to the industry by reducing the tax burden and encouraging more investment and innovation in the sector.

The review might also lead to lifting bans on exchange-traded funds (ETFs) containing tokens, a step Hasegawa considers “natural.”

Japan’s Regulatory Landscape: Enterprise Prioritization

The FSA has long sought to balance the promotion of innovation with the need for investor protection, and this latest review signals the regulator’s intent to find a more sustainable middle ground.

The Japanese government has been pushing to revitalize its digital asset sector, with several companies exploring blockchain technology and stablecoins.

The regulatory framework introduced in 2022 requires all cryptocurrency exchanges operating in Japan to apply for licenses, and several high-profile firms, such as Bitget and Bybit, are currently vying for these licenses.

However, the uncertainty surrounding the leadership transition from Prime Minister Fumio Kishida, who supported web3 and blockchain innovation, to his anticipated successor, Shigeru Ishiba, could impact the direction of future policies.

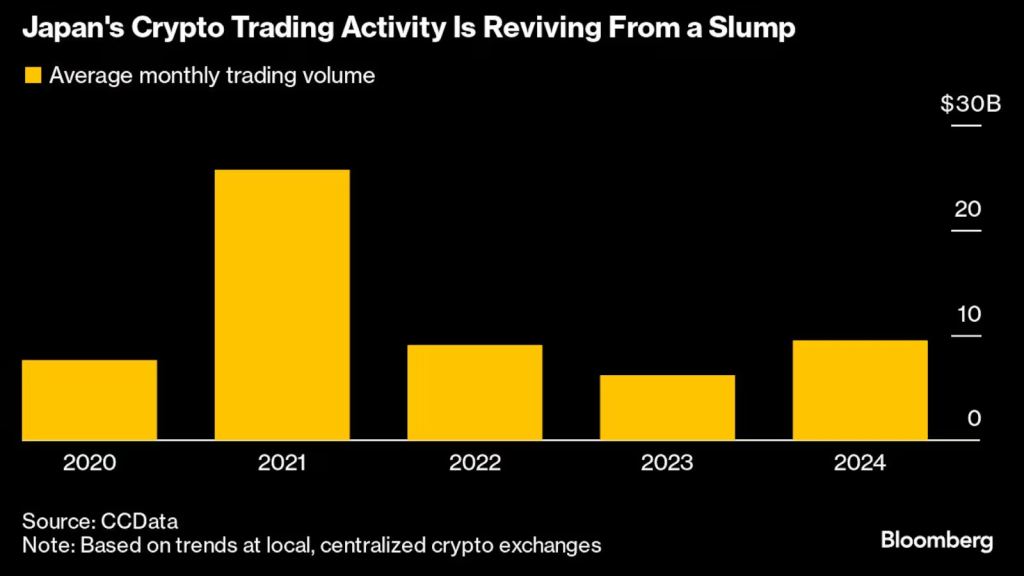

Despite these challenges, trading activity at Japan’s digital asset exchanges has recovered this year, buoyed by the rally in Bitcoin and other tokens.

According to the report, average monthly trading volumes have surged to nearly $10 billion, a notable increase from $6.2 billion in 2023.

In addition to the FSA’s current review, Japan has already taken several steps to support its blockchain and cryptocurrency ecosystem.

Earlier this year, the government allowed local investment ventures to invest in cryptocurrencies, part of broader legislative changes to encourage venture capital investment in web3 projects.

This amendment to the Act on Strengthening Industrial Competitiveness provided much-needed regulatory clarity for crypto-focused startups and has been seen as a positive move toward boosting the country’s venture capital scene.

Furthermore, earlier this year, Japan announced it is set to ease restrictions on venture capital (VC) investment in Web3 companies, allowing VCs to hold crypto assets.

The Japanese Cabinet has approved a proposal to amend laws governing Limited Partnership Funds (LPS), which currently only allow investments in unlisted companies and security tokens.

This change would allow LPS operators to acquire and hold crypto assets.