Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. Read more

The Fed’s revised projections have lowered anticipation for further easing running into 2025, somewhat stifling bullish projections for the Bitcoin price and other risk assets.

The ‘Santa rally’ phenomenon has historically provided significant tailwinds over the festive period, but with a 14.5% Bitcoin price plummet from its December peak, hopes have dwindled.

Something evident as trading volume remains at a $55 billion low, a telling sign that traders are less willing to jump on the asset.

Is It Too Late for a Santa Rally?

While this dismal price performance is worrying, the ‘Santa Claus Rally’ window extends post-Christmas, during the last five trading days of December through to the first two trading days in January.

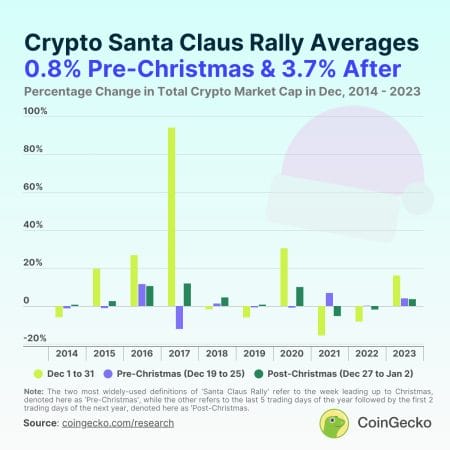

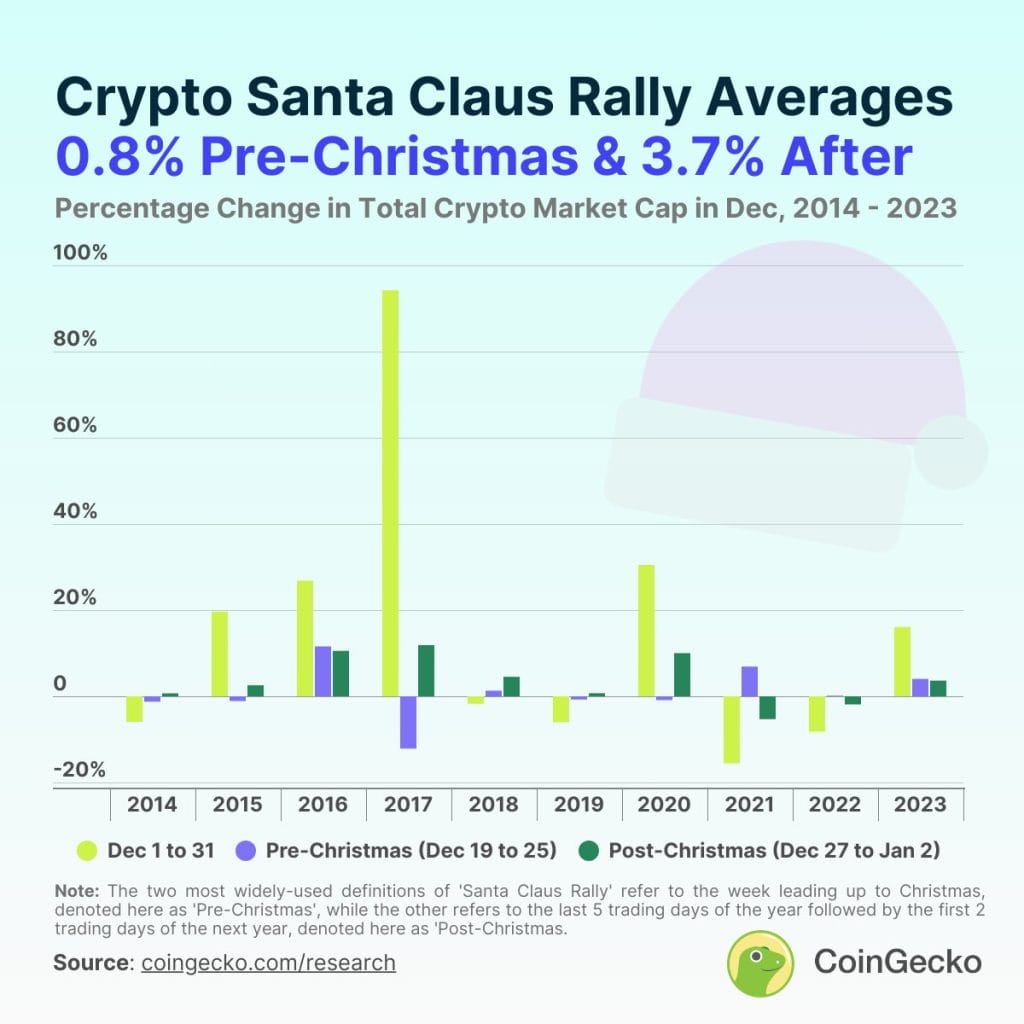

From 2014 to 2023, crypto markets experienced a Santa Claus rally eight out of 10 times post-Christmas, according to CoinGecko data.

During these rallies, the total crypto market cap increased between 0.69% and 11.87% over a one-week timeframe from December 27th to January 2nd.

The exception was the cycle peak in 2021, when the Bitcoin price had fallen about 26% from its high of $69,000 by Christmas Day and continued to decline throughout 2022.

The difference is that 2021 was the cycle’s peak year, whereas 2025 is expected to be this cycle’s peak year, following the four-year pattern that has played out since Bitcoin’s inception.

December 27th seems a credible kickoff for a Santa Claus rally, particularly as the market is set for increased volatility with $18 billion worth of Bitcoin and Ether options contracts due to expire.

Bitcoin Price Analysis: Is a Bottom In Sight?

Technical indicators lend to a potential bottom, with the Breakdown of an ascending channel forming since mid-November.

This breakdown eyes a potential bottom at the $87728.44 support level, representing a further 6.85% decline from current levels.

While the 50SMA currently offers support, it seems unlikely to be an early bail-out. The Relative Strength Index (RSI) at 43 and the MACD line’s hold below the signal line indicate that the bears continue to dominate Bitcoin’s price action.

Therefore, the support at $92,597.58 could be lost, leading to a retracement to lower support levels. However, this could ultimately provide Bitcoin with more stable footing, setting the stage for a potential Santa Rally as the year closes.

This New Opportunity Could Be the Better 2025 Play

While Bitcoin certainly has high potential running into 2025, its meteoric rise this year has been overshadowed by meme coins – the foremost narrative driving gains this cycle.

Indeed, As “meme coin supercycle” sentiment takes hold and coins like $PNUT and $PEPU experience sudden rises to prominence, 10-100x opportunities seem a dime a dozen. But let me guess, you’ve missed out?

Well, Wall Street Pepe ($WEPE) stands to level the playing field by flipping the script on market manipulation, providing exclusive trading insights, strategies, and alpha calls to its holders.

With $WEPE, the community becomes the insider, trading smarter and moving markets together as the unstoppable WEPE Army. Something which may be credited to the project’s instant success, raising over $35 million in its presale already!

This project finds value in community, built around a suite of premium tools and benefits such as trading alpha, private insider groups, and weekly rewards for its most profitable traders.

Even just by holding, investors can rake in passive gains by staking their $WEPE, with dynamic rates that reward early adopters and loyal stakers. Currently, this staking boasts an impressive 66% APY.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.