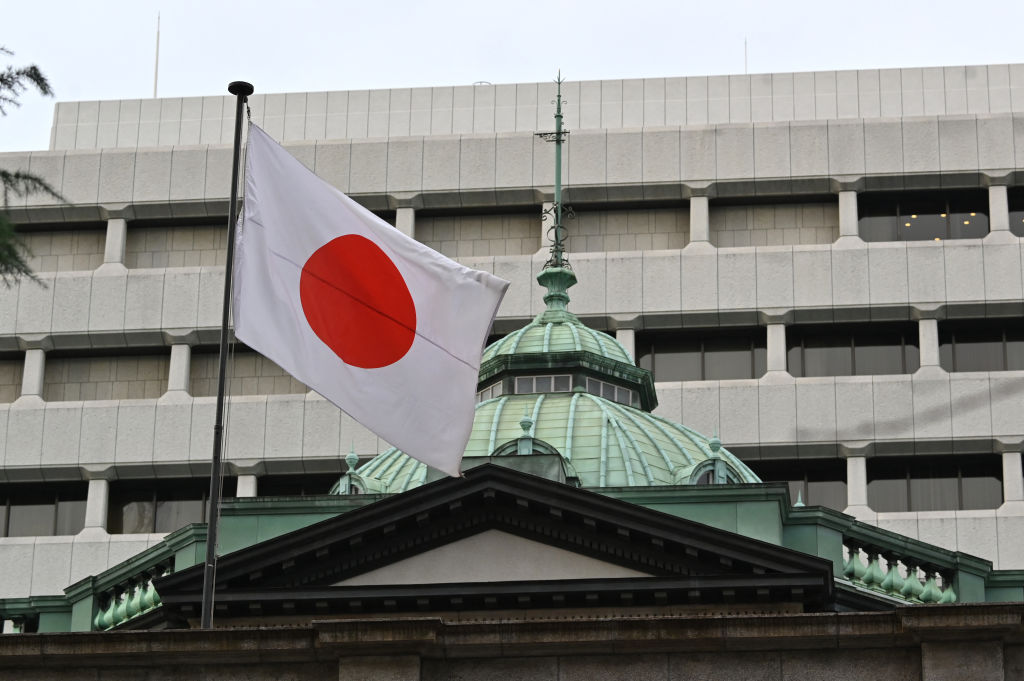

Late on Thursday afternoon, around the time that Joe Biden was saluting officers at Iwakuni Marine base and Rishi Sunak was leaving for Hiroshima from an exclusive business club in Tokyo, investors around the world received a research note entitled Japan’s Rising Sun.

The timing of the analysis, written by the chief economist at the Bank of Singapore and reviving a metaphor that has promised so much and so often disappointed, seemed perfect.

A confluence of factors, say investors, has made the place more interesting than it has been for some time. They can point to reasons why this time might, finally, be different. Japan is at last allowing itself — and being granted — some swagger. The question, as always, is how long the phenomenon will last.

For now, at least, the momentum is strong. A few hours before Japan’s Rising Sun hit inboxes, the broad Topix index of Japanese stocks had hit a fresh 33-year high on a rally driven by an exceptional six straight weeks of buying by foreign institutions.

Some of that has been drawn to the general promise of accelerating governance reform, but a lot of it is because of what is arguably the biggest practical and psychological change in the Japanese economy for decades. A country where an entire generation of consumers, businesses, banks and political leaders knew only flat or falling prices now has sustained inflation.

Analysts at Bank of America have begun explaining to clients how, on a longer timeframe, the Topix could rise a further 33 per cent to exceed the level that has not, for the majority of many brokers or investors, seemed remotely attainable: its absolute peak in the final days of Japan’s 1980s asset bubble.

The buzz is primed to intensify. On Thursday evening, hundreds of fund managers, representing an estimated $20tn of assets under management and drawn to the promise of stock market reform and a shift in corporate behaviour, began arriving for the Citic CLSA Japan Forum and the first big conference of its type in Tokyo since the pandemic.

Their arrival coincided with a string of announcements that the world’s biggest chipmakers — TSMC, Samsung, Micron and Intel among them — were in discussions that could result in significant manufacturing coming back to Japan as a direct result of economic security concerns and the global redrawing of supply chains.

And, as an anti-China consensus beds-in in Washington and elsewhere, Japan’s current sunrise is also geopolitical. In his hometown of Hiroshima on Thursday, Prime Minister Fumio Kishida welcomed leaders of the G7 nations for a summit that gives Japan the increasingly rare chance to be the biggest representative of Asia at any given table. Japan visibly relishes both that and the role of international host, say visiting diplomats, and has extended the scope of the summit by including leaders from South Korea, India, Brazil and Vietnam.

Kishida, say officials, has positioned Japan as a stable, stalwart and supply-chain friendly partner of the west in a region now increasingly defined by China-US decoupling, military tensions and bloc formation for a new cold war. The announcement of an in-person visit to Hiroshima by Ukrainian president Volodymyr Zelenskyy — one of his highest profile foreign excursions since the Russian invasion — helps lock-in that image.

And as the Bank of Singapore note confirms, the G7 leaders find Kishida at the helm of an economy in what some of the visiting heads of governments might consider an enviable shape.

Broader economic activity has been recovering firmly since the start of 2023. Data for the first quarter of the year showed gross domestic product expanding at an annualised, forecast-beating rate of 1.6 per cent. Wages are finally increasing modestly but decisively after years of stagnation.

After decades of deflation, core inflation in April was 3.4 per cent compared with a year earlier and has now been running above the Bank of Japan’s targeted 2 per cent for 13 straight months: high by local standards, but still well under control.

The strength of the Japanese economy, says Stefan Angrick, senior economist at Moody’s Analytics, is often underestimated but has arguably always lain in its stability. In a world of increasing turmoil, he says, Japan’s mix of lowish growth and stability “is a feature, not a bug”.

The harshest questions, though, will be asked after everyone has left: when the G7 leaders are gone and the investors are back home looking at the historic charts of fizzled “Japan’s rising sun” rallies and struggling to convince themselves that this time is different. Japan, meanwhile, will be back in a reality where China is still by far its biggest trading partner, its population is shrinking faster than anyone expected and its companies are geared to global growth at a time when many economists fear global recession.

The 500 or so international investors expected to attend next week’s CLSA event will be given a number of good reasons to hope that — in the context of Japanese stocks at least — the sun will keep rising in a way it has not for more than three decades.

Large funds, such as Elliott and Citadel, have said since the start of the year that they are either opening offices in Tokyo or expanding their coverage of Japan at home.

An April visit to Tokyo by Warren Buffett intensified global investor focus on Japan. Berkshire Hathaway’s investments in five Japanese stocks make Tokyo its largest market destination outside the US. At the fund’s May 6 annual meeting, Buffett reassured his audience that he was “not done” with his search for more investable targets there.

One reason for why investor interest has so strongly revived is that managements in Japan are now under unambiguous and unavoidable pressure to engage with shareholders in a way they were not before.

This year the newly installed head of JPX, the group which owns the Tokyo Stock Exchange, outlined a decisive shift in stance. Hiromi Yamaji publicly rued the fact that more than half of TSE stocks were trading below their book value. He suggested that the exchange would support mechanisms that would cajole companies into improving corporate value, rewarding shareholders and paying greater attention to their cost of capital — three changes investors had largely given up hope of seeing.

Masashi Akutsu, chief Japan equity strategist of Bank of America, believes that by picking on low price-to-book, Yamaji had in effect created a formalised metric of shame for managements to live in fear of.

“Investors are asking me whether the TSE’s plan will work without punishment and I say yes, it will. When the corporate governance code was introduced in 2015 it was a time of deflation and companies had little motivation to dramatically change their behaviour. This time the economic situation is different,” he says, noting how radically the return of inflation to Japan after such a long absence had shifted the scenery.

At the same time, shareholder activism has also evolved to sit more comfortably in the mainstream of Japan investment. The number of activist funds in the country has risen from under 10 in 2014 to nearly 70 this year. Between 2015 and 2022, notes Masatoshi Kikuchi, chief equity strategist at Mizuho Securities, the number of shareholder proposals submitted by activists in Japan rose from below five to nearly 60.

This year’s June AGM season, he says, is on track to smash records in terms of proposals. But as many others note, the proposals themselves may be less significant than the more general fear that once docile domestic pension funds and institutional investors will vote against managements for any number of governance-related infractions common across corporate Japan.

The comments from the TSE, along with the greater presence of Japanese activists, has forced what Adrian Gornall, a veteran Tokyo broker and head of investment advisory at Astris in Tokyo, describes as a “total change” in how companies talk and behave.

“I think that a lot of it has to do with who is driving the push on governance. Japan has a resistance to things when they feel forced on it from outside; that was the case before when it was foreign activists pushing companies for these improvements,” he says. “Now there is more Japanese ownership of the idea itself — the idea that companies need to have better capital efficiency, governance — that idea can now be thought of as owned by Japan now.”

Two further factors are also in play, say analysts. One is that the reshaping of global supply chains to build-in a distance from China could unleash a wave of foreign acquisitions of Japanese manufacturers and facilities. The other is that the Japanese market itself may be benefiting directly from what some investors describe as the “not China” trade — a hunt for investable, liquid ways to gain exposure to China without the risk of being directly invested there.

Geopolitical uncertainty around China, says Christopher Willcox, head of wholesale banking at Nomura, “is very good for Japan: the fourth-largest economy in the world, very deep investable markets, and world-class companies. It’s the obvious place where international investors, if they want to have exposure to Asia, will invest over the next five to 10 years.”

The problem with the “rising sun” thesis is that, in several cycles and across multiple decades, it has been rapidly followed by a decisive reversal as concerns around the shrinking and ageing population have resurfaced and derailed brief spurts of optimism.

Rallies are always strongest in Japan when there is a pro-reform regime in government and a perception that there will be action as well as words, say analysts at Morgan Stanley. It is still not completely clear that Kishida can deliver both.

In the meantime, there are a number of reasons to question the sustainability of the stock rally. As brokers point out, major global fund managers, as canvassed by the BofA monthly survey, remain underweight Japan. The recent six weeks of net buying has nowhere near offset the huge selling that persisted for most of the past six years.

Brokers point out that the buying spree that has propelled the Topix to its 33-year high has been passive money buying the whole index rather than active money seeking out the sort of stocks that represent particularly good value or likely activist targets.

“Global fund allocation has not actually changed,” says one broker at a Japanese house eager to see if CLSA’s conference will make a difference, and start the inflows of active money. “Will it change? Maybe. I wish them luck.”

Data visualisation by Keith Fray

How Japan got its swagger back