Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

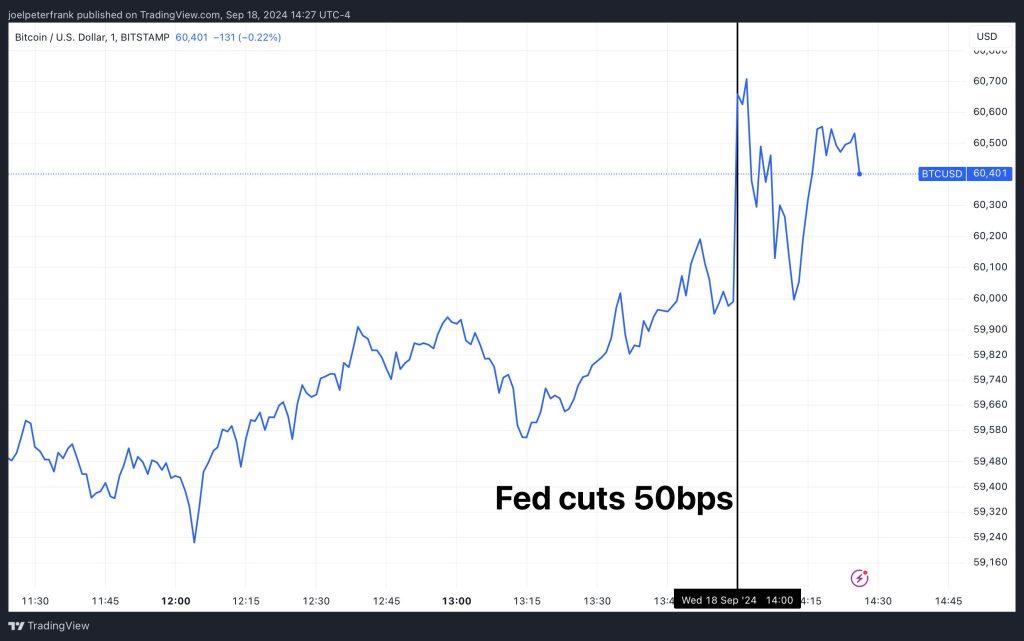

Bitcoin (BTC) saw choppy, albeit bullish, price action on Wednesday after the Fed cut rates in the US by 50bps to 4.75-5.0%, and signaled more interest rate easing than the market had been anticipating in 2025 in its updated dot-plot.

The price of Bitcoin swung between $60,000 and $61,000 in the aftermath of the Fed rate cut announcement.

Going into this week’s meeting, Wall Street had been split over whether the Fed would cut interest rates for the first time since 2020 by 25 or 50bps.

So the decision to opt for a larger 50bps cut to the target range of the federal funds rate would have come as a surprise to some market participants.

But that wasn’t the only dovish aspect of the policy announcement.

The Fed’s graphic showing the interest rate forecasts of its members, called the dot-plot, showed that the median Fed policymaker expects a further 150bps in rate cuts by the end of 2025.

New economic projections were also released. The Fed expects inflation to continue falling towards 2.0% and for the unemployment rate to stabilize around its current level between now and 2026.

Focus will now turn to Fed Chair Jerome Powell, who will conduct a press conference in a few minutes to discuss the policy decision.

But the ingredients for a Fed-fueled rally in crypto markets appear to be falling into place.

The Fed looks intent on aggressively lowering interest rates, but remains upbeat on the economy.

As long as US recession fears don’t suddenly surge back, the stage could be set for BTC heading back towards $70,000.

And Fed rate cuts lower recession risk.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.