Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

The US Federal Reserve’s decision to ease interest rates by 50 basis points has pushed investors to take on risk assets, raising anticipations of an altcoin season.

To Mason Jappa, CEO and founder of U.S.-based Bitcoin miner Blockware, the medium to long-term outlook for cryptocurrency remains bullish, as lower interest rates tend to support risk-on assets like Bitcoin.

Speaking to Cryptonews, he noted that “if Powell comes out with extremely dovish rhetoric, crypto will likely see a brief pump,” something which unfolded, reflected by overwhelming market optimism and a shift towards risk-on assets.

Altcoins saw significant benefits from this, with significant inflows as new hands entered the market, pushing its market cap up $22 billion over the past 24 hours, according to Coingecko data.

This turn of events echoes pseudonymous analyst Mustache’s comments that traders are “not bullish enough” on altcoins. Mustache cited historical patterns as the basis for an impending altcoin season that will extend into 2025.

Has Altcoin Season Started?

Despite the recent uptick in altcoin trading, on-chain metrics suggest that altcoins still have room to grow before a clear altcoin season sets in.

According to Coincodex data, Bitcoin’s dominance has only been minorly affected. It has declined 0.6% since the Fed rate decision. While this represents a shift towards altcoins, Bitcoin still maintains an overwhelming presence.

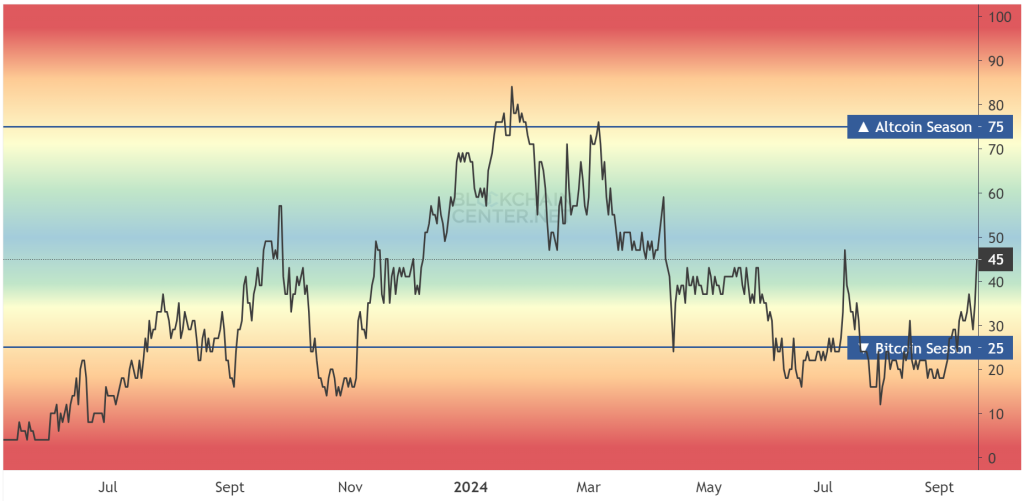

Blockchaincenter.net’s Altcoin Season index chart reinforces this, currently at 45, a neutral zone.

This is far from the benchmark of 75, which signifies an altcoin season in full swing as capital flows away from Bitcoin to alts.

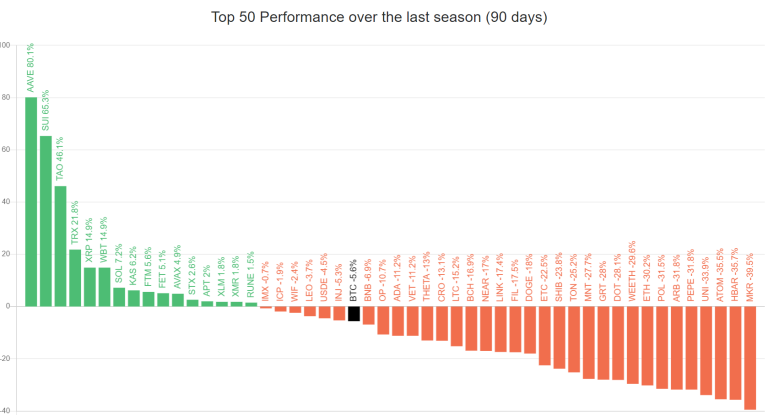

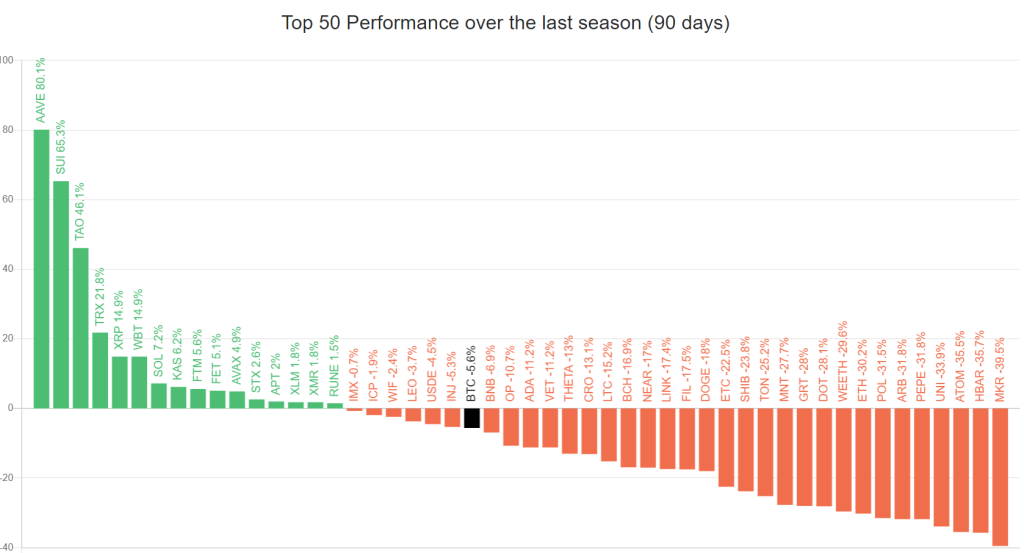

Meanwhile, the top 50 altcoins by market cap show marked underperformance compared to Bitcoin.

Over the past 90 days, only a select few altcoins have managed to outpace the leading cryptocurrency, with most still deep in the red. While a 75% outperformance is seen as the benchmark for an altcoin season, currently, just shy of 50% of altcoins outpace Bitcoin.

Analyst Point Next Two Quarters for Altseason Kick-Off

Although the altcoin season may not be in effect yet, in a September 20 X post, pseudonymous analyst Nilesh Rohilla noted a bullish breakout from the descending channel forming on the altcoin market cap chart.

Looking wider, the analyst noted that a Bitcoin breakout would be a stepping stone to a “parabolic” altcoin breakout, unleashing high-gain opportunities.

This sentiment was echoed by other analysts, who pointed to historical and technical patterns as grounds that the final quarter of this year could be a potential Bitcoin breakout point, with a six-figure Bitcoin “still in play” as we move toward 2025.

This forecast aligns with what is expected to be a monumental catalyst: the US presidential election, which will bring new all-time highs due to “positive drivers dominating regardless of the election outcome.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.