Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Institutional interest in Bitcoin (BTC) continues to surge, according to K33 Research analysts.

The number of professional firms holding investments in the United States (U.S.) spot Bitcoin exchange traded funds (ETFs) jumped by 262 in the second quarter of 2024 to a total of 1,199.

While retail investors continue to dominate Bitcoin ownership, institutional investors have significantly increased their stake in the market. Their share of total assets under management (AUM) climbed 2.41 percentage points to 21.15% in Q2.

Institutional ownership of BTC ETFs grew solidly in Q2!

According to 13F filings, 1,199 professional firms held investments in U.S. spot ETFs as of June 30, marking an increase of 262 firms over the quarter.

While retail investors still hold the majority of the float,… pic.twitter.com/YanrZpfcCG

— Vetle Lunde (@VetleLunde) August 16, 2024

Institutional Investors Reshape Bitcoin ETF Landscape

Vetle Lunde, a senior analyst at K33 Research, highlights a shift in institutional preferences within the Bitcoin ETF landscape. While Grayscale Bitcoin Trust (GBTC) has seen a decline in institutional capital, other ETFs such as Invesco Bitcoin Trust (IBIT) and Fidelity Bitcoin Trust (FBTC) have seen a significant increase “in professional investor dominance”.

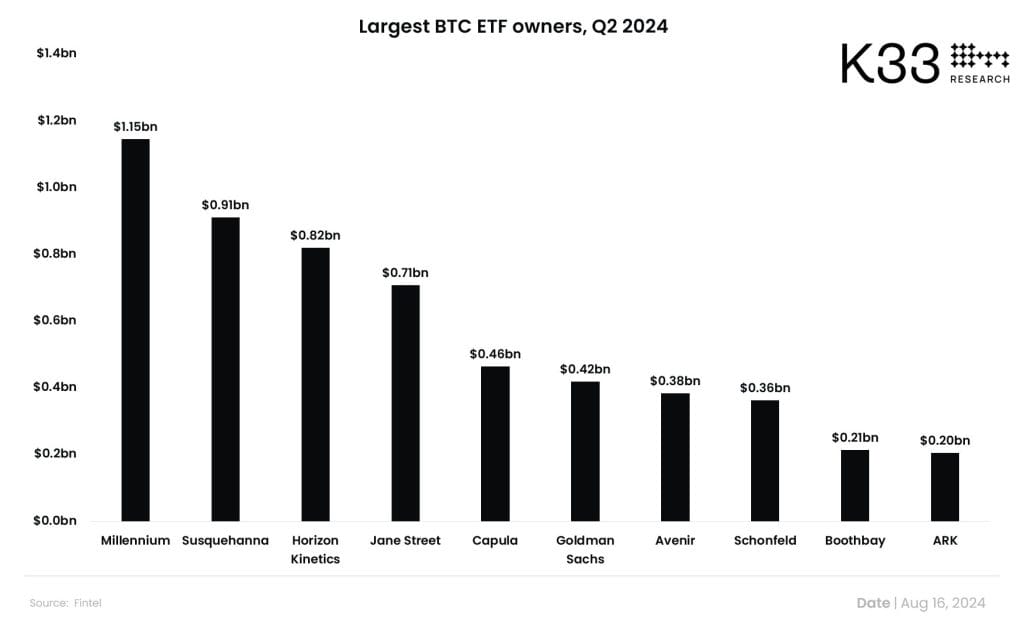

Market makers emerged as the largest institutional Bitcoin ETF owners. However, prominent investors like Millennium and Susquehanna reduced their exposure, likely due to increased competition from new entrants such as Jane Street and calmer market conditions leading to lower trading profits: “Annualized CME premiums closed at 8.6% on June 30, down from 14% on March 31”.

Despite the overall trend, the analyst also notes a positive development with renowned investor Paul Tudor Jones adding a $30 million position in IBIT.

Appetite for Bitcoin ETFs Intensifies

Recent 13-F filings also show increased interest in spot Bitcoin ETFs, according to Coinbase weekly report from Aug. 16.

13-F filings, quarterly reports, required for investment managers with at least $100 million under management, provide a snapshot of the market’s largest players.

These updated 13-F filings reveal that the second quarter of 2024 saw a dramatic increase in institutional holdings of Bitcoin ETFs, with a collective investment of $4.7 billion. In particular, financial giants such as Goldman Sachs and Morgan Stanley significantly increased their Bitcoin ETF positions. In addition, high-frequency trading firm DRW Holdings also joined the fray with a substantial investment.

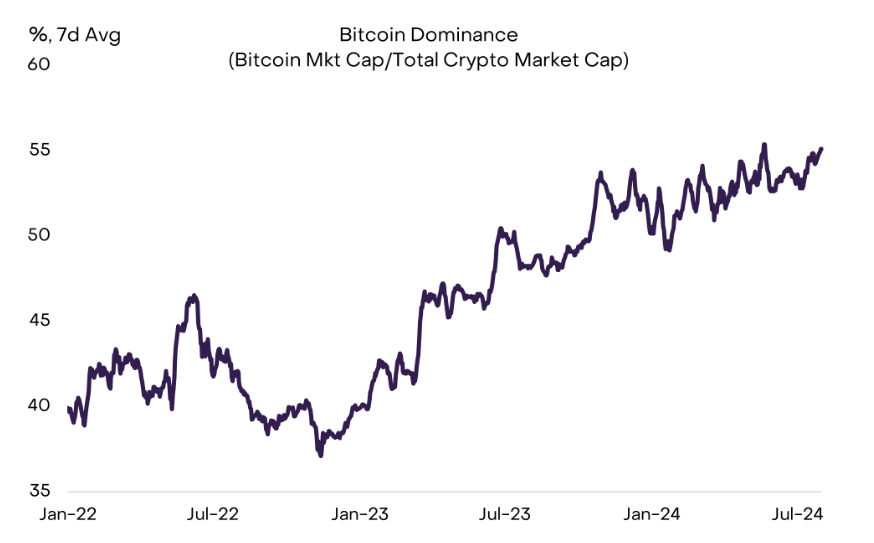

Bitcoin Dominance Grows Amidst Institutional Inflows

Fueled by strong performance and significant investment, Bitcoin’s market dominance continued to grow in July. The cryptocurrency’s market capitalization relative to the overall crypto market expanded as spot Bitcoin exchange-traded products (ETPs) attracted approximately $3 billion in net inflows during the month, according to Grayscale’s August 1 monthly report.

According to Farside Investors, ETF inflows saw positive dynamics on Aug. 15 with over $11 million worth of inflows. However, this is far less than the cumulative outflows of $81.4 million recorded on August 14.