Futu Securities International, Hong Kong’s largest online brokerage, has entered the cryptocurrency market by enabling retail cryptocurrency trading.

This move is perceived to be part of a broader strategy to establish Hong Kong as a global hub for digital assets and blockchain technology.

The new initiative offers incentives, such as shares of prominent companies and Bitcoin deposit bonuses, to attract investors and facilitate user engagement.

Bitcoin Exposure to Millions of Users, a Bullish Outlook

Futu Securities, known for its substantial customer base of over 22 million users, launched Bitcoin and Ether trading for its retail clients. This new service allows Hong Kong residents to trade these leading cryptocurrencies directly on Futu’s brokerage platform using either Hong Kong or US dollars.

The South China Morning Post reported that this makes Futu the first online broker in Hong Kong to offer direct access to Bitcoin and Ether for retail investors.

Futu’s move into the cryptocurrency space follows the recent approval from the Hong Kong Securities and Futures Commission (SFC) to provide virtual asset dealing services.

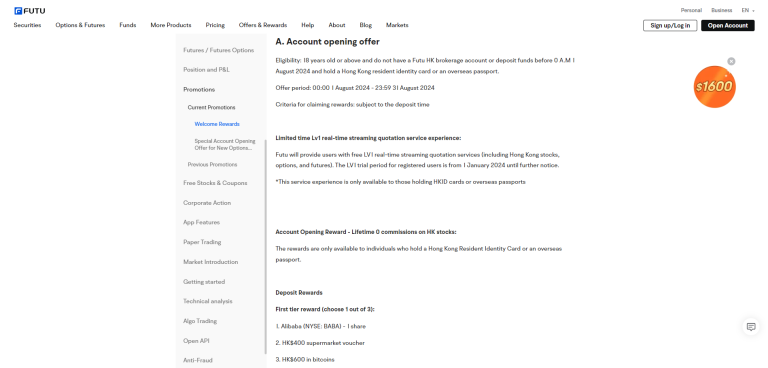

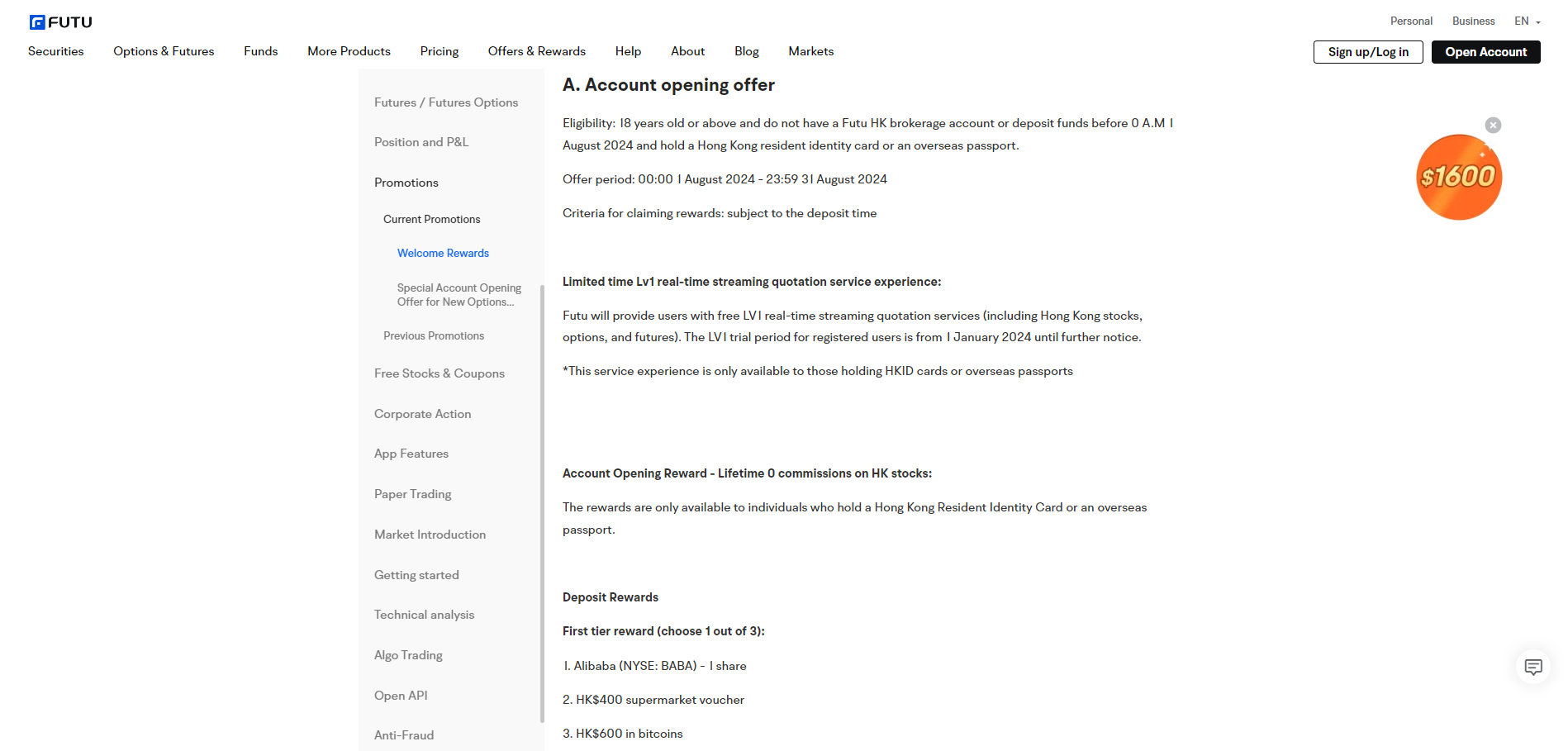

To further incentivize participation, Futu is offering various rewards. Hong Kong investors who open accounts in August and deposit HK$10,000 (US$1,280) over the next 60 days can receive HK$600 worth of Bitcoin, a HK$400 supermarket voucher, or a share of Chinese e-commerce giant Alibaba.

Investors who deposit US$80,000 can receive HK$1,000 in Bitcoin or a share of Nvidia, the US AI chip leader.

Notably, PantherTrade, Futu’s new crypto exchange, is among 11 platforms that the SFC has not licensed in Hong Kong but is ready to start trading crypto while waiting for full approval.

Futu’s aggressive push into the crypto market also includes strategic marketing, which involves waiving commission fees for crypto trading from the launch date until further notice.

Hong Kong’s Crypto Hub Ambitions, Pushing for a Crypto-friendly Country

Futu’s entry into cryptocurrency trading aligns with Hong Kong’s strategic ambitions to become a global crypto hub.

Over the past two years, the Hong Kong government has introduced several new crypto policy initiatives, including a mandatory licensing regime for cryptocurrency exchanges and many more.

However, the city-state has faced challenges, including several major crypto platforms’ recent withdrawal of license applications.

Despite these hurdles, Hong Kong remains committed to fostering a regulated and inviting ecosystem for cryptocurrency trading. Just last month, the HK government recently explored DeFi and Metaverse in an effort to be among the leading countries in the global fintech space.

The recent approval of Bitcoin and Ethereum exchange-traded funds (ETFs) and the introduction of a stablecoin licensing mark the rigid starting point for the country.

The regulatory environment aims to promote a sustainable and responsible digital asset ecosystem in Hong Kong, as highlighted by Eddie Yue, CEO of the Hong Kong Monetary Authority, who stated,

“We believe that a well-regulated environment is conducive to the sustainable and responsible development of the stablecoin ecosystem in Hong Kong.”

Futu Securities’ entry into the cryptocurrency market is expected to significantly impact the adoption and integration of digital assets in Hong Kong.

If Futu leverages its large client base and established brand, Futu can drive substantial retail volume for Bitcoin and Ether trading in the coming weeks.

The journey to establish Hong Kong as a crypto hub has not been without challenges. Despite the supportive regulatory framework, several cryptocurrency exchanges, including HKVAEX and HTX, have withdrawn their license applications.

While there have been some glowing aspects, these setbacks show the ongoing tension between regulatory compliance and operational feasibility in the global crypto industry.