Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

FTX/Alameda recently unstaked over $1 billion worth of Solana (SOL), raising concerns about potential market impact. Despite this, Solana has remained resilient, trading near $137.77 and reaching a high of $139.76.

Broader market optimism, fueled by expectations of a Fed rate cut, has supported this bullish trend, though increased SOL supply may create future selling pressure.

Solana Stays Strong Despite FTX/Alameda Unstaking $1B – Will Bullish Momentum Last?

Despite the recent news of FTX/Alameda unstaking over $1 billion in Solana (SOL), the coin has surprisingly maintained its bullish momentum. SOL held strong near the $137.77 mark, even reaching an intra-day high of $139.76.

This resilience is largely supported by broader market optimism, as the global crypto market cap surged by 3.31% to $2.11 trillion, with a total volume increase of 8.6% to $66.54 billion.

The market’s positive sentiment is partly driven by expectations of a Federal Reserve rate cut ahead of the upcoming FOMC meeting. U.S. Producer Price Index (PPI) data, which came in slightly above expectations at 0.3%, further boosted confidence in risk assets.

As a result, Bitcoin crossed the $60K mark, with the overall crypto market following this bullish trend. However, FTX/Alameda’s massive withdrawal of SOL could introduce significant selling pressure, potentially limiting further gains. This large unstaking event may weigh on SOL’s upward trajectory in the near future.

FTX/Alameda Unstakes Over $1B in Solana, Raising Concerns About Market Impact

FTX/Alameda has unstaked more than $1 billion of Solana (SOL) over recent months. In the past three months alone, 530,000 SOL, valued at $71 million, have been unstaked, averaging 176,700 SOL ($23.5 million) per month.

Despite this, FTX/Alameda still holds 7.06 million SOL, worth roughly $945.7 million. This large-scale unstaking has sparked concerns about potential selling pressure, which could affect Solana’s market performance.

Key points:

- 530,000 SOL unstaked in three months

- FTX/Alameda holds 7.06 million SOL

- Potential for selling pressure to impact SOL price

Meanwhile, Solana continues to show resilience, trading at $139.60 with a 4% increase. The broader crypto market remains bullish, with Bitcoin surpassing $60,000 and Ethereum climbing past $2,400.

Rising expectations of a Fed rate cut and better-than-expected U.S. PPI data have fueled this momentum. However, the increased supply of unstaked SOL may put downward pressure on its price if selling intensifies.

Solana (SOL/USD) – Daily Technical Outlook: September 14, 2024

Solana (SOL/USD) is trading at $137.03, down 1.35% on the day, but remains within an upward channel, finding strong support near the $136.04 pivot point.

Immediate resistance is seen at $139.98, and a break above this level could lead to further gains, with next targets at $144.30 and $148.48.

The 50-day EMA at $134.89 provides additional support, suggesting that the bullish trend may continue if prices exceed this key moving average. Meanwhile, the RSI stands at 54, signalling modest buying momentum.

If SOL dips below $136.04, it could test support at $131.79 and potentially $128.24. A break below these levels would likely trigger accelerated selling, increasing the price to $124.24.

Key Insights:

- Immediate resistance at $139.98, with higher targets at $144.30 and $148.48.

- 50-day EMA support at $134.89, maintaining a bullish trend.

- Break below $136.04 could lead to selling pressure toward $131.79 and $128.24.

In conclusion, Solana’s short-term outlook remains cautiously bullish as long as it holds the $136 support level. It has the potential for further gains if it breaks resistance at $139.98.

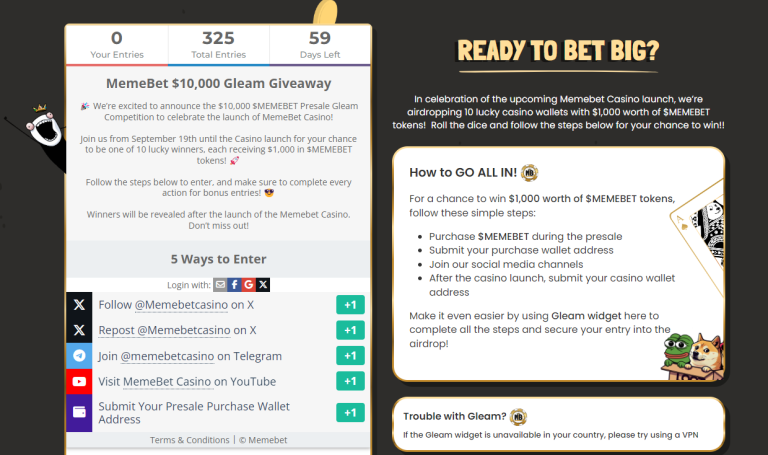

Join the Memebet Token Presale – The Future of Meme Coin Casinos

Memebet Token is your gateway to Memebet Casino, the only platform where you can wager meme coins like $PEPE and $DOGE in web and Telegram casinos.

By buying $MEMEBET, you’ll unlock exclusive play-to-earn airdrops, VIP bonuses, and special rewards for degens. As crypto casinos and meme coins grow, Memebet strategically targets Telegram’s 1 billion users and degen gamblers.

Key Benefits:

- Play with meme coins and earn rewards.

- 20% of $MEMEBET supply dedicated to airdrops for players.

- Exclusive bonuses for $MEMEBET holders.

Don’t miss your chance to buy $MEMEBET at presale prices. You can purchase with ETH, USDT, BNB, or even with a bank card.

Buy Memebet Token Here

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.