Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Crypto exchange giant Gemini is leaving Canada and announced the closure of all Canadian user accounts by December 31.

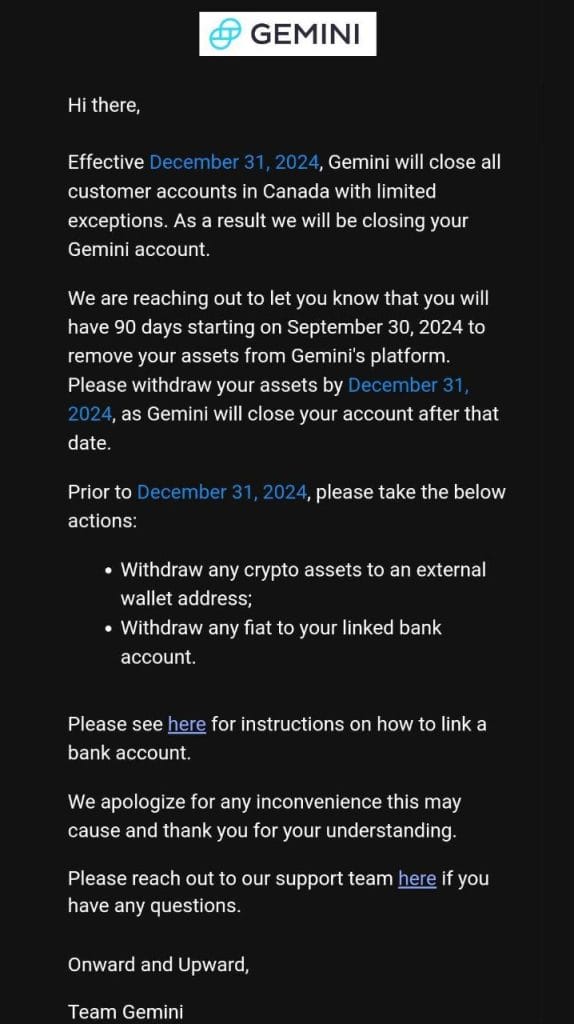

In a private mail sent to its Canadian customers on Monday, the Winklevoss-run exchange told users that they have 90 days to withdraw assets from their accounts.

“Effective December 31, 2024, Gemini will close all customer accounts in Canada with limited exceptions,” the mail read.

“We are reaching out to let you know that you will have 90 days starting on September 30, 2024, to remove your assets from Gemini’s platform.”

The Gemini team has asked Canadian customers to move their crypto assets to an external wallet address. Users who have fiat in their accounts can withdraw them to their linked bank accounts, it added.

Gemini decided to shut down its operations in Canada months after the Canadian Securities Administrators (CSA) set a strict compliance deadline for crypto trading platforms.

Gemini and Top Exchanges Leave Canada Due to Stringent Regulatory Regime

The Canadian Investment Regulatory Organization (CIRO) has set tight membership requirements, ensuring regulatory alignment and customer protection.

Further, in 2022, the CSA tightened registration requirements for crypto exchanges. The regulator released a document asking crypto trading platforms to enter into legally binding pre-registration undertakings.

Another CSA requirement prevents platforms from “permitting clients to purchase or deposit value-referenced crypto assets (commonly referred to as stablecoins).”

However, some Canadian provinces have their own regulations on crypto assets. This means Canadians must be aware of provincial and federal guidelines.

As a result, global crypto exchanges, including OKX, dYdX, Paxos, Bybit and Binance, announced their withdrawal from the Canadian market.

For instance, Binance pulled out of Canada last year due to new guidance about stablecoins and investor limits. The exchange noted that it has become apparent that there are no “reasonable avenues to protect our Canadian users.”

Bybit exited Canada in June 2023, citing growing regulatory scrutiny in the country.