Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

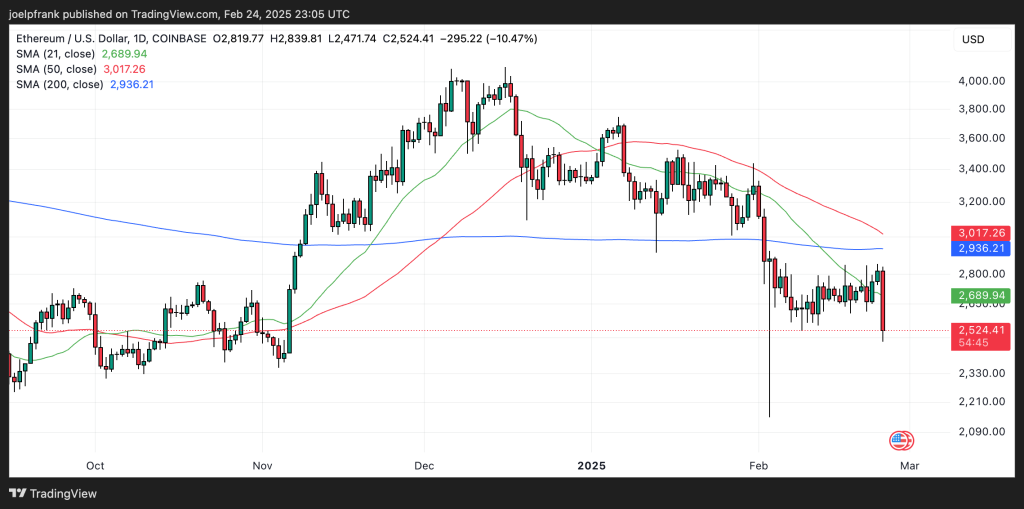

The Ethereum (ETH) price dumped 8% on Monday as the market continued to digest the fallout in wake of the near-$1.5 billion Bybit hack, but despite the downbeat price action, various experts remains highly bullish on Ethereum’s long-term outlook.

ETH was last changing hands around $2,600, having dumped back to the south of its 21DMA at $2,700 after briefly hitting $2,850 on Sunday.

The world’s second largest cryptocurrency by market capitalization remains trapped within multi-week ranges, as it continues to experience elevated sell pressure as it nears it 200DMA just above $2,900.

The Ethereum price is now down over 35% from its December highs above $4,000 and remains stuck in a medium-term downtrend.

With Bitcoin (BTC) and the broader market also appearing to lose steam, a retest of recent lows in the $2,100s could be on the cards.

However, Ethereum could still be a great crypto to accumulate on the dip, owing to what various analysts are referring to as an excellent “risk-reward” profile at current price levels.

Big Ethereum Price Bounce Coming? ETH Presents Excellent “Risk Reward”

Popular anonymous crypto analyst Doctor Profit argued in a thread on X on Monday that ETH is “the best opportunity in the market”.

First, he pointed out that the Ethereum price is currently only trading around 18% above its 200-week exponential moving average, which has been a key historic level of support.

He also pointed out a multi-year ascending trend channel, and a multi-year ascending triangle formation.

Doctor Profit is targeting a rally to the $8,000-$10,000 region this cycle.

Fellow crypto analyst Mister Crypto also pointed out this ascending triangle structure, saying that “it doesn’t get any better than this”.

TraderPA, meanwhile, pointed out the difference in performance between the Ethereum price and Bitcoin this cycle, referring to ETH as “heavily undervalued”.

While volatility could remain elevated in the coming weeks, with further downside likely, Ethereum’s relative underperformance, relatively more “over-sold” market conditions and higher levels of FUD could mean that ETH has less downside risk versus other major cryptos.

While there are no guarantees around when the next major market bounce will come, its arguably more favorable price suggests Ethereum has a lot more room to bounce when market sentiment does turn substantially for the better again.

Fundamentals Align Towards Ethereum Outperformance

The crypto bull market so far this cycle has been characterized by justifiable Bitcoin outperformance.

But it has also been characterized, up until the last few weeks anyway, by the outperformance of the low/zero meme coin sector and its associated ecosystem (like the Solana chain), and the relative underperformance of utility cryptos (like Ethereum).

That trend could be about to flip. The meme coin market has swooned hard in recent weeks.

The Trump meme coin launch and LIBRA scandal has left crypto degenerates and retail exhausted and burnt.

A preference towards cryptos that actually have some underlying value thanks to their underlying utility, but still have massive upside potential, could soon set in.

That could see retail traders starting to flood back to undervalued utility plays like Ethereum, Aave (AAVE) and Chainlink (LINK) in droves, rather than chasing the next high-risk, lower-reward meme play.

Given that Solana is the main meme coin casino, SOL’s relative outperformance versus ETH could soon flip on its head.

That’s especially the case as Ethereum extends its lead over another altcoin in terms of institutional adoption.

Having secured spot US ETFs in mid-2024, Ethereum ETFs are soon likely to feature staking, making them substantially more attractive to institutional investors.

Whilst ETF inflows have slowed in recent days, they are likely to remain mostly positive this year against the backdrop of the positive shift in the US regulatory environment.

FUD may be high right now, but ETH remains the undisputed king of DeFi and, as BlackRock’s preferred altcoin, is likely to remain a major crypto market leader in the years ahead.

At current Ethereum price levels, now is likely a very good time to continue stacking.