While plebs wonder if UBS is now too big, and rubes muse whether global banks can ever really be smoothly wound down, the crediterati have been speculating whether Credit Suisse actually defaulted in its forced merger with its Swiss rival.

And now it looks like we might find out. A Bloomberg news spike alert made Alphaville scurry over to the website of the International Swap and Derivatives Association Credit Derivatives Determinations Committee, and, lo:

This week, someone finally asked the determinations committees — a group of up to 10 representatives from banks and five from investment groups that decides whether credit-default swaps pay out — whether CS defaulted.

*Here we should note that ISDA, which originally set up the DC system back in 2009 and acted as its secretary, in 2018 transferred the admin work to an ISDA subsidiary called DC Administration Services is that is nominally independent. ISDA’s docs still set the standard for credit derivatives.

Longtime Alphavillain readers will recall Lisa Pollack’s oeuvre on the machinations and ruminations of the DCs, which operate not dissimilarly to a papal conclave choosing a new pope and announcing the decision with white or black smoke.

Now, we still don’t know if the DC will decide to even hear the case (this is just flagging that someone has asked it to make a ruling), but we suspect that it will have to.

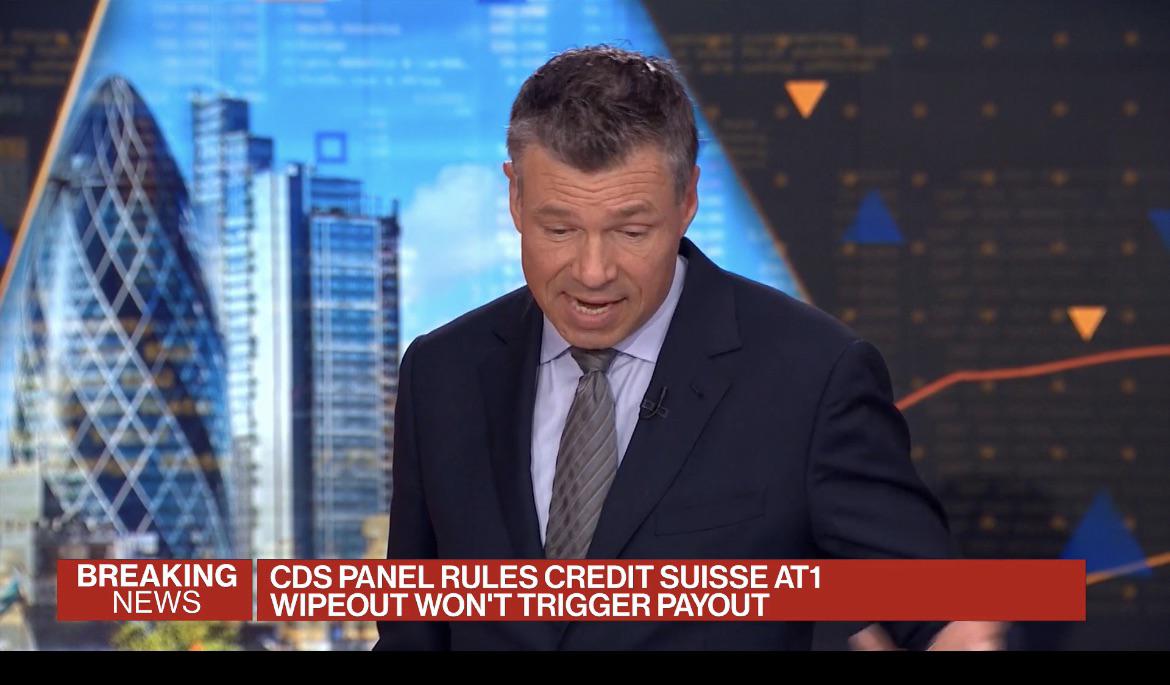

There was about $20bn of CDS on CS debt at the time of its collapse, and, as Risk reported at the time, it wasn’t “crystal clear” whether the AT1 bond vaporisation would trigger CDS payouts. But it seems some hedge funds have grown confident that it will.

From Bloomberg yesterday:

An illiquid corner of swaps insuring Credit Suisse Group AG debt surged back to life this week as some hedge funds make the case they should be triggered.

Funds including FourSixThree Capital and Diameter Capital Partners have been buying swaps insuring Credit Suisse’s subordinated bonds with the idea that the controversial writedown of the firm’s AT1 securities could prompt a potential payout of the derivative contracts, according to people familiar with the matter.

While the five-year credit default swaps dipped on Thursday, they’re up more than 80 basis points this week to about 360, according to CMAI prices. That’s the biggest increase since UBS Group AG agreed to buy Credit Suisse in an emergency weekend deal in March. As part of that acquisition, Swiss regulators forced the wipeout of about $17 billion of so-called Additional Tier 1 notes.

ISDA* happening!